The real estate market's greatest enemy is "information monopoly." During periods of overheating, vague expectations dominate the market, while during periods of recession, unfounded fears dominate.

Data Knows developed a six-month short-term forecasting model using 26 key indicators carefully selected from 160 variables. It achieved an accuracy rate of less than 1% in major areas of Seoul. The "Richigo" app, with 1.3 million monthly visitors, gained widespread popularity and subsequently expanded into construction, construction, and financial sectors with the launch of the enterprise solution "AI MAS."

“In fact, before the ‘Richigo Real Estate’ app was created, its original model was ‘Richigo Expert,’ an analysis solution for professionals.”

Kim Jae-gu, CEO of Data Knows, developed a model that combines global economic, financial, and regional data to predict the future. He explained that the model "received an explosive response from experts." Driven by a desire to share these analytical findings with the general public, he drastically simplified the UI/UX, resulting in the current "Richgo Real Estate" app.

The general user service served as a massive "data validation testbed." He explains, "Our prediction model became more refined by comparing the purchasing sentiment displayed by 1.3 million users, regional interest, and actual market changes on the app." Because the "reliability of data and prediction models" verified through the general user service served as a foundation, the enterprise solution "AI MAS" was able to quickly convince conservative financial and construction companies.

When President Kim Jae-goo took over the corporate business in 2022, he set a goal of becoming "a partner for transitioning to high-value-added work and successful business decision-making."

“We focused on reducing the time corporate clients spend analyzing the real estate market and calculating sales prices from days or weeks to just a few hours.”

To achieve this, he combined three core competencies: practical investment experience, data analysis capabilities, and AI and big data technology. He recalled, "Collaboration with major construction companies like Hyundai Engineering & Construction, DL Engineering & Construction, and Hanwha Engineering & Construction was crucial." He added, "Rather than simply pursuing technological ideals, we combined our strengths to continuously improve upon the challenges faced by real-world real estate developers."

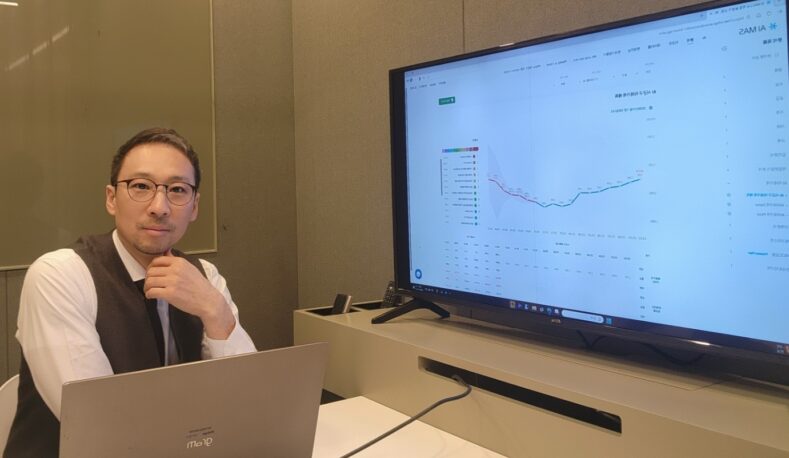

A recently released short-term price prediction model demonstrated an accuracy of less than 1% in major areas of Seoul. This was the result of a comprehensive analysis of 26 indicators, including M2 money supply, interest rates, and buying sentiment.

"The success or failure of AI price prediction ultimately hinges on the quality of the data. Simply adding more data doesn't necessarily improve accuracy."

Data Knows has been refining and testing various variables in the real estate market for nine years, since its founding. He explained, "Of the approximately 140 to 160 variables Richigo possesses, we only use 26 core variables, which are most sensitive to short-term changes, for our six-month short-term forecasts."

Data is managed at three levels: public data prototypes, combined and processed data, and proprietary logic data.

"In real-world predictive models, the metrics with the highest contribution are usually directly designed, processed, and proprietary logic data. This is RichGo's unique selling point, one that existing statistical models can't match."

There are two key factors that contribute to maintaining accuracy within the 1% range in the highly volatile domestic market. From a macro perspective, the "market capitalization to money supply," which assesses the overall liquidity level of the real estate market, and the "Richgo Leading Economic Index," which anticipates economic trends, provide a snapshot of the broader market. From a regional and psychological perspective, indicators such as the "Rising Strength Index," which quantifies investor sentiment, the "Buyers' Burden Index," which analyzes the affordability of actual residents, and the "Monthly Rent Yield to Deposit Rate" are crucial.

"Existing models simply use public data like supply and demand trends and transaction trends for reference purposes, but we interpret and analyze these data as 'immediate changes in market participants' sentiment.' These indicators are extremely useful for predicting changes within the next one to three months."

Data Knows has embraced "explainable AI" as its core value. In the real estate project financing market, where hundreds of billions or trillions of won are invested, persuasive tactics like "trust us because AI predicted it" won't work.

“We go beyond simple price predictions to provide numerical data showing which variables contributed to the outcome and by what percentage.”

This "explanatory power" is actually driving two major changes in the field. He emphasized, "Within companies, there's always a debate over the appropriate selling price between the aggressive sales team and the risk-managing marketing team. In the past, each department's 'intuition' or 'experience' clashed, but with the introduction of AI MAS, discussions are now based on objective variable contributions."

Moreover, while existing project review reports were limited to past analyses, such as, "Since nearby complexes sold at this price in the past, it will likely be possible this time as well," companies that adopt Data Knows' solutions create future scenarios.

“A culture is taking root where we examine and simulate the variables that impact a given region to make the best decisions.”

Data Knows received the highest level of data quality certification, 'Class A (quality score 0.99 or higher)' from CAES.

To ensure that even a 0.01% error is not tolerated in the process of handling 10 years' worth of data from 252 cities and counties, a multi-layered 'automated purification system' is in operation.

“To process massive amounts of data that are simply beyond the human eye, we built an AI-based outlier filtering algorithm.”

If a transaction is out of sync with the market or data that doesn't make sense logically, it is immediately isolated and corrected during the engineering stage. Data Knows' unique competitive edge lies in its virtuous cycle of services for both general users and enterprises.

He explained, "The 1.3 million users of the Richigo app aren't simply consumers of information; they also serve as the ultimate verifiers of real-time data. They are the first to spot subtle changes in information or data errors in the field and provide feedback, which is immediately reflected in the system."

The method of calculating the appropriate selling price has also been changed to a scientific simulation with Data Knows.

"The first change that large construction companies are experiencing is 'speed.' Previously, it took an average of a week for practitioners to collect data and prepare reports to determine the appropriate sale price for a project site. However, AI MAS instantly combines data from surrounding market prices, asking prices, actual transaction prices, and future forecasts, delivering initial results in just a few minutes."

The risk costs that construction companies save go beyond just labor costs. When an incorrect pricing strategy results in unsold units, the financial costs, brand value decline, and resale marketing costs that construction companies must bear can amount to tens to hundreds of billions of won per project.

Beyond providing simple solutions, we're expanding into a marketing area called "Buying Plus." While the existing buying advertising market lured customers with indiscriminate exposure and provocative phrases, "Buying Plus" connects suppliers and buyers at the optimal point using precise criteria like AI and big data.

Collaboration with financial institutions is also active. Data Knows collaborates with major financial institutions like KB, Hana, and NH because its data reduces financial institutions' risks and increases profit opportunities.

"While traditional banks' collateral loan review process focuses on 'current market prices,' our predictive data provides a glimpse into 'future collateral value.'"

The recently held 'AI MAS DAY' event was attended by a large number of construction and trust company officials, showing great interest.

"What the people I met in the field wanted was 'objective indicators that would complement the limitations of human judgment.' With the recent popularization of generative AI, practitioners in the real estate field also wanted AI that could logically explain 'why certain results were achieved.'"

Regarding concerns that increased predictability could accelerate market concentration, CEO Kim Jae-goo has a clear philosophy.

He said, “Information monopolies create bubbles, and when those bubbles burst, it’s always the common people who lack information who suffer,” and explained, “The ‘data democratization’ we’re pursuing is not a game of guessing the future, but the work of building a social safety net that turns the ‘uncertainty’ of the market into ‘manageable predictability.’”

Market overheating often stems from vague fears or unfounded expectations, not accurate information. When everyone is shouting, "If you don't buy now, you'll never buy again," if data objectively demonstrates that "this area is currently historically overvalued," it can act as a brake, halting the irrational panic. Conversely, when a real estate market slump poses a societal problem, objective indicators of undervaluation and future value can help people secure a home.

Finally, I asked about his vision. CEO Kim Jae-gu responded, "Beyond cold numbers, we aim to be a 'trusted lighthouse' connecting homes and dreams, the 'Bloomberg of real estate.'" He emphasized, "Despite differences in nationality and language, we will create a world where everyone can make the best choices through the objective compass of data."

You must be logged in to post a comment.