This article is a contribution from the accounting firm Milestone. If you would like to share quality content for startups in the form of a contribution, please contact the Venture Square editorial team at editor@venturesquare.net.

One of the most fundamental yet crucial tax obligations for running a business is withholding tax. Withholding tax is a system whereby the payer of income collects taxes in advance from the recipient (individual or corporate) and remits them to the government on their behalf, effectively fulfilling the tax obligation on behalf of the recipient. This is more than simply a tax deduction; it's a key tool for the government to secure tax revenue early and understand income flow. However, the sheer diversity of income, coupled with the complexities of tax rates and reporting requirements, often leaves many business owners feeling confused.

In this column, we will provide a practical overview of the five major income items subject to withholding tax that business owners must be aware of, the easily confused exclusions, and the obligation to submit payment statements.

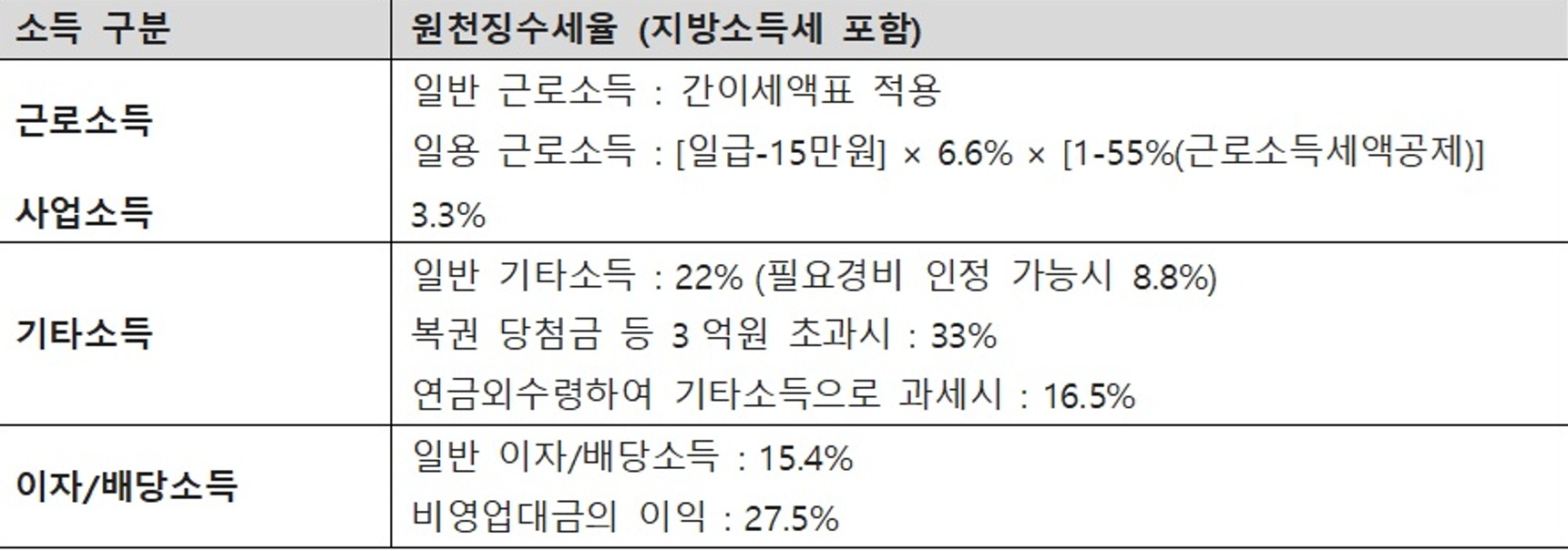

1. Income subject to withholding tax and tax rate

Under the Income Tax Act, income subject to withholding tax is divided into three categories: earned income, business income, miscellaneous income, interest/dividend income, and pension/retirement income. Of these, we will focus on the five most commonly encountered income categories (earned income, business income, miscellaneous income, interest/dividend income).

1) Earned income

Earned income refers to income paid in exchange for labor (salaries, bonuses, various allowances, etc.) under an employment relationship or similar contract. Withholding tax is required according to the National Tax Service's simplified tax table. For daily wages, up to 150,000 won per day is tax-exempt, and any excess is subject to a lower tax rate of 6.6% (including local taxes). However, since the earned income tax credit applies to 55% of the calculated tax amount, the actual withholding tax is calculated as 2.97% (including local taxes) on the amount exceeding 150,000 won per day.

2) Business income

Business income refers to payments received for services provided on an ongoing basis in an independent capacity, without an employment relationship (e.g., freelancers, private academy instructors, designated drivers). The withholding tax rate is 3.3% (including local taxes). This is a simple tax rate that does not account for necessary expenses, so business owners must settle their final tax amount by filing their comprehensive income tax return in May of the following year.

3) Other income

Other income refers to temporary or incidental income (e.g., lecture fees, manuscript fees, prize money, honorariums, penalties, transfer fees for goodwill, etc.) that does not fall under earned income or business income. The withholding tax rate is generally 22% (including local taxes). However, for income where necessary expenses, such as lecture fees, are recognized as 60%, an 8.8% withholding tax (including local taxes) is effectively withheld. However, other income of 50,000 won or less per item is exempt from withholding tax.

4) Interest and dividend income (financial income)

Financial income includes deposit interest, bond interest, and stock dividends. In principle, a 15.4% tax rate (including local taxes) applies. However, profits from non-business loans received by individuals who do not lend money for business purposes are subject to a higher tax rate of 27.5%. Interest and dividends exceeding 20 million won per year, combined, are subject to comprehensive income tax.

The above contents are summarized in a table as follows.

Business owners must pay withholding tax by submitting a withholding tax performance report to the competent tax office by the 10th day of the month following the month in which the above-mentioned income payment date falls.

2. Exceptions to withholding tax obligations

There is no withholding tax obligation for dividends paid to domestic corporations. However, dividends paid to foreign corporations may be subject to reduced or exempted tax rates depending on the application of a tax treaty. However, withholding tax is still mandatory, so caution is advised.

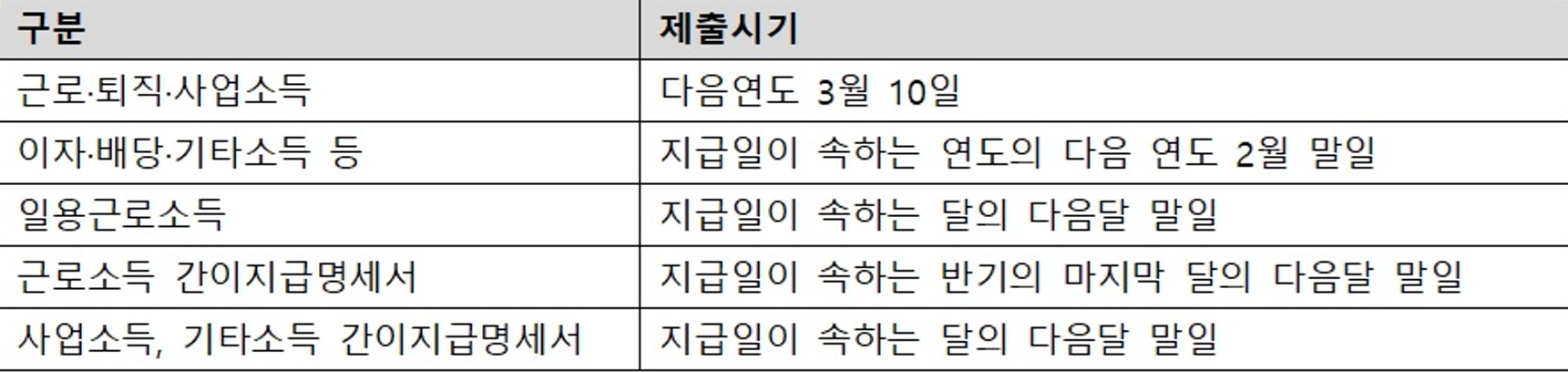

3. Obligation to submit payment statement and surtax

In addition to withholding tax, business owners must submit a payment statement detailing the income and the amount withheld to the tax office. The submission deadlines for each income type are as follows:

If a payment statement is not submitted by the deadline, is unclear, or contains a discrepancy between the payment amount and the actual payment amount, a surcharge of 1% (0.25% for daily wage income and simplified payment statements) of the unsubmitted or unclear payment amount will be imposed. However, if the statement is submitted within three months (or within one month for daily wage income and simplified payment statements) of the due date, the surcharge will be reduced by 50%.

4. Conclusion

Business owners must fully comply with their obligations, including filing monthly withholding tax returns (by the 10th of the following month) and submitting annual payment statements, to minimize tax risks. In particular, distinguishing between business and other income and excluding withholding tax on dividend payments to corporations are among the most common mistakes in practice. It's recommended to seek professional assistance before filing to accurately classify income types and diligently fulfill these obligations.

- See more related columns

You must be logged in to post a comment.