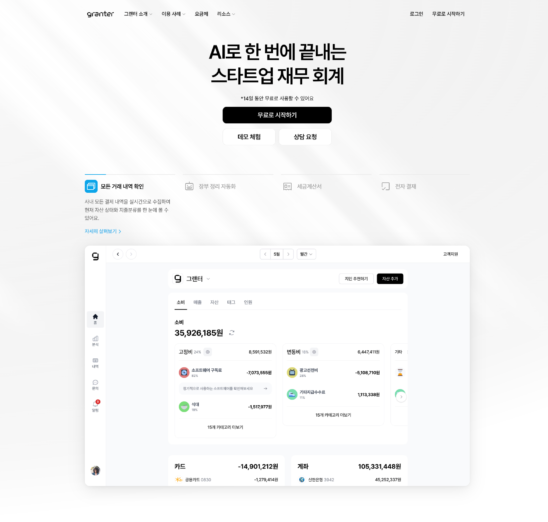

– Innovating inefficient expense management for small and medium-sized businesses with 'Granter,' an AI-based financial accounting automation program.

– Save time with automatic recognition, classification, and visualization of everything from receipts to card details.

From Samsung Electronics AI developer to entrepreneur solving pain points for small and medium-sized businesses

CEO Lee Young-in graduated from Sungkyunkwan University with a degree in Computer Engineering and has been building his career as a software solutions developer in the AI and big data fields at Samsung Electronics for six years since 2016. He later moved to a startup developing blockchain and NFT solutions, where he served as a development team leader, broadening his experience at the forefront of IT technology. In an interview, CEO Lee explained the impetus for his startup, saying, "No matter how good the technology is, it's meaningless if it doesn't solve real-world problems. In particular, observing the inefficient expense processing processes faced by small and medium-sized enterprises (SMEs), I became convinced that AI could solve these problems."

Granter secured seed funding less than a year after its founding, laying the foundation for rapid growth. CEO Lee emphasized, "The Korean business market is dynamically changing, but information asymmetry in corporate management remains a persistent problem. Granter's goal is to bridge this gap with AI, enabling companies to focus on their core businesses."

" Excel with AI"… Granter's Expense Management Automation Begins

The expense management problem that Granter seeks to address for SMEs is clear. Most SMEs lack an expense management system, forcing CEOs or accounting teams to manually enter each receipt and manage it in Excel. This process is incredibly time-consuming and often leads to missing documentation, increasing the risk of tax issues and making it difficult to recognize unnecessary expenses.

When running a solutions-based business, the most crucial element is data. Typically, companies handle over 100,000 pieces of financial data. However, managing this data directly from the user's perspective is incredibly complex and challenging.

CEO Lee Young-in explained, "Granter is an integrated accounting management program that uses AI to automatically recognize and categorize receipts and card statements. Employees can upload photos of receipts or link corporate and personal card statements, and the AI automatically categorizes and organizes expenditures. This significantly reduces expense processing time from 10 minutes to less than a minute."

Granter's core features include:

- Automatic receipt/card history recognition: Automatically retrieves receipt images and card usage history and inputs data through OCR (optical character recognition) technology and card company integration.

- AI- based automatic expense item classification: AI learns expense data to automatically classify even complex items, and continuously improves accuracy by relearning user-edited data.

- Real-time spending analysis and visualization: Provides a visualized dashboard that displays all spending details at a glance, helping you identify unnecessary expenses and manage your budget efficiently.

- Improving tax efficiency: Prevent missing documentation and automatically generate tax data to maximize the efficiency and accuracy of tax tasks, including VAT refunds.

- Detecting outliers: AI automatically detects anomalies such as duplicate spending and policy violations, enhancing corporate financial transparency and providing internal control functions.

Beyond ' Financial Insights', Dreaming of an 'OS for Corporate Expenditure Management'

Granter aims to go beyond simply automating expense processing to provide essential financial insights for business management. CEO Lee stated, "We aim to position Granter as the 'OS (Operating System) for corporate expense management.' We envision an era where small and medium-sized businesses will naturally use Granter for financial management and plan growth based on this data."

Granter is SaaS (Software as a Service)-based, ready to use immediately without separate installation, and its intuitive UI/UX makes it easy for anyone to use. This makes it ideal for small and medium-sized businesses (SMEs) that find complex systems burdensome to implement. CEO Lee emphasized, "With its ease of use and reasonable price, we will accelerate the digital transformation of SMEs and contribute to making transparent and efficient AI-based financial management a cornerstone of all businesses."

Granter plans to further enhance its AI capabilities to provide more sophisticated spending forecasting and optimization capabilities, and expand its integration with other financial solutions to evolve into an integrated platform encompassing all financial activities for small and medium-sized businesses.

You must be logged in to post a comment.