On the 9th, New Paradigm Investment shared its investment performance for 2025 and announced an investment roadmap centered on "growth, technology, and globalization" that will lead changes in the startup ecosystem in 2026.

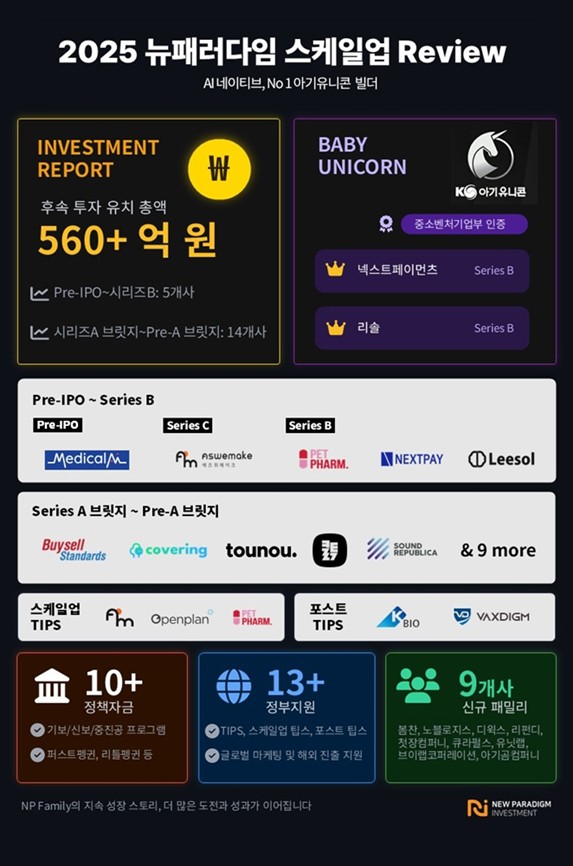

Throughout 2025, New Paradigm focused on discovering and nurturing promising startups, driving the growth of its portfolio companies. Last year, portfolio companies attracted approximately KRW 56 billion in cumulative follow-up investment, with companies such as Medical AI, Azwemake, Petfarm, NextPayments, and Lysol successfully completing large-scale follow-up investments ranging from pre-IPO to Series B.

In addition, around ten companies, including Bycell Standard, Sound Republica, and Kookmin Bio, have secured Series A and Pre-A bridge investments, entering a stable growth trajectory. This demonstrates that New Paradigm's "Baby Unicorn Program" goes beyond simple financial support to contribute to the advancement of startup businesses and strengthen their global competitiveness.

New Paradigm also achieved success in the area of technological advancement as a TIPS operator under the Ministry of SMEs and Startups. Azwemake and Petfarm were selected for Scale-up TIPS, Openplan for Global Scale-up TIPS, and Baxdime and Kookmin Bio for Post TIPS. Furthermore, numerous companies, including Countdown AI, Bomchan, and Noble Logis, were selected for General and Global Track TIPS. Next Payments and Lysol also garnered attention by being selected as the Ministry of SMEs and Startups' Baby Unicorn companies.

New Paradigm sets 2026 as the first year of its "quantum leap," signifying rapid growth, and is pursuing three core strategies. First, it plans to accelerate AX (AI Transformation), which integrates artificial intelligence into the core of its business, and digital innovation.

Furthermore, the company plans to secure new growth engines by discovering promising companies leading their respective fields, such as AI agent automation company Dewix and innovative logistics company Noble Logis, and strengthen its global network to support the overseas expansion of its portfolio companies. Nine companies, including imported stone distribution company Bomchan and global shopping refund service Refundy, have already been identified and are being intensively nurtured.

Park Jae-hyun, CEO of New Paradigm Investment, said, “Last year’s performance demonstrated the competitiveness of a network that connects the entire portfolio,” and added, “In 2026, we will support the rapid growth of startups that will lead the AI era through investments worth approximately 10 billion won.”

He continued, “We are currently recruiting for the ‘2026 Baby Unicorn Growth Program’ targeting early-stage companies established within the past four years with technological prowess and AX potential. Selected companies will be provided with customized acceleration, including financial support of up to 5 billion won per team, tips recommendations, and strategic consulting.”

- See more related articles

You must be logged in to post a comment.