The VC, a startup investment data platform, has released statistics on Korean startup investment in 2025.

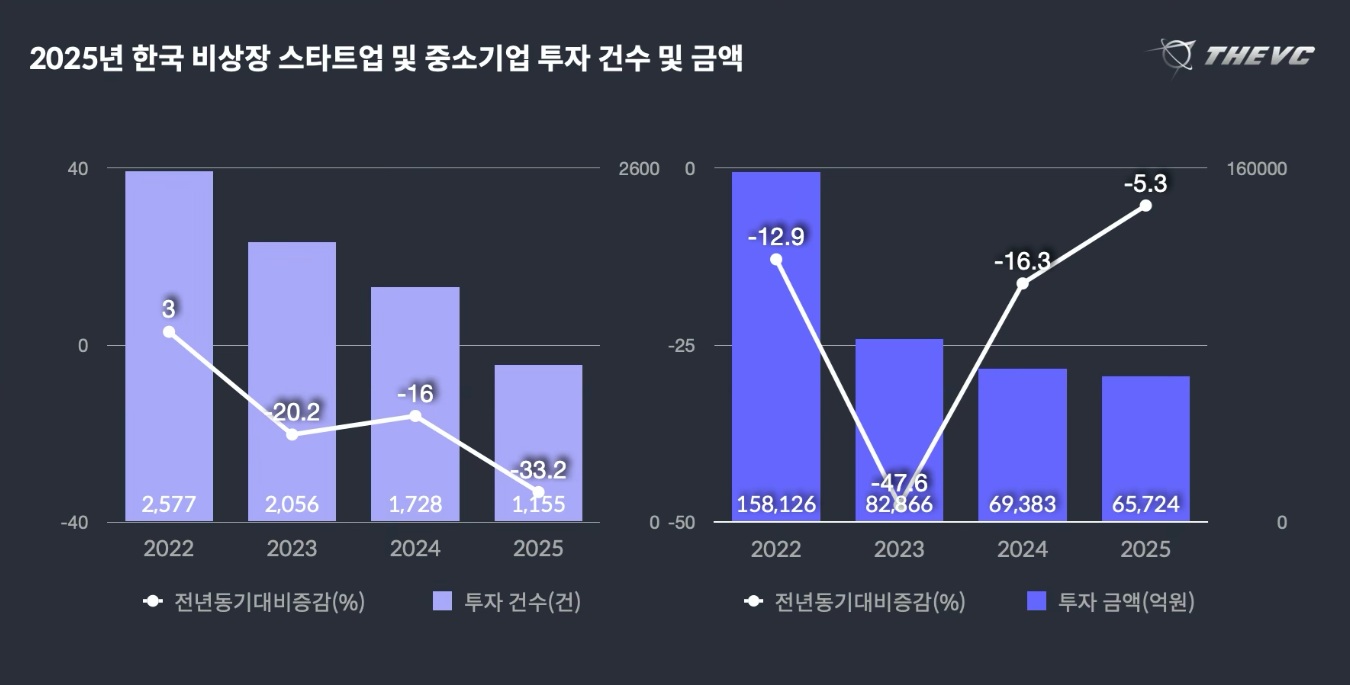

According to DBC, a total of 1,155 investments were made in Korean unlisted startups and SMEs in 2025, totaling 6.5724 trillion won. Considering the nature of unlisted investments, which often involve undisclosed transactions being reflected after the fact, the total investment amount remained similar to the previous year, but the number of deals decreased by more than 30% year-on-year. This further accentuated the concentration of funds in a small number of companies.

The average investment amount also showed an upward trend. The average investment amount in 2025 was KRW 9.26 billion, a 47.3% increase from the previous year and exceeding the level set in 2022, before the investment cold spell. The median investment amount also doubled to KRW 4 billion, confirming the polarization of the venture investment market.

By round, a significant contraction in early-stage investment was evident. While mid- and late-stage investment increased year-on-year, early-stage investment decreased by approximately 30%, and its share of total investment decreased by approximately 10 percentage points. Conversely, the number of pre-IPO rounds increased by more than 30% year-on-year, fueled by expectations of an IPO market recovery, showing relatively robust performance. The Financial Services Commission's announcement that it would expand the customized technology special listing system, previously limited to the bio sector, to include core technology sectors such as AI, space, and energy is also believed to have influenced this trend.

By industry, the AI-centric investment trend continued. Driven by large-scale investments in AI semiconductor companies like Rebellion and Furiosa AI, AI's share of total investment increased from 9.4% in 2022 to 23.6% in 2025. With AI investment projected to exceed half of the global venture capital market, the domestic market also saw a reorganization of venture capital around AI.

In terms of specific sectors, the semiconductor and bio industries maintained their strength, while investment in startups in the shopping and financial sectors seeking to expand into overseas markets also increased. Conversely, investment in the content and gaming sectors declined significantly due to shifting investment preferences and profitability pressures, revealing a distinct difference in investment intensity across industries.

A DBC official explained, “Although funding conditions have improved somewhat due to the end of global austerity measures, expectations of a base rate cut, and expanded tax incentives for private venture funds, continued external uncertainty has led to a trend of investment being concentrated in a small number of proven companies centered on deep tech such as AI, semiconductors, and bio.”

You must be logged in to post a comment.