India-based Korean startup Balance Hero has acquired a business license for electronic payments from the Indian Government.

The company announced today that is has been granted with a PPI (Prepaid Payment Instrument) license from the Reserve Bank of India. It is the first time a Korean company has acquired this license, and Balance Hero plans to use it to expand its mobile business to India’s market of 1.3 billion people.

PPI refers to payment methods such as mobile wallets or debit cards, and the license is required in order to run a business that uses mobile transactions in India. Other well known companies that have received the license include Amazon and WhatsApp.

The Indian Government is putting its support behind issuing PPI licenses to encourage mobile payment methods rather than cash. According to the Bank of America Merrill Lynch, this trend means India’s mobile payment market is expected to grow by 200 times, or 3 trillion dollars. In addition to this, by mid-2022, mobile transactions are expected to overtake cash for payments.

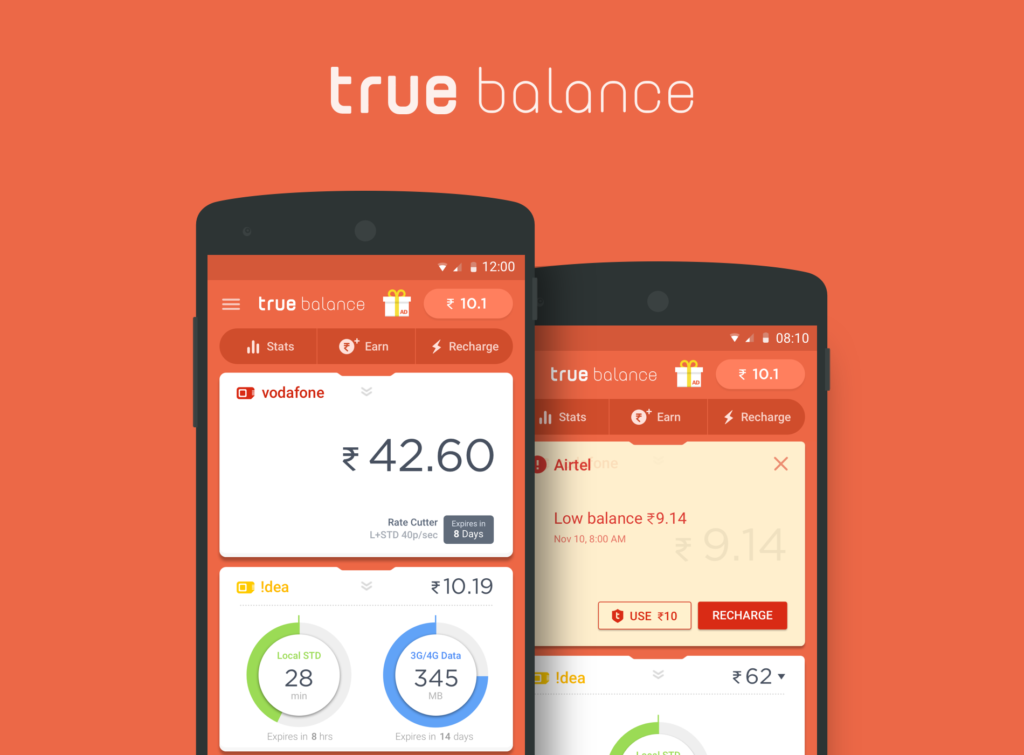

Balance Hero now plans to grow its presence in the Indian market with mobile payments, following the success of its True Balance app. The service allows smartphone users to easily check balances and recharge prepaid accounts rather than call their provider manually, something that is still commonplace in India. True Balance has been downloaded over 40 million times, and the company says that mobile payment functionality will eventually be added to the service.

“Having obtained this license, we have cemented ourselves as a fintech company in India’s ever-growing mobile payment market,” says Charlie Lee, CEO of Balance Hero.