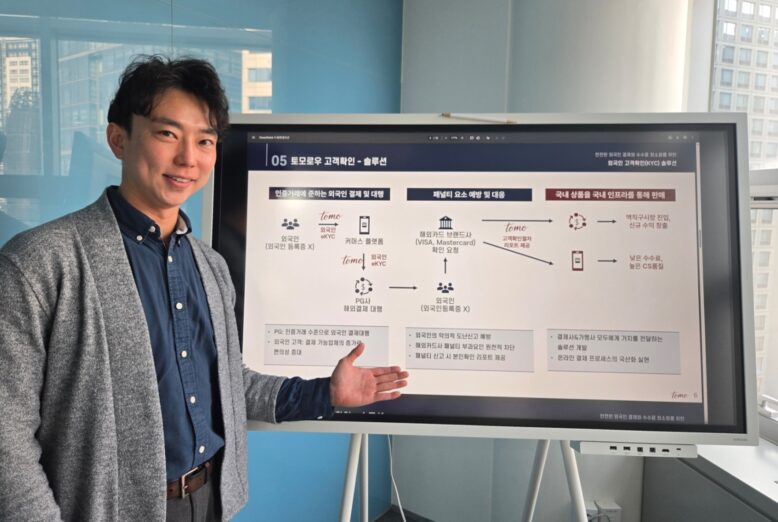

Foreigners living in Korea often face payment barriers when using everyday online services like delivery and taxis. Because identity verification procedures are designed solely based on Korean mobile phone numbers, foreigners without this verification are blocked at the payment stage. Tomorrow solved this problem by directly comparing user-submitted information against a trusted overseas database, rather than simply ascertaining its authenticity. Having proven its marketability by recording 70 million won in sales in the third quarter of 2025, Tomorrow recently secured a 500 million won investment from SJ Investment Partners, accelerating its growth.

Yongwoo Cho, CEO of Tomorrow, left behind a stable career as a certified public accountant in the United States to jump into entrepreneurship. The decisive factor was a series of recurring events he witnessed while participating in the foreign community.

"It was quite common for my foreign friends to pay for me with their cards because they couldn't make online purchases," he said. "At first, I thought it was a matter of willpower, but when I asked, I learned it was actually a structural limitation. Because identity verification was designed to require a Korean mobile phone number, foreigners without a number were left in a blind spot."

With his experience as a co-founder, he was convinced he could solve this problem with a product. This was the beginning of Tomorrow, developing a solution to fill the gap in foreign customer verification (KYC) procedures.

Directly check the source DB

What sets Tomorrow apart is that it "verifies" information, not "guesses." Rather than internally assessing the authenticity of user-submitted information, it directly queries trusted overseas data sources to confirm the authenticity of the information.

The problem is that API standards and identity schemas vary across countries and institutions. CEO Yongwoo Cho saw this as both a technical barrier to entry and an opportunity. Tomorrow normalized disparate interfaces into a unified standard. They built a lightweight and stable operating system that includes fault response, delay handling, retry processes, and even verification logs. This allows e-commerce, payment gateways, and financial institutions to easily integrate foreigner authentication into domestic payment flows without having to directly handle complex overseas data.

The balance between security and user experience

Tomorrow solved the conflicting challenges of strengthening security and optimizing the user experience with "risk-based step-by-step authentication." Rather than requiring a uniformly heavy authentication process for all users, this approach adjusts the authentication intensity based on the partner's policies and transaction context.

In terms of UX, "familiarity" is our top priority. "Each country has its own unique input methods, terminology, and screen flow. We offer different screen layouts for each country to reflect the unique UI cultural characteristics that American and Japanese users naturally perceive."

CEO Cho Yong-woo graduated from elementary, middle, and high school in Jeonju, where he also laid the foundation for his business. Jeonbuk's early startup support system, specifically the Jeonbuk Center for Creative Economy and Innovation, which was designated as a fintech special zone, was a crucial factor in sustaining his business.

"The local ecosystem offers robust support to help us survive the initial stages. However, considering the concentration of major partners in Seoul, we've diversified our operations. Our headquarters are located in Jeonju, but we're based in Seoul's 2nd Seoul Fintech Lab, where we conduct partnerships and recruit."

Reaching 70 million won in sales in the third quarter of 2025 signals market stability. Beyond the current per-transaction fee model, the company plans to diversify its revenue structure by introducing subscription-based services such as data analysis reports and operational dashboards.

In the highly regulated fintech sector, CEO Cho's principles are clear: △explanatory auditing and reporting; △risk management through least privilege and separation of powers; and △on-site operability that takes into account failures and rollbacks.

The recently raised 500 million won will be used to expand the source database and enhance technology, focusing on Southeast Asia. He envisions an ecosystem based on "reusable customer verification tokens" that eliminate the need for users to repeatedly submit information.

"Rather than simply dreaming of becoming a unicorn, I want to become a company that demonstrates a sustainable revenue structure. Furthermore, my ultimate goal is to break the cycle of foreign currency outflow due to reliance on overseas payment companies, and to contribute to Korea's financial infrastructure becoming an international standard by independently processing foreign transactions."

You must be logged in to post a comment.