Lucent Block is pursuing distribution platform approval in accordance with the financial authorities' principle of separating issuance and distribution, and plans to apply for approval next month.

– Plans to expand from a real estate token securities platform to a real asset exchange, creating a reliable trading environment for various assets.

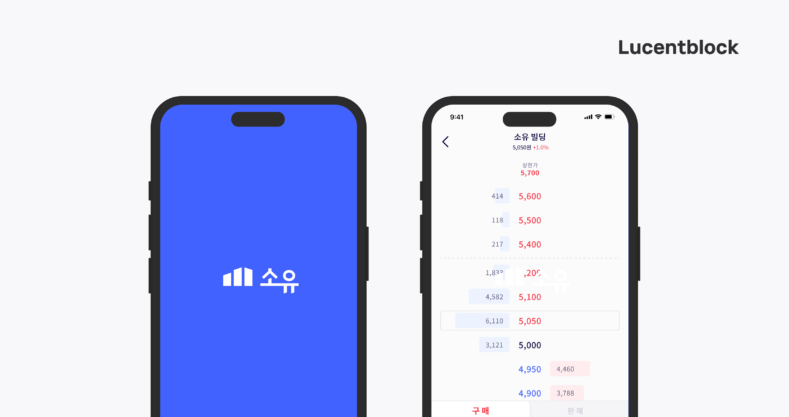

Lucent Block (CEO Heo Se-young), which operates the real estate token securities (STO) platform ‘Soyou’, announced on the 4th that it will pursue obtaining an investment brokerage license related to the distribution of trust beneficiary securities, which will be newly established by the Financial Services Commission in October.

As the financial authorities introduced the principle of separating issuance and distribution during the government's STO legislation process, most fragmented investment companies chose issuance licenses. However, Lucent Block decided to focus on the distribution platform based on its experience in operating both issuance and distribution.

Founded in 2018, LucentBlock has been providing commercial real estate piece investment services under the philosophy of "giving everyone the opportunity to own." Over the past three years, it has sold out 11 properties, including F&B, hotels, and offices, securing approximately 500,000 customers. Investments in all products start from 5,000 won, making real estate investment, previously considered a high barrier to entry, more accessible.

Through this distribution approval process, LucentBlock plans to expand its investment horizon beyond existing real estate products to include a variety of real assets. Upon obtaining approval, it will be able to select assets from various issuers and list them on the exchange, providing investors with a wider range of options.

In particular, Lucent Block plans to manage all real estate assets in the current 'Own' app in the existing manner, and to establish an environment where new assets can be safely traded within the institutional framework after the distribution platform is approved.

“While we have improved investment accessibility through piecemeal real estate investments, we now aim to open an era where anyone can own shares of desired real assets through distribution approval,” said Heo Se-young, CEO of Lucent Block. “Our goal is to build a real asset exchange that investors can trust within the institutional framework.”

Meanwhile, LucentBlock signed an agreement with the Seoul Metropolitan Government in August to tokenize public assets. They are participating in building a model that digitizes public assets to increase their usability and share development profits with citizens.

You must be logged in to post a comment.