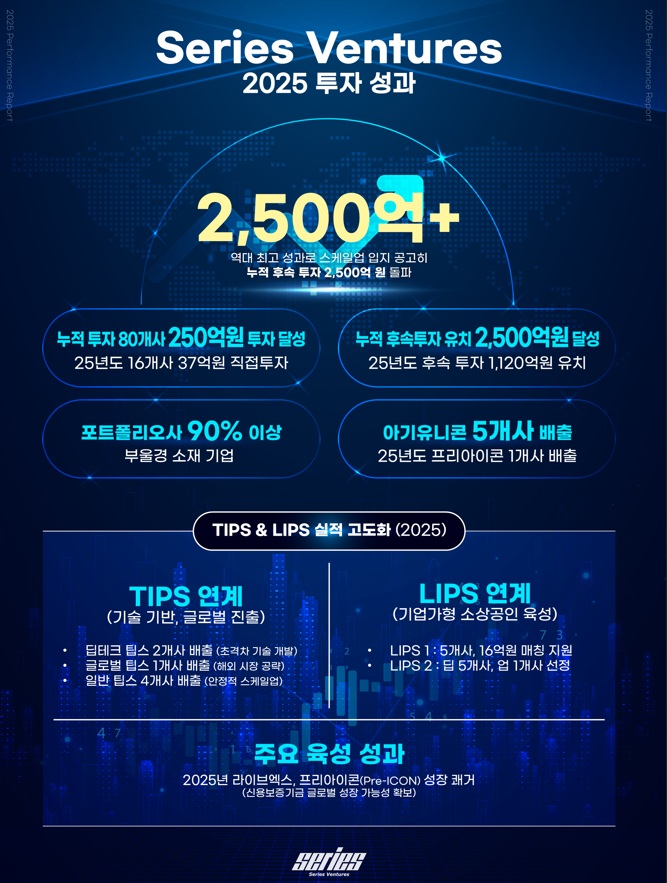

Series Ventures , a Southeastern region-focused accelerator (AC), announced that its portfolio companies have raised over KRW 250 billion in cumulative follow-up investment. This represents the largest scale-up since Series Ventures' founding, with a total of KRW 112 billion in follow-up investment secured in 2025 alone.

Series Ventures has made direct investments totaling KRW 25 billion in approximately 80 promising companies to date. In 2025, it expanded its portfolio by making new investments of KRW 3.7 billion in 16 companies. These investments and the resulting nurturing efforts are driving up the corporate value of its portfolio companies, strengthening their market competitiveness.

In 2025, its portfolio company LiveX was selected as a Pre-ICON company by the Korea Credit Guarantee Fund. Series Ventures has produced a total of five baby unicorns to date, and by producing additional Pre-ICON companies, it has proven the global growth potential of local startups.

Government-backed projects are also continuing to yield positive results. Series Ventures supported the growth of technology-based startups by supporting 12 general TIPS companies in 2024, followed by four general TIPS companies, two deep-tech TIPS companies, and one global TIPS company in 2025.

We also expanded our activities in the LIPS program, a program to foster entrepreneurial small business owners. Following KRW 2.5 billion in matching loans in 2024, we provided KRW 1.6 billion to five companies in the LIPS1 sector in 2025. The newly introduced LIPS2 sector produced five deep companies and one upstart, supporting the commercialization and growth of local innovative small business owners.

Series Ventures plans to continue strengthening the growth foundation of the local startup ecosystem by discovering and nurturing startups targeting deep tech and the global market.

- See more related articles

You must be logged in to post a comment.