This article is a contribution by Attorney Hye-rin Kim of Choi & Lee Law Firm. If you would like to share quality content for startups in the form of a contribution, please contact the Venture Square editorial team at editor@venturesquare.net.

The domestic market for personal overseas remittances has been growing rapidly in recent years. Whether you're a fintech startup or a company considering a spin-off from an existing service, entering the overseas remittance business requires more than just a simple idea. You must meet detailed registration requirements and pass the rigorous registration process of the Financial Supervisory Service and the Ministry of Strategy and Finance. Today, for those considering entering the small-sum overseas remittance business, we'll examine trends in the domestic overseas remittance market, the registration process, and key requirements.

1. What is small-sum overseas remittance business?

The small-sum overseas remittance business is a system that allows general business operators (including fintech companies) other than banks to conduct small-sum overseas remittance business after meeting certain requirements and registering with the Minister of Strategy and Finance. According to the Foreign Exchange Transactions Regulations, it refers to the business of remitting small amounts overseas of up to USD 5,000 per transaction and up to USD 50,000 per person per year (Article 2-31 of the Foreign Exchange Transactions Regulations).

2. Growth of the domestic overseas remittance market: Revision of the Foreign Exchange Transactions Act and the emergence of fintech.

Overseas remittances, once the exclusive domain of banks, were plagued by high fees and complex procedures. As personal transfer income and salary/wage payments grew, the need for low-cost, convenient remittance services emerged. To enhance the convenience of overseas remittances for the public and foster domestic fintech businesses, the Enforcement Decree of the Foreign Exchange Transactions Act was revised in 2017 to allow non-financial companies to operate small-sum overseas remittance services if they meet certain requirements. This changed the structure of the domestic overseas remittance market.

As fintech companies began to dominate the international remittance market with lower fees and faster transfer speeds compared to traditional banks, the number of registered small-sum international remittance companies more than doubled from 12 in 2017 to 26 this year. Hanpass, a leading fintech remittance company, surpassed KRW 10 trillion in cumulative international remittance transactions in April of this year, and currently processes one remittance every 2.6 seconds in real time. Fintech company SentBe, which started out as a small-sum international remittance service for individuals, has expanded its services to include SentBiz, an international remittance and payment service for businesses, targeting small and medium-sized enterprises (SMEs) that require international remittance and settlement. In July of this year, the company launched a foreigner-only international remittance service in collaboration with Viva Republica (Toss), integrating its international remittance service into the Toss app.

3. Registration procedures and requirements for small-sum overseas remittance businesses

Any entity other than a financial institution seeking to engage in the small-sum overseas remittance business must meet the registration requirements stipulated by law and register with the Ministry of Strategy and Finance. The small-sum overseas remittance business registration process can be broadly divided into four steps.

1) The applicant company first conducts preliminary consultations with the relevant authorities (Financial Supervisory Service, Bank of Korea, etc.).

2) An application for registration of small-sum overseas remittance business must be prepared in accordance with the format of Appendix 3-7 of the Foreign Exchange Transaction Regulations, and all documents stipulated in the law (Article 2-30 of the Foreign Exchange Transaction Regulations) must be attached, including the articles of incorporation, a copy of the corporate registration, explanatory materials on the scope and method of handling small-sum overseas remittance business, a copy of the bankbook, a copy of the establishment permit issued by the foreign partner's home government, etc., and submitted to the Financial Supervisory Service.

3) The Financial Supervisory Service's registration requirements review is based on submitted documents, and on-site inspections are conducted during the registration review period. The Financial Supervisory Service notifies the Ministry of Strategy and Finance of the results of the registration requirements review.

4) When the Ministry of Finance issues a registration certificate, the Financial Supervisory Service posts the registration information on its website.

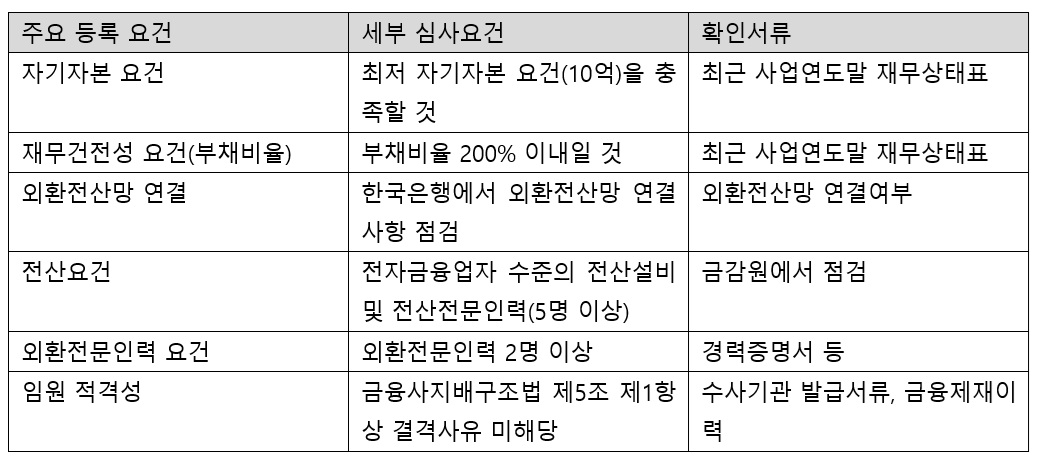

The most important thing in the registration process for small-sum overseas remittance businesses is to meet the key registration requirements stipulated in Article 15-2, Paragraph 2 of the Enforcement Decree of the Foreign Exchange Transactions Act, including equity capital requirements, financial soundness requirements (debt ratio), foreign exchange computer network requirements, computer equipment and computer specialist requirements, foreign exchange specialist requirements, and executive qualifications.

If you're preparing to register as a small-sum overseas remittance business operator, you're likely concerned about the requirements for specialized personnel (foreign exchange specialists, IT specialists, and information security officers). Based on the FAQ, we've compiled detailed requirements for each specialized personnel at a glance.

1) Foreign exchange specialists

● Secure at least two people per branch who have experience in foreign exchange business for more than two years or have completed training prescribed by the Minister of Strategy and Finance.

● For a foreign exchange professional career certificate, you can submit a document issued by a foreign exchange business agency, but you must be able to confirm that you have worked in foreign exchange business for more than 2 years (① the period of employment and responsibilities by department must be written separately, or ② a phrase must be included to confirm that you have been in charge of foreign exchange business for more than 2 years. A career certificate that simply states the period of employment cannot be submitted.)

● Employment must be completed and registration application submitted at the time of registration.

● Must be employed on a full-time basis

● If you have completed a designated training course from the Korea Financial Training Institute or the Korea Financial Investment Education Institute, you can be recognized as a foreign exchange specialist. However, foreign exchange-related qualifications (foreign exchange specialist, etc.) are not recognized.

2) IT specialists

● At the time of application, secure at least 5 employees with at least 2 years of experience in IT work.

● Must be employed on a full-time basis

● Employment must be completed and registration application submitted at the time of registration.

3) Information Protection Manager

Foreign exchange/IT specialists and information security officers may hold concurrent positions.

● It is also possible for executives to concurrently serve as foreign exchange/IT specialists and information security officers.

● Must be employed on a full-time basis

● Employment must be completed and registration application submitted at the time of registration.

● Details of the designation of the information security officer (designation date, designated person, etc.) must be submitted. If you wish to be recognized as an information security officer based on a degree or certificate, you must submit the relevant degree or certificate. When submitting a certificate of employment/career, you must specify the career experience (department, responsibilities, etc.) that can be recognized as an information security officer.

● For details on the qualifications of the information protection officer, refer to <Appendix 1> of the Enforcement Decree of the Electronic Financial Transactions Act.

In addition, documents required to meet the main registration requirements can be confirmed through Article 15-2, Paragraph 2 of the Enforcement Decree of the Foreign Exchange Transactions Act and materials related to registration of small-sum overseas remittance businesses distributed on the Financial Supervisory Service's business data site .

4. Conclusion

The small-sum international remittance business has become a key pillar of the fintech industry in recent years. With advancements in AI, blockchain, and new interface technologies, and the anticipated arrival of 3 million foreign residents in Korea within the next five years, the industry predicts continued growth in the domestic personal overseas remittance market. If you're considering entering the market, it's crucial to thoroughly understand the registration procedures and requirements beforehand and secure the necessary capital, human resources, and IT infrastructure. By using the key points discussed in this column as a starting point and preparing step by step, you'll be able to take a more stable first step.

- See more related columns

You must be logged in to post a comment.