OpenAI, which operates ChatGPT, declared 'Code Red'.

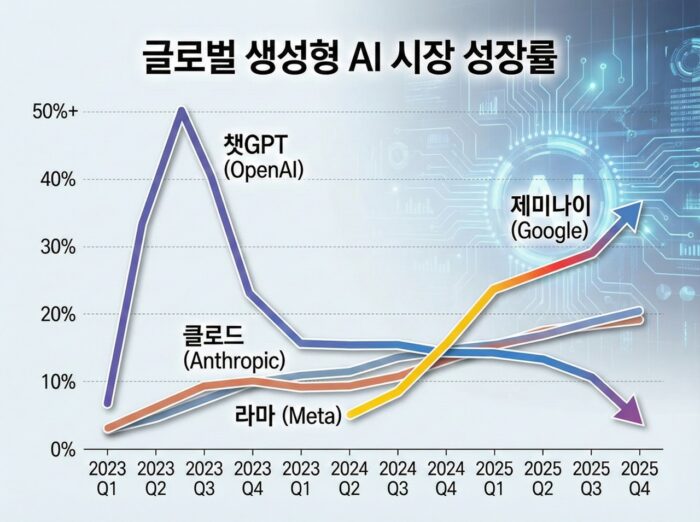

With ChatGPT's growth slowing and competition in generative AI intensifying simultaneously, some are assessing that the global generative AI market has entered its second act. While OpenAI, the leader, still maintains a strong user base, it faces the dual challenges of maintaining growth and market dominance amidst the pursuit of competitors like Google, Anthropic, and Meta.

Is Rapid Growth Halting? Signs of ChatGPT Growth Slowing

According to industry analysis, ChatGPT's global user base remains in the hundreds of millions, but monthly and weekly active user growth rates have fallen to single digits, demonstrating a different pattern from its initial explosive growth. Mobile app download growth is also showing clear signs of slowing, with declines in dwell time and number of sessions observed, particularly in key markets like the US.

Looking at usage patterns, the share of business and productivity uses has significantly increased, leading to higher usage intensity. However, the pace of new adoption is gradually slowing, coinciding with market saturation. Some analysts suggest that this is the result of initial exploratory demand dwindling and increasing demand for more sophisticated applications, exposing a gap between expected and actual performance.

Gemini's advances, Claude and Lama's "Gradually, Gradually," and the surprise emergence of Chinese AI are encroaching on the ChatGPT market. The competitive landscape is being reorganized.

Coinciding with the slowdown in growth, competitors are also making notable strides. Google is rapidly expanding its market share with its "Gemini" series, which emphasizes multimodal performance and search and ecosystem integration, and its monthly active users are also growing rapidly. Antropic's "Claude," Meta's "Lama" series, and specialized search and Q&A services are also targeting niche markets with their competitive pricing, integration, and specialized features. Recently, Chinese AI models have emerged, closely following Google's lead.

While ChatGPT still holds an overwhelming majority in terms of market share, the market is becoming increasingly polarized, with competing services like Gemini, Cloud, and Perplexity holding double-digit market shares. In the enterprise market, growing demand for security, on-premise capabilities, and customization is driving the adoption of models optimized for specific workflows and agent-based solutions.

OpenAI Issues 'Code Red' Alert

Amid these changes, OpenAI's management reportedly shared internal "crisis alerts" and began reorganizing ChatGPT's competitiveness. On the 1st, OpenAI's Sam Altman declared a company-wide "Code Red," the highest level of OpenAI's three-level internal alert system. He urged a shift in strategy, focusing on improving usability, personalization, and expanding global distribution, while simultaneously enhancing model performance, enhancing experience quality, and redesigning pricing and product structures.

At the same time, OpenAI is accelerating revenue diversification by exploring new touchpoints, including enterprise solutions, agents and automation, robots, and hardware. Industry observers believe that ChatGPT, which remains the leader in traffic and brand power, has ample room to regain its growth curve if it succeeds in restoring trust and innovating its products. However, some argue that intensifying structural competition makes it difficult to return to the high-growth era.

Accordingly, attention is focused on whether OpenAI will maintain its market dominance with ChatGPT 5.2, which will be released on the 9th.

The company generated $4.3 billion in revenue in the first half of 2025, but recorded an operating loss of $7.8 billion, primarily due to research costs and ChatGPT operations. OpenAI expects annual revenue to exceed $20 billion, but it projects continued losses through 2028. Consequently, at a time when it urgently needs to secure diversified investment sources, including an IPO, the prospect of losing market share is a significant concern.

Beyond the generative AI market, what new uses are there?

Experts interpret this slowdown not as a limitation of individual services, but as a sign that the generative AI market has moved beyond the initial experimental phase and entered the phase of full-scale commercialization and competition. From a user perspective, they also see a shift in usage patterns, from a single, general-purpose chatbot to a combination of multiple AIs optimized for specific tasks and domains.

Ultimately, the mid- to long-term competitiveness of the generative AI market will depend on comprehensive capabilities encompassing data, platforms, ecosystems, and regulatory compliance, beyond the performance of a single model. The slowdown in ChatGPT growth is a reflection of this transition, and the market landscape is likely to undergo significant turbulence again in the coming years, depending on the strategic choices made by big tech and independent AI companies.

You must be logged in to post a comment.