PFCT (PFCT Technologies, CEO Lee Su-hwan), an on-to-finance company with a strong focus on risk management technology, announced the <2025 PFCT Corporate and Professional Investor Trends and Product Usage Behavior> based on data from active corporations and professional investors who invested at least once in 2025.

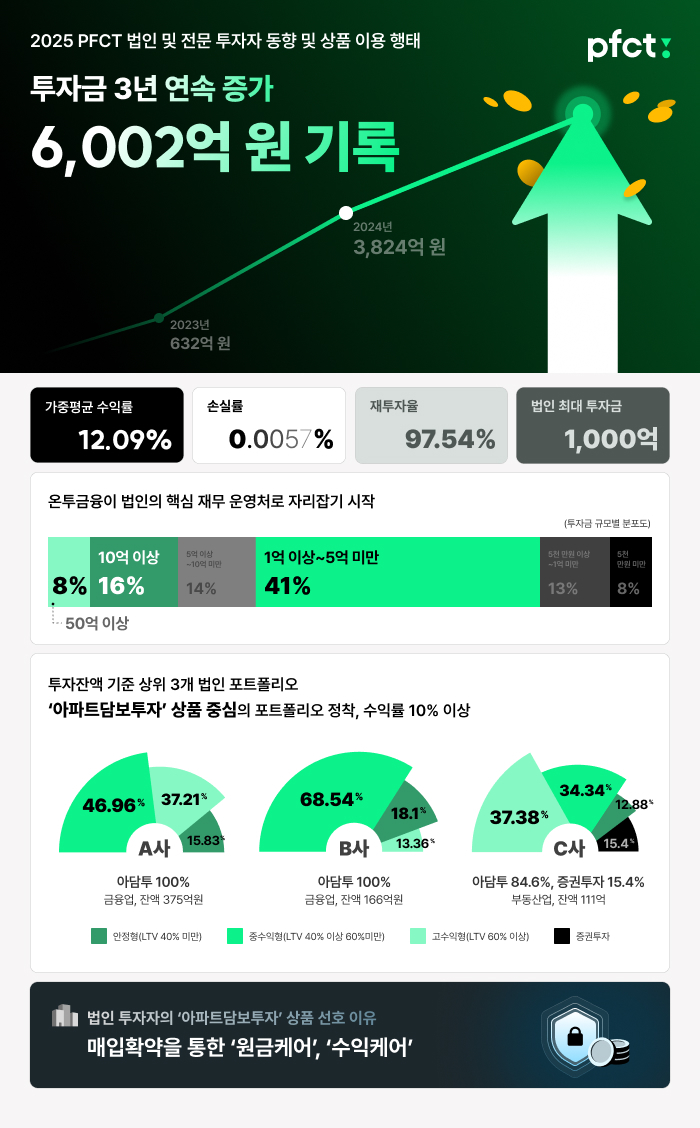

According to the analysis, corporate investment will record KRW 63.2 billion in 2023, KRW 382.4 billion in 2024, and KRW 600.2 billion in 2025, demonstrating rapid growth for three consecutive years. The weighted average return in 2025 was recorded at 12.09%, with the loss rate converging to zero. Consequently, the reinvestment rate reached 97.5%. The number of active corporate and professional investors investing at least once a year increased from 237 in 2024 to 285 in 2025, and the average monthly investment amount also expanded from KRW 137.22 million to KRW 175.49 million over the same period.

PFCT cited changes in the financial market environment in 2025 as the backdrop for this growth. While the base rate cut has lowered the expected returns on traditional short-term financial products, political and geopolitical uncertainty and the regulatory environment have increased the burden on high-risk assets, strengthening the preference for relatively stable bond assets. On2Finance's bond products, with their relatively clear maturities and cash flows, are being used as a strategic means of managing corporate funds.

By investment size, corporations managing between KRW 100 million and KRW 500 million accounted for the largest proportion, at 41%, while corporations managing over KRW 1 billion reached 23%. Notably, the maximum investment amount for a single corporation is projected to exceed KRW 100 billion for the first time in 2025, demonstrating that on-to-finance is moving beyond a supplementary tool and becoming a primary financial management tool for some corporations.

The main product group driving the increase in corporate investment was apartment mortgage investments. In 2025, corporate investment in this product group increased by more than 1.8 times compared to the previous year. An examination of the portfolios of the top three corporations by investment balance as of the end of 2025 revealed that all of them maintained a management strategy centered on apartment mortgage investments while achieving a weighted average return of over 10%. These corporations utilized a diversified investment strategy by LTV bracket. Some corporations allocated all of their funds to apartment mortgage investments but combined stable, mid-yield, and high-yield products to segment and manage risk within a single product group.

PFCT cited the stability of the recovery structure through purchase commitments and the potential for double-digit returns as reasons why corporate investors prefer apartment mortgage investments. The company has implemented purchase commitments as a basic or expanded requirement for its apartment mortgage investment products and offers various investment periods, including 6, 12, and 24 months, to support predictable cash flow planning.

PFCT plans to continue to strengthen its position as an alternative investment vehicle that corporate investors can utilize over the long term in an uncertain financial environment by advancing AI-based risk management technology and strengthening safety measures within its product structure.

- See more related articles

You must be logged in to post a comment.