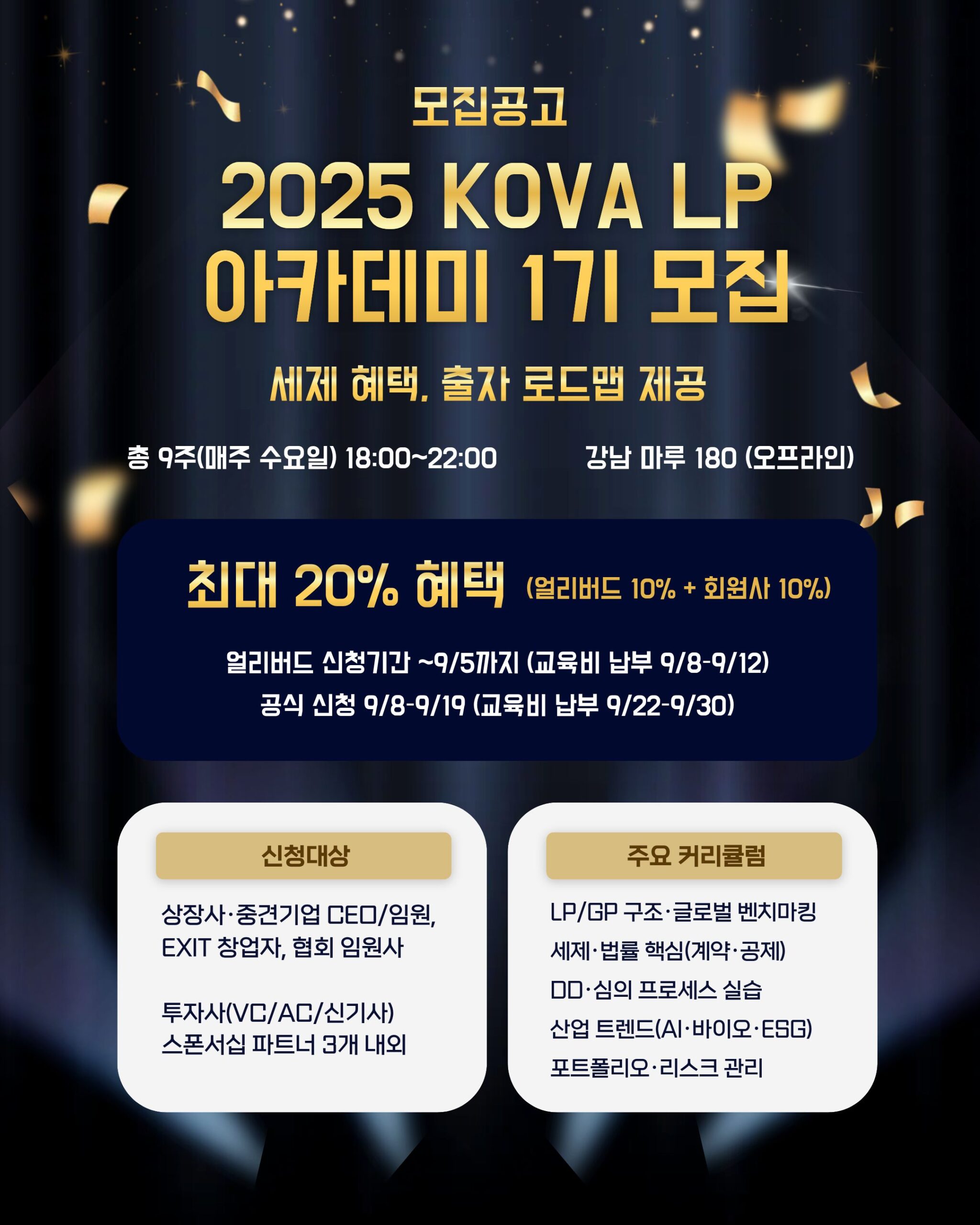

The Korea Venture Business Association (Chairman Song Byeong-jun) announced on the 29th that it is establishing the 'Venture/Startup LP Academy' to expand the base of private venture investment and is recruiting participants for the first round.

This training program aims to systematically cultivate specialized private LPs (Professional Limited Partners) and angel investors, thereby revitalizing the shrinking venture investment market, broadening the investment base, and expanding a healthy investment ecosystem.

The curriculum is structured around core competencies necessary for investment decisions, including ▲understanding the venture investment structure ▲laws, systems, and tax benefits ▲investment practices and case analysis ▲special lectures by senior LPs.

Participants will gain hands-on experience with the entire investment process through practical training, including writing investment proposals and participating in mock investment review committee sessions.

A key feature of this course is its close collaboration with current venture capital (VC) appraisers. Each week, current appraisers participate in the training, providing vivid feedback on investment attraction criteria and processes and providing practical networking opportunities. This structure ensures that the training goes beyond mere learning and leads to actual investment execution.

Graduates will participate in regular investor relations (IR) briefings and networking events through the "LP Club" alumni community. This will go beyond one-off training sessions and serve as a focal point for a sustainable private investor network.

An association official emphasized, “In a situation where the venture investment market has recently shrunk, expanding the pool of professional LPs is a key to revitalizing venture and startup investment,” and “Through the LP Academy, we will expand the private sector-centered venture investment participation base and create a sustainable investment environment.”

- See more related articles

You must be logged in to post a comment.