“As the exit market opens, we wanted to cover strategies that need to be prepared now, rather than knowledge that will be needed someday.”

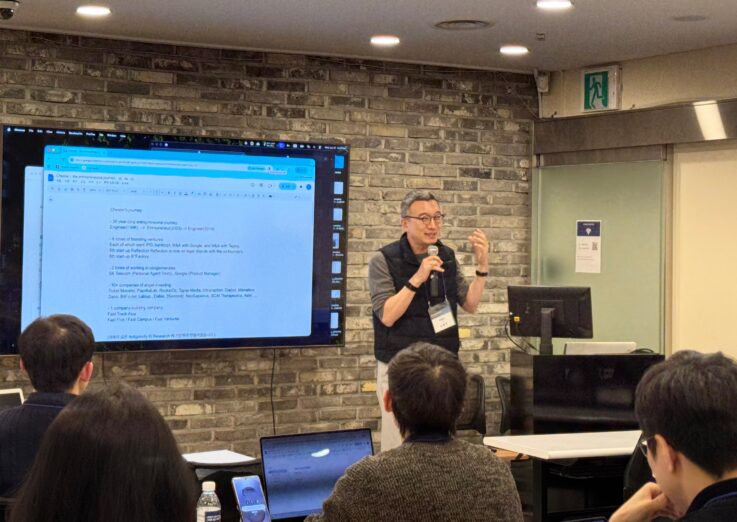

The first session of Venture Square Academy's "Next Round Class – M&A Class," held on the evening of January 21st in the basement lecture room of the Mobi Building in Gangnam, Seoul, began with this critical awareness raised by Venture Square CEO Seung-eun Myeong. "If investors and entrepreneurs don't understand mergers and acquisitions (M&A) in the same language, exits will inevitably remain a vague future," Myeong explained the rationale behind the class.

The most frequently used words on the spot that day weren't "valuation" or "structure." Instead, the lecture hall was filled with "situation," "relationship," and "timing."

“ If you build a good company, deals will naturally follow.”

At the center of the lecture that day was Noh Jeong-seok, CEO of B Factory. An entrepreneur who has personally experienced some of the most notable exits in Korean startup history, including Tatter & Company's acquisition by Google and FiveRocks' acquisition of Tapjoy, he devoted more time to answering attendee questions than to presenting his prepared slides.

"Many people consider M&A as their goal, but the order is reversed. Building a good company comes first, and then deals will follow. However, preparation is essential, and you must constantly monitor market sentiment and trends."

Representative Roh's lecture was far from a typical success story.

Beginning with the statement, "A theoretically correct choice may be wrong in an actual deal," he went on to detail the background and timing of the decision to sell, the balance of power with the buyer, and the conditions that changed during the negotiation process.

What was particularly impressive was how M&A was described as a continuous process, not a mere "result." Questions from the field naturally led to discussions about when attracting investment becomes toxic, when an exit should be considered, and what criteria entrepreneurs should adhere to throughout the process.

The classroom atmosphere felt more like a small deal meeting than a quiet lecture. As questions continued, answers became more specific, revealing market insights and real-world context that aren't readily apparent in public settings. CEO Noh emphasized, "Opportunities don't come without preparation," and emphasized that if you're considering an exit, you need to be mindful of structure and data from the management stage.

“ The data room is a collection of prepared answers.”

Ji Hyun-cheol, a partner at Ilum Invest who also spoke on the day, revisited the meaning of the "data room," which is often considered a formality in the M&A preparation process.

CEO Ji stated, "A data room is not simply a collection of data, but a 'collection of prepared answers' to buyers' questions." He added, "Only companies that anticipate and prepare for the questions will be able to seize the initiative at the negotiating table." He added, "Through this class, we will provide practical assistance to participating companies so they can prepare those answers in advance."

This was a passage that showed that this program goes beyond simple theoretical transmission and places the preparation process itself, which assumes actual dealing, at the center of education.

Not ' Learning M&A' but 'Practicing M&A'

The 'Next Round Class – M&A Class', planned by Venture Square Academy, is a four-week course that covers the entire M&A process step-by-step, from understanding follow-up investment structures to matching simulations, valuation practice, and legal and tax risk management.

The second session will feature a buyer-seller matching simulation based on actual M&A cases. Subsequent sessions will feature experts in accounting, law, and data, providing practical perspectives that can be immediately applied in the field. Expert organizations covering all aspects of M&A practice, including Illum Invest, Jeongdong Accounting Firm, Mission Law Firm, and Factsheet, will participate.

Beyond the first generation, to a continuous M&A community

Starting with this first course, Venture Square Academy plans to continue with second and third courses, expanding its learning community ecosystem centered on M&A and exit. Beyond one-off lectures, the goal is to create a network among participants, accumulating and sharing deal information and market insights.

CEO Myeongseung Lee emphasized, “EXIT is not an event that comes suddenly one day, but the result of long preparation,” and “This class is a starting point for investors and entrepreneurs to understand M&A at the same table and continue to connect in the future.”

This program is hosted by Venture Square Academy and features participation from key players in the startup and investment ecosystem, including Mobidays and Ilum Invest. The participants, who were unable to leave even after the lecture, confirmed that this class goes beyond mere education and is a practical preparation for the upcoming exit market.

You must be logged in to post a comment.