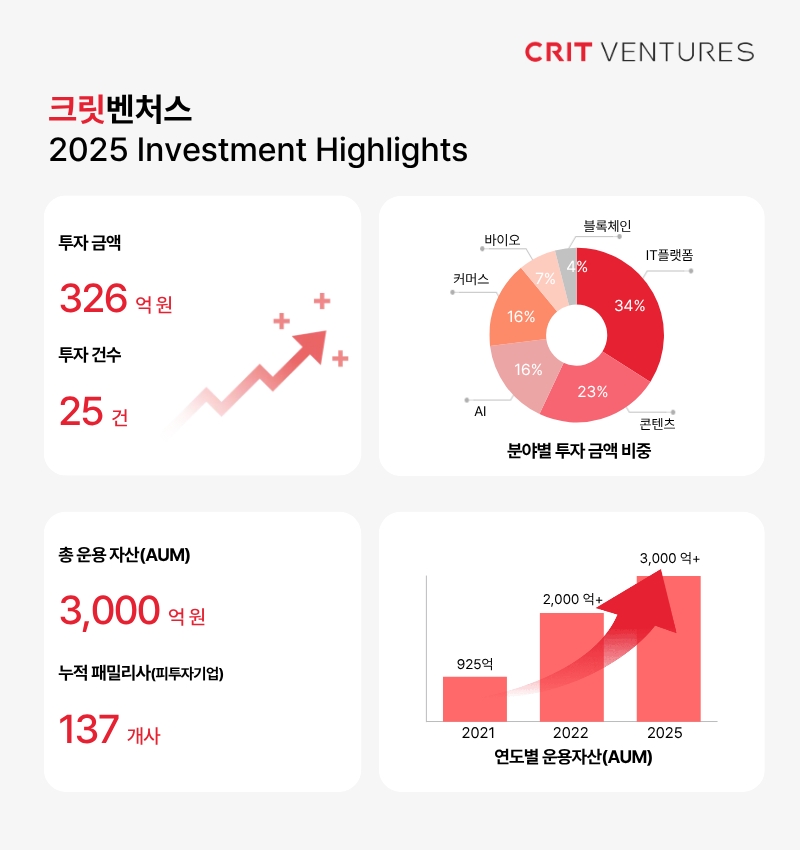

Venture capital firm Crit Ventures (CEO Song Jae-jun) announced on the 28th that it has invested a total of 32.6 billion won domestically and internationally in 2025. This represents a 30% increase compared to the previous year.

Last year, Crit Ventures made 25 investments, investing KRW 29.3 billion and KRW 3.3 billion (approximately USD 2.26 million) in Korea and the US, respectively. By sector, the investment mix was as follows: IT platforms (34%), content (games, music, and media) (23%), AI (16%), commerce (16%), bio (7%), and blockchain (4%).

Based on the number of investments, we identified teams with high growth potential, including five in AI, five in blockchain, four in IT platforms, and two in bio, as well as six in content and three in commerce. This has resulted in a cumulative portfolio of 137 companies.

In the IT platform sector, investments included Oneself World (advertising), Artoo (art curation), and Carrot Market through a separate project fund. In the content sector, investments included Rezim International (music), Offbeat & Pep (games), and Clink (media). The company also diversified its portfolio by investing in deep tech, including AI semiconductor design company Furiosa AI, Newbility (autonomous driving), WithPoints (robotics), and AboveTech & DIT (AI content).

In the bio and commerce sectors, we invested in Petfarm (animal medicine) and Mobicontent Tech (music), and made follow-up investments in Doctor Now, a non-face-to-face medical treatment platform, and Rezim International, a global entertainment company.

Portfolio companies also performed remarkably. Furiosa AI achieved unicorn status with a corporate value of 1 trillion won, and Buffett Seoul, an online-to-offline (O2O) fitness platform, secured 10 billion won in follow-up funding. Dr. Now, along with securing investment, established a stable foundation for business operations by institutionalizing non-face-to-face medical treatment.

Last year, Crit Ventures demonstrated its fundraising prowess by establishing new funds, including the "IVK-Crit Global Content Investment Fund" and the "Crit Global Scale-Up Investment Fund," totaling 41.8 billion won. Currently, it operates eight funds domestically and internationally, solidifying its position as a mid-sized venture capital firm.

This year, Crit Ventures will begin a full-scale expansion into the US market to address global K-culture sectors like fashion, beauty, food, and medicine, as well as technological paradigm shifts like physical AI and robotics. Following the establishment of its Palo Alto office in Silicon Valley, Crit Ventures plans to expand its local workforce and expand support for early-stage startups founded by Korean entrepreneurs in the US.

Song Jae-jun, CEO of Crit Ventures, said, “We will rewrite the history of K-startups with a founding team that maintains the mindset of the early days of the company and pioneers the global market with technology and culture as weapons.”

- See more related articles

You must be logged in to post a comment.