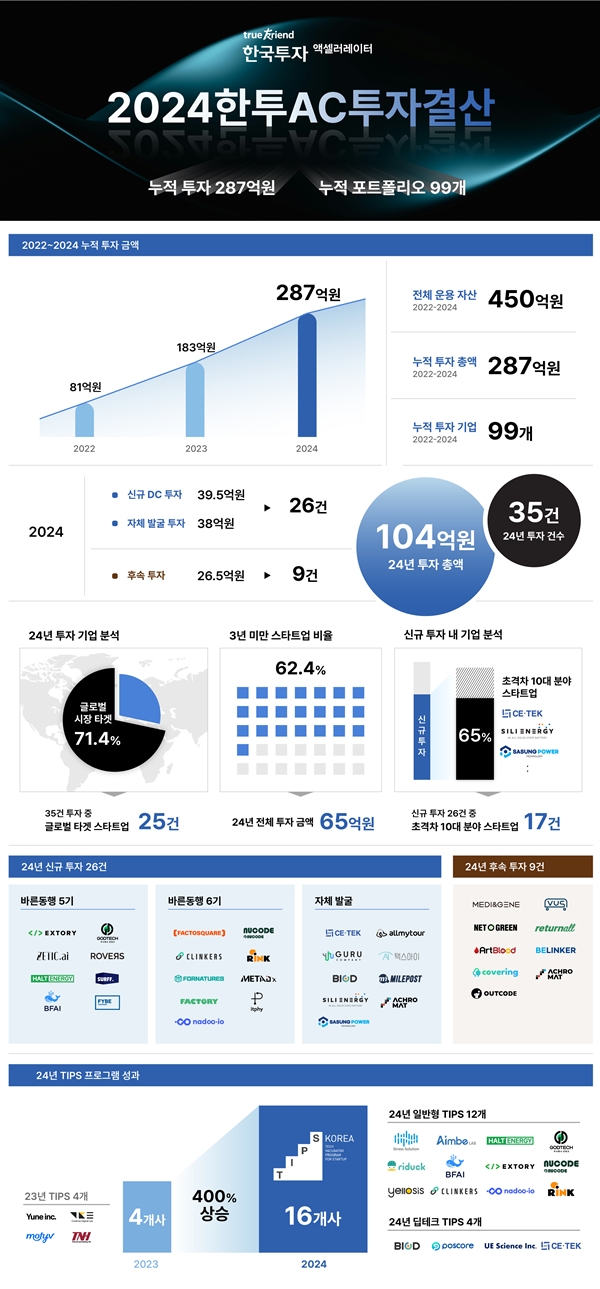

Korea Investment Accelerator (hereinafter referred to as Hantoo AC, CEO Baek Yeo-hyeon) announced on the 6th that it executed a total of 10.4 billion won in investments last year, reaching a cumulative investment of 28.7 billion won in just two and a half years. This is an encouraging achievement, demonstrating Hantoo AC's commitment to social contribution through early-stage startup investments even amidst declining early-stage startup investment. This brings Hantoo AC's cumulative portfolio to 99 companies. Since the launch of the "Hantoo Barundonghaeng Sherpa Fund No. 1" in 2022, a fund comprised of funds from Hantoo Financial Group and its affiliates, Hantoo AC has annually raised 15 billion won in funds using its own funds, up to its third fund last year. Currently, Hantoo AC has assets under management of 45 billion won.

Of Hantoo AC's 35 investments over the past 24 years, 26 were new investments, with an average investment amount of approximately KRW 300 million. Specifically, the company invested approximately KRW 4 billion in 17 companies through its placement program targeting early-stage startups (those established less than three years ago). Furthermore, the company invested KRW 3.8 billion in nine companies it independently discovered, not through the placement program, resulting in an average investment amount of KRW 420 million.

Of the 26 new investments, 17 are in the top 10 emerging sectors, successfully fulfilling the company's early-year plan to increase the proportion of its deep-tech portfolio. Examples include investments in eco-friendly and energy startups like Sasung Power (development of panel-type structural batteries), Siri Energy (development of next-generation secondary battery cathode materials), and Seetech (development of wet carbon capture technology), as well as AI startups like Jetic AI (development of on-device AI).

The company's strategy of investing in startups targeting global markets has also been reflected in figures. In fact, of the 35 investments made last year, 25 were in startups targeting the global market. Investments in companies such as Robus Company (Seed IP global transaction solution), BFAI (global AI expert matching solution), and Clinkers (global migrant worker settlement solution) demonstrated its commitment to investing in startups targeting the global market. Another notable achievement is that Kangsters (wheelchair exercise solution), a product of two rounds of investment, starting with SEED, was selected as one of Time magazine's "Best Inventions of 2024."

The continued growth of portfolio companies from existing funds 1 and 2 has led to nine follow-up investments. One such follow-up investment, particularly demonstrating Hantoo AC's commitment to strengthening synergy across affiliates, is ▲VUS (a waste collection and transportation solution). Selected for Hantoo AC's second placement program, VUS attracted KRW 2.8 billion in pre-A funding last year from Korea Investment Partners, Daekyo Investment, and the Korea Credit Guarantee Fund. This investment serves as a symbolic example of Hantoo AC nurturing a start-up company, which is then followed up by follow-up investment from Korea Investment Partners.

Through its "Barun Donghaeng" program, Hantoo AC invested KRW 6.5 billion, or more than 60% of its total investment in 2024, in early-stage startups less than three years old. This investment is seen as aligned with the company's social contribution to revitalize the startup ecosystem. Furthermore, the high rate of follow-up investment in companies invested by Hantoo AC is noteworthy. Forty-one of its 99 portfolio companies successfully secured follow-up funding, serving as a reliable partner in overcoming the "Death Valley" (the stage where early-stage startups struggle to secure funding) in the early stages of growth.

Hantoo AC recommended 16 companies (12 general TIPS and 4 deep-tech TIPS) through its 2024 TIPS (Tele-Innovation Support Program for Private Investment-led Technology Startups). This represents a 400% increase compared to 2023 (4 companies), resulting in a 100% selection rate.

In 2025, we plan to continue the investment trend from 2024 and further strengthen our investment in companies with high potential for global market expansion and deep-tech startups. We also plan to continue supporting early-stage startups within three years of establishment.

Baek Yeo-hyeon, CEO of HantooAC, said, “We will continue to actively discover and support global startups and deep-tech companies with innovative technologies in 2025,” adding, “At the same time, we will continue to invest to revitalize the early-stage startup ecosystem.”

- See more related articles

You must be logged in to post a comment.