-Restaurants trade used cooking oil at a fair price.

·Innovation of complex distribution structures such as middle and left-handed distribution

– Get a quick overview of your franchise and branch waste cooking oil usage… Also used as ESG data.

– Establishing a circular resource sharing hub next year to revolutionize Korea's waste cooking oil trading market.

According to the Korea Bioenergy Association, the amount of waste cooking oil discarded in Korea annually is estimated at approximately 250,000 tons. This figure is believed to be significantly higher, including amounts not included in statistics. Eighty percent of waste cooking oil is generated by food factories, restaurants, and franchises, while the remaining 20 percent comes from households. But how is this waste cooking oil handled?

Waste cooking oil is strictly managed due to its potential for water and soil pollution. Collected waste cooking oil is being recycled into various biofuels, including biodiesel and sustainable aviation fuel (SAF). The Renewable Fuel Standard (RFS), introduced in 2006, began as a voluntary regulation and became mandatory in 2013. It requires a certain percentage of biodiesel to be blended into diesel fuel. In July of this year, the government announced plans to increase the mandatory biodiesel blending ratio from 3% to 3.5%, increasing it to 5% by 2030.

Kim Ki-ok, CEO of allsu, has been working in the waste cooking oil collection industry for over 12 years, encountering fundamental problems within the field. The key issue he discovered was the lack of transparency in the market. In early 2021, CEO Kim established "allsu," a platform that combines IT technology with international certification systems to ensure transparency in the waste cooking oil trade. Currently, allsu has secured 1,200 of its approximately 5,000 collection partners nationwide, 17,000 restaurants and franchises, and has traded a cumulative 5,000 tons of waste cooking oil. In May 2021, allsu was selected for the "Eco Startup" program hosted by the Korea Environmental Industry & Technology Institute, and this year, it was selected for SK Telecom's "ESG Korea 2025" program, marking its continued growth as an ESG company.

We met with Kim Ki-ok, CEO of allsu, which is aiming to change the market landscape with a new business model called the "Circular Resource Sharing Hub," and heard about the collection and trading system for used cooking oil, as well as resource utilization.

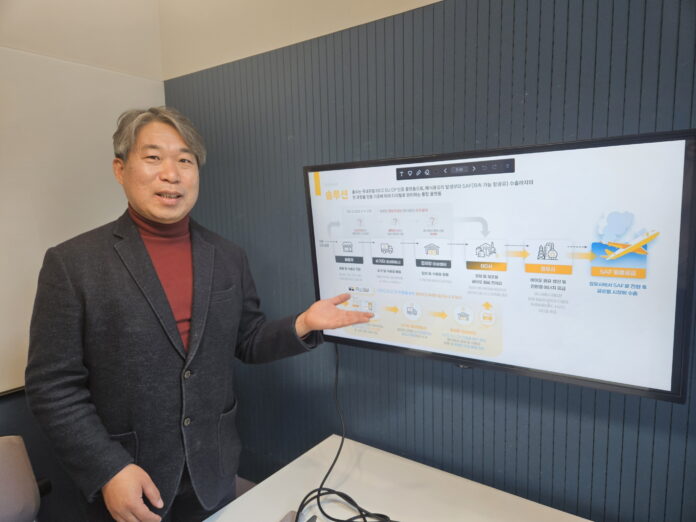

Making complex distribution structures transparent

The distribution process for used cooking oil consists of complex steps. Waste cooking oil collected by collectors (jungsang) is then collected by intermediary collectors (jwasang), who then sell the waste cooking oil received from various middlemen to refiners. This multi-layered distribution structure has led to inefficiencies throughout the industry. While the adoption of RFS has led to growth in the used cooking oil trading market, it remains plagued by fundamental issues: a lack of transaction data, a lack of a tracking system, and opaque pricing. The startup that has solved these problems is allsu. Allsu has revolutionized and transparently transformed the complex distribution process and data-deficient trading market.

Allsu revolutionized the collection process from the most basic level. Instead of the traditional phone call system, restaurants can now directly access the Allsu app to request waste cooking oil collection. Restaurant owners simply input their waste volume and submit a request, and Allsu's platform automatically matches them with the nearest collection partner. All transaction information, including photos of the collection site, collection time, location information, and actual weight, is automatically digitized.

Allsu has received the International Sustainability and Carbon Certification (ISCC) EU international eco-friendly certification. ISCC EU, an international certification standard originating in Europe, certifies transparency across the entire resource production process, from its origin to collection and distribution.

ISCC EU CP certification is crucial in the waste cooking oil trade. Only with ISCC EU CP certification can refineries and biodiesel companies use UCO as a raw material for SAF and export it. We were the first to obtain this certification and implement a system that traces the waste back to its origin.

The pricing structure has also changed. With multiple collection partners competing on the allsu platform, a structure has been created that naturally allows restaurant owners to offer more competitive prices.

Changing the way franchise headquarters manages

For large franchises, waste cooking oil management is a daunting task. Supervisors had to personally visit each store to ensure it was properly managed, used containers of the correct specifications, and collected properly.

The introduction of "allsu" has transformed the situation. Instead of visiting stores in person, the allsu app allows customers to check all their stores nationwide at a glance from their headquarters. The allsu dashboard records in real time the time waste cooking oil was discharged, the amount of waste, the person collecting it, and the exact weight. This data allows headquarters to understand waste cooking oil discharge trends at each store, serving as a valuable reference for management decision-making.

More importantly for franchise headquarters, allsu enables them to demonstrate their ESG management practices. They can provide concrete figures showing the exact number of tons of waste cooking oil collected each year, the carbon reduction achieved, and the positive environmental impact. This data will soon become key data for their ESG management reports.

A transparent tracking system ensures safe use of bioenergy and sustainable aviation fuel.

The waste cooking oil collected by Allsu is stored at the Siheung Center and then sent to a biodiesel refinery. The biodiesel refinery chemically refines and processes the waste cooking oil into biodiesel, which is blended with diesel fuel. The refinery also produces SAF and HVO (a more advanced fuel than biodiesel, suitable for use in automobiles, railways, shipping, and heavy equipment).

The government announced a roadmap in September 2025 to mandate a 1% blend of sustainable aviation fuel (SAF) for all domestic departures starting in 2027, gradually expanding to 3-5% in 2030 and 7-10% in 2035.

The global bioenergy and sustainable aviation fuel market is expected to grow rapidly, driven by efforts to reduce carbon emissions. The bioenergy (HVO) fuel market is projected to be worth USD 15.8 billion in 2024 and is projected to reach USD 55.2 billion by 2032, at a compound annual growth rate (CAGR) of 14.14%. The sustainable aviation fuel (SAF) market is projected to grow from USD 2.7238 billion in 2025 to USD 28.63636 billion by 2032, at a CAGR of 39.95%.

What value does allsu create in this huge market opportunity?

The key lies in transparency. From the moment the waste cooking oil collected by Allsu is collected, all information is recorded in a database. Everything is recorded: which restaurant it came from, when it was collected, who collected it, the exact number of kilograms, and where it was sent. This data is shared with oil refineries and biodiesel companies, ensuring complete visibility into the source of the raw materials.

Building a UCO Circular Resource Sharing Hub

In October 2024, the government designated waste cooking oil as a "circular resource," marking a significant regulatory shift. Previously, waste cooking oil was legally classified as a "waste," preventing the construction of collection facilities in urban areas. However, the change in classification to a "resource" made it possible to construct collection facilities in urban areas. Allsu immediately incorporated this policy change into its business strategy. It established a plan to build a "UCO Circular Resource Sharing Hub," a waste cooking oil collection facility near urban areas.

Allsu plans to open its first hub in the Gyeonggi region in 2026. Construction costs alone are expected to be 4.5 to 5 billion won, and the facility will be approximately 300 pyeong (approximately 1,000 square meters). Starting with this hub, the company plans to build three more hubs in South Chungcheong, North Jeolla, and South Gyeongsang by 2030, for a total of four hubs nationwide. This will allow SMEs in each region to locate at the hub closest to their location, reducing inefficiencies in long-distance transportation, improving the economic structure of SMEs, and expanding Allsu's nationwide network. This strategy promises to kill three birds with one stone.

There's a key problem that shared hubs solve. Under tax and environmental laws, merchants cannot file collection and transportation reports without their own offices. This has been a structural cause of merchants' dependence on the left-wing. Allsu's shared hub addresses this problem by providing merchants with private offices. Resident merchants can use the offices as their registered business addresses and operate independently.

The hub operates not only as a private office but also as a large-scale shared collection center. Merchants can collect their own waste cooking oil here, and Allsu transports the collected bulk quantities to the refinery. This model allows Allsu to perform the role previously performed by the left-hand merchants, while providing a margin to the merchants.

Allsu is currently seeking investment to secure the funds needed to establish a shared hub.

Expansion into a 'comprehensive waste management company'

Allsu aims to become a comprehensive waste management company, evolving into a platform capable of handling not only waste cooking oil but also animal fats, waste plastic fuel, and frying scraps. It is also preparing to expand overseas, including to Vietnam and Malaysia.

"allsu was designed from the beginning with global use in mind. We hope it will become the standard in the global market as well."

Waste cooking oil was once a simple headache for restaurants. Later, with the mandatory biodiesel blending policy, it became "hidden cash." This led to the creation of an opaque and closed market. However, the emergence of allsu has brought transparency to the market, giving franchise headquarters access to verified ESG data and enabling refineries to secure a reliable supply of certified raw materials.

"Allsu isn't simply a waste collection company. We want to be a company that transparently transforms waste cooking oil into aviation fuel. Our mission is to create a structure that allows all stakeholders to share in the profits fairly throughout the process."

Allsu's future hinges on expanding this transparency. Starting with waste cooking oil, it aims to become a circular resource platform encompassing all waste streams, and to establish itself as a global standard beyond Korea. This is Allsu's current goal. It remains to be seen how deeply Allsu's philosophy—that data creates transparency, and transparency creates fairness—will take root in the market and ultimately expand to the global market.

You must be logged in to post a comment.