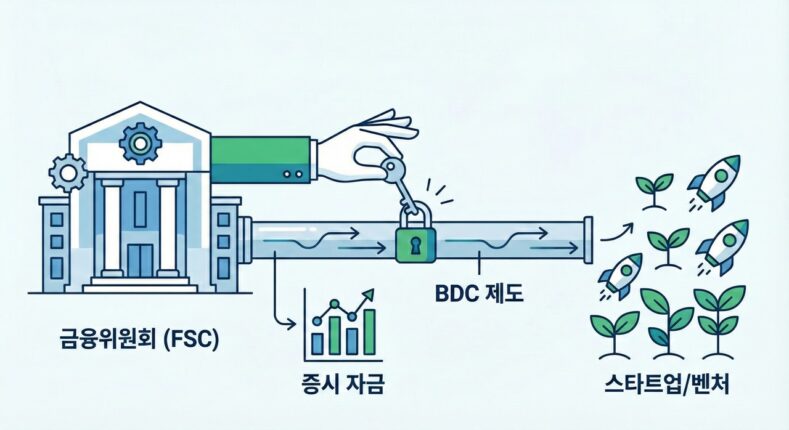

As the BDC (Corporate Growth Collective Investment Corporation) system enters the legislative notice stage, the potential for structural changes across the domestic capital market is being raised. With the institutional opening of public offerings for unlisted and venture capital investments, some anticipate a restructuring of the domestic capital raising structure, which has historically been heavily focused on IPOs.

The government announced the implementation of the BDC system in March of next year through amendments to the Enforcement Decree of the Capital Markets Act and the Financial Investment Business Regulations. BDCs are investment vehicles designed to provide growth capital to unlisted, venture, and KOSDAQ-listed companies using a public offering fund structure. They are positioning themselves as a means of bringing individual investors' access to venture capital within the institutional framework.

According to the proposed legislation, BDCs must invest at least 60% of their assets in unlisted venture and innovative companies, KOSDAQ and KONEX listed SMEs and startups, and venture capital funds. The fund must raise at least KRW 30 billion and adopt a no-redeem policy with a maturity of at least five years, ensuring a certain amount of funds are tied up as mid- to long-term venture capital.

The management method offers greater flexibility compared to existing public offering funds while strengthening accountability. Management companies are required to make seed investments based on their size, and BDCs are subject to stricter information disclosure requirements, including quarterly fair value assessments and disclosure of key management information. While lending is permitted up to 40% of the investment in the primary investee company, investments exceeding 10% in the same company, holding more than 50% of the equity, and investing without external growth assessments are prohibited.

The growing attention given to BDCs stems from structural biases in the domestic capital market. Historically, the domestic market has been heavily focused on IPOs, with funds concentrated in companies after they go public. Individuals have had limited access to unlisted and middle-market companies. BDCs offer a public offering-style channel for equity and loan investments in unlisted, venture, and mid-sized companies, raising hopes that this will alleviate the current situation where only successful IPOs enjoy capital market advantages.

Along with the expansion of venture investment flows, there is also controversy over passing the buck.

Overseas examples provide clues to the effectiveness of institutional adoption. In the US, BDCs have become a key player in mid-market LBOs and non-bank direct lending, expanding their assets under management to hundreds of billions of dollars. In particular, the proportion of direct lending in mid-market LBO financing has surged, even partially replacing the existing bank-centric credit brokerage structure.

Changes are also expected in the domestic venture and startup ecosystem. If BDCs become established, the unlisted and venture capital supply structure, centered around VC, PE, and policy finance, will be supplemented with public offerings, potentially creating a new layer of capital for later-stage companies and companies nearing IPO. If coupled with the recent recovery in venture investment, particularly in ICT, this could also contribute to diversifying exit paths.

Individual investors face both new opportunities and risks. Through BDCs, individuals can move beyond the traditional investment spectrum centered on listed stocks and ETFs and access the return and risk structures of unlisted and venture capital funds. However, due to the high proportion of illiquid assets, long-term holding is a fundamental prerequisite. This necessitates an understanding of product structures, including portfolio composition, fees, and valuation systems, which could potentially clash with an investment culture focused on short-term trading.

The market is experiencing a mix of expectations and concerns. While some anticipate that BDCs could provide a new growth engine amidst the sluggish public offering fund market, others are concerned that the introduction of BDCs could further pressure the valuations of unlisted and venture funds. In particular, the risk management capabilities of asset managers and the independence of external rating agencies are identified as key variables that will determine the success or failure of the system.

Industry insiders expressed concern, saying, “If we don’t divide our responsibilities through collaboration or M&A with accelerators and venture capitalists who have been focusing on existing venture investments, the market distortion could worsen,” and emphasized, “We must continue to cooperate with startup venture investors on secondary and M&A.”

The government plans to revise lower-level regulations through regulatory review, review by the Ministry of Government Legislation, and the State Council. The market's biggest concerns are the strategies and structures with which the first-generation BDCs will enter the market, and whether the system's goal of "expanding the supply of venture capital" and "investor protection" will be achieved in the actual product, sales, and after-sales management stages.

You must be logged in to post a comment.