Smilegate Orange Planet Startup Foundation announced on the 22nd that it will be operating an 'IPO Research Group' for startups that have reached the stage of corporate value exceeding 100 billion won and are considering an initial public offering (IPO).

The IPO Study Group is a program designed to support startups in reviewing the entire IPO preparation process and developing practical response strategies. Unlike existing programs that focus on short-term lectures, this program is designed with a long-term structure that encompasses pre-initial diagnosis, implementation, and post-initial review.

Startups that have grown to a certain size face a variety of practical challenges during the IPO process, including establishing internal controls, restructuring governance, developing a listing strategy, and communicating with shareholders. With recent revisions to the Commercial Act and strengthened pre-listing review requirements raising the barriers to entry into the IPO market, Orange Planet recognized the need for customized support tailored to each company's individual circumstances, and has developed this program.

The research group was organized to prepare for not only general listings but also special technology listings, which prioritize technological competitiveness. The workshop will cover practical examples covering the entire IPO process, including requirements and strategies for each listing track, considerations when selecting an underwriter, preparation for preliminary screening, and subsequent procedures.

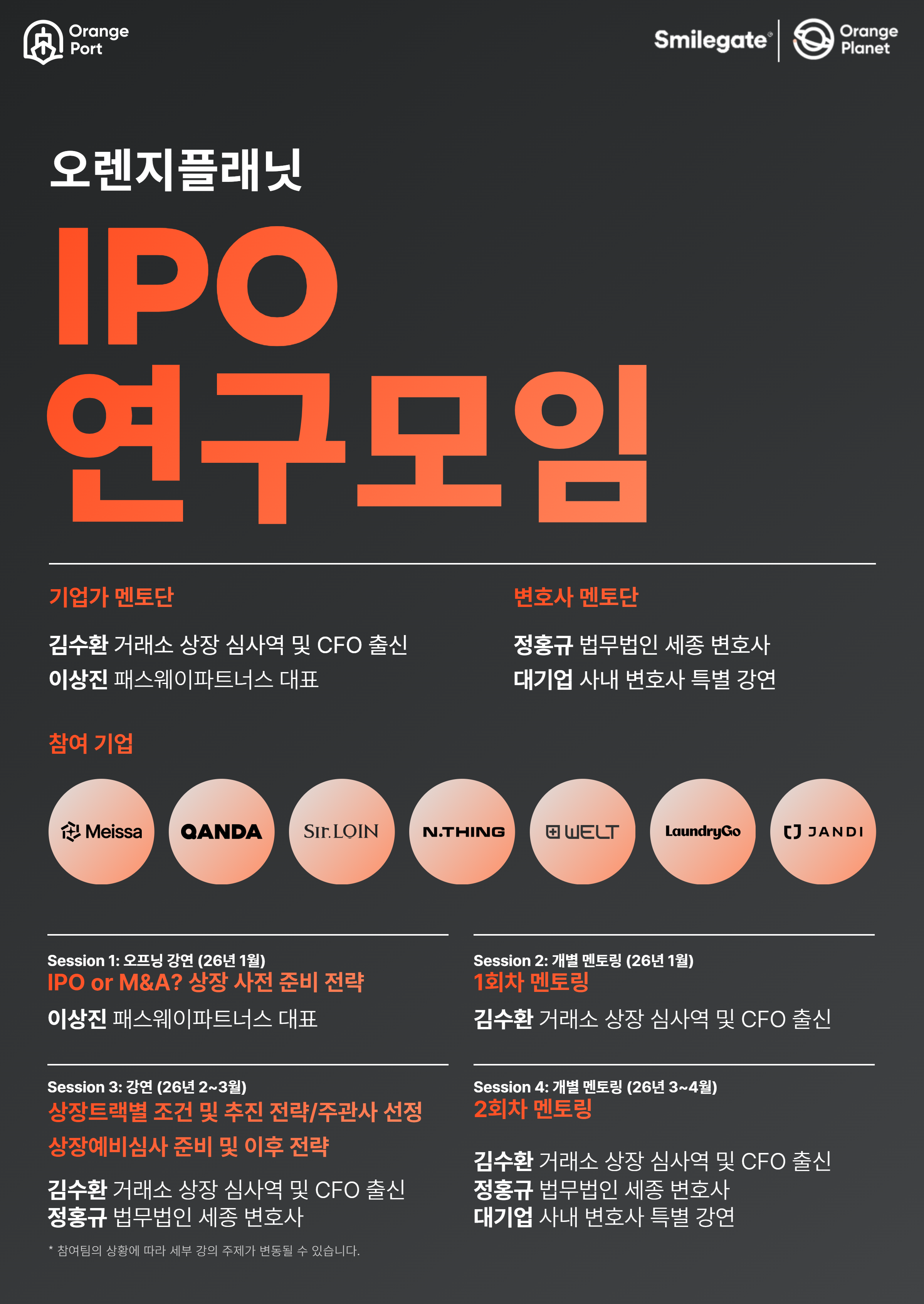

Mentors include experts with practical experience in IPOs and technology-specific listings. Kim Soo-hwan, a former Korea Exchange listing reviewer and startup CFO, Jeong Hong-gyu, an attorney at Sejong Law Firm, and Lee Sang-jin, CEO of Pathway Partners, will provide individualized advice to each company. Participating companies include startups considering or preparing for an IPO, including Seolroin, Masspresso, Enthing, Meisa, Welt, Toss Lab, and Food & Beverage Company.

The IPO research group will run for approximately four months, and will assess each company's IPO readiness level through lectures and individual mentoring, and comprehensively analyze key factors such as internal control, governance, growth potential, and financial stability.

- See more related articles

You must be logged in to post a comment.