Stocks fluctuate several times a day, and sharp fluctuations in global stock and cryptocurrency markets have become routine. Despite this, some investors maintain a relatively calm demeanor. What they have in common is that they invest based on steady cash flow, not fluctuations in asset prices.

Lee Hyo-jin, CEO of Eight Percent, explained, “Our investors have rational investment standards that allow them to objectively assess the stability and sustainability of cash flow, rather than being exposed to temporary gains and losses due to market volatility.” He added, “In short, they prioritize ‘will money come in this month?’”

“Investors who feel fatigued amidst the interplay of ups and downs are focusing more on their ‘second paycheck,’ or passive income.”

Eight Percent is Korea's first online investment-linked finance (on-to-up, P2P finance) company. He explained a recent notable investment trend as follows:

"More important than the rate of return is the sense of security that comes with a paycheck."

Eight Percent isn't simply a platform that promises "10% annual returns." The key word CEO Lee Hyo-jin emphasizes is structured cash flow.

"Anyone can talk about annual yield numbers. But what truly satisfies investors is the experience of seeing predictable interest deposited into their accounts each month for a long period of time."

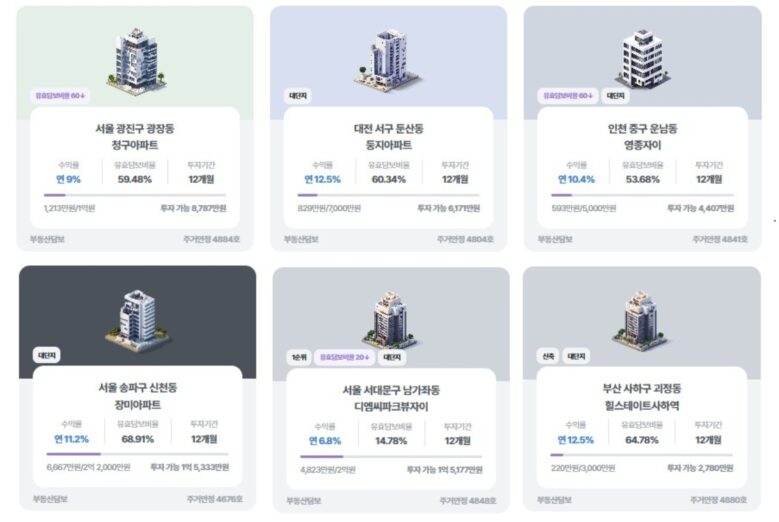

According to the company, individual and corporate investors investing through Eight Percent receive monthly interest payments through on-to-up investments secured by real estate or securities account collateral. In fact, a 100 million won investment generates an average monthly cash flow of 700,000 to 800,000 won.

CEO Lee Hyo-jin says, “This structure is positive for investor sentiment.”

"Assets whose prices fluctuate are constantly being looked at. On the other hand, if interest payments follow a consistent pattern each month, investors can step away from market volatility and enjoy a relative sense of peace and leisure in their daily lives."

Active Income Fatigue, Funds Shifting to Passive Income

A life centered on earned income can sometimes feel its limitations. Prices rise, but income growth lags behind. This structural change is also the backdrop for the inevitable growth of online businesses.

“Working hard is necessary, but regardless of whether you’re an office worker, self-employed, or wealthy, you’re also concerned about the income that flows unrelated to your main job.”

Traditional passive income sources, such as real estate rentals, dividends, and bonds, often require significant initial capital or incur high management costs. He emphasized, "In this niche, cash flow investments based on on-the-job investments, which allow for small start-ups, have low market correlation, and generate monthly income, are emerging as an alternative."

Stability built on 10 years of data… Industry-leading risk indicators.

For over a decade, what Eightpercent has relentlessly built is risk management capabilities, rather than expansion. Eightpercent's key risk indicators are rated among the most stable among platforms with diversified portfolios in the industry. Eightpercent, which has handled KRW 1.1187 trillion to date, recorded an average return of 10.36% as of December 31, 2025, a delinquency rate of 1.45%, and an average loss rate of 1.01% over the past five years. The average loss rate for real estate collateralized investments over the past five years is 0.41%.

"The essence of investing is 'consistency.' More important than one-off performance is a structure that will remain unshaken for the next ten years."

The CEO explains that these achievements are based on a system of review, post-management, and collections developed by a team of experienced financial experts and fintech-focused developers. Eightpercent has continuously refined its product structure by incorporating a machine learning-based evaluation system into the review data accumulated over the past decade.

Black membership in the spotlight in a volatile environment

Amidst this trend, Eightpercent's "Black Membership," a VIP investment service first introduced in the fintech industry, is rapidly gaining traction among high-net-worth individuals and professional investors. This is because, with the rapid fluctuations of global stock and cryptocurrency markets becoming routine, the investment trend toward stable cash flow has become even more pronounced.

The average investment amount for Black Membership subscribers is 160,000 won, with a maximum investment of 3.9 billion won, and a maximum of 300 million won for a single product. The most active diversified investor executed 4,555 investments. The average annualized return for subscribers was 10.42%. This is not a short-term achievement, but the result of 8%'s decade-long accumulated screening data and a machine learning-based evaluation system.

Why the wealthy are rethinking on-top.

According to Eight Percent, real estate-collateralized and securities account-collateralized on-to-up products offer annual returns of around 11% and 9%, respectively, and are attracting attention as alternative investment assets with low correlation to market fluctuations. This structural advantage is particularly attractive to investors seeking additional fixed income beyond earned income, as well as professional investors and high-net-worth individuals who prefer low volatility and steady monthly income.

Black Membership is an advanced premium investment service introduced to address this demand. It offers customized benefits to professional and income-qualified investors, including one-on-one investment briefings, exclusive membership networking, a 50% discount on platform fees, and exemption from withdrawal fees.

It is evaluated as a non-face-to-face asset management model equivalent to the PB and WM services of traditional financial institutions, and is quickly absorbing the gap in the market where there were almost no VIP-targeting services in the fintech industry.

"The participation of professional investors enhances trust across the industry."

This representative sees the significance of Black Membership not as a simple expansion of VIP services, but as a starting point for the advancement of a sound industrial structure.

"Black Membership is a premium investment service carefully designed to meet the needs of wealthy individuals who value predictable cash flow."

He explains, "Professional investors tend to have a high level of insight into investment products, so their increased investment has a positive impact on the transparency and sophistication of the operation of peer-to-peer (P2P) finance platforms."

"As professional investors with meticulous verification capabilities steadily attract investors, product structures, information disclosure, and risk management become more sophisticated. This lays the foundation for a more stable financial environment for not only general investors but also borrowers with limited access to finance."

Money you earn while sleeping

Passive income is often described as "making money while you sleep." However, this CEO adds a caveat to this expression.

Passive income is different from passive investing. Initial structure design and platform selection require a unique set of criteria and analysis.

Since these are not principal-guaranteed savings accounts, understanding maturity structure, collateral value, and diversification is essential. However, if structured properly, you can experience a steady, accumulating cash flow each month without being exposed to market fluctuations.

In an era of volatility, it's time to talk about cash again.

Warren Buffett, who recently announced his retirement, said this in his last shareholder letter:

“If you don’t find a way to make money while you sleep, you’ll work until you die.”

The representative says this sentence penetrates the concerns of investors.

"Many investors' goals aren't simply numbers; they're about stability and peace in life. We aim to provide that stability in a reasonable and realistic way."

In an era of repeated market crashes and slumps, investors are changing their questions. Instead of asking how much the stock market has risen, they're asking whether they're getting a "second paycheck" this month.

You must be logged in to post a comment.