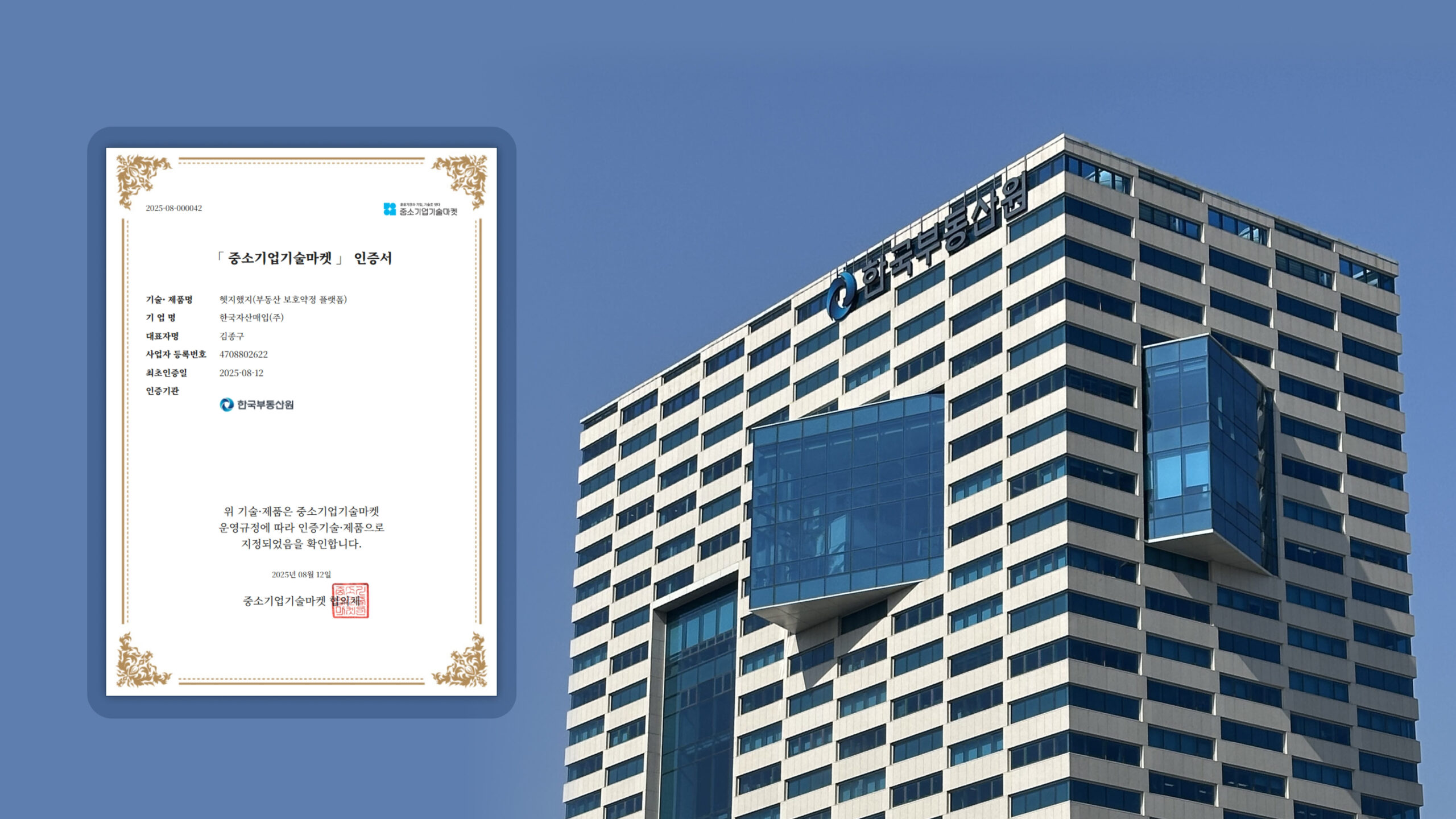

"Hedge," an AI-based housing finance service operated by Korea Asset Purchase, has passed the Korea Real Estate Board's technology verification process and has been registered as a "certified technology" in the SME Technology Market. This registration establishes a transaction channel for official use by public institutions, private companies, and investors.

The SME Technology Market is a technology exchange platform that connects public and private sector users with technologies whose performance and reliability have been verified by state-certified institutions. Technology registration is based on objective evaluations, providing a foundation for public institutions, large corporations, and financial institutions to consider adopting proven technologies.

The newly registered "Hedge" technology utilizes "AI PRISM," an AI-based valuation model developed by Korea Asset Purchase, to precisely analyze real estate values and predict risks by generation. Unlike existing proptech models, which rely solely on average market prices and have structural limitations that make it difficult to reflect value variations across generations, AI PRISM integrates and analyzes over 200 factors, including floor/building location, view, sunlight access, and accessibility, along with macroeconomic variables, to derive the appropriate value for each generation.

The generated data is automatically reflected in the financial product conditions in conjunction with the purchase claim (real estate put option), and risk changes are monitored and response scenarios are provided through the Early Warning System (EWS).

"Hedge" is recognized as more than just a simple financial service; it's a technology-based housing safety net that responds to market uncertainty. It simultaneously pursues market stability and social value creation through various functions, including protecting end-users, mitigating risks for construction companies and financial institutions, and resolving information asymmetry.

Korea Asset Purchase plans to use this technology registration as an opportunity to expand collaboration with public institutions, large corporations, and institutional investors. It is also considering expanding into overseas markets.

Kim Jong-gu, CEO of Korea Asset Purchase, said, “Technology that reflects generational values, not just averages, could become a new standard for real estate financial products in the future,” and added, “Based on this registration, we will expand the ‘Hedged’ model to domestic and international markets.”

- See more related articles

You must be logged in to post a comment.