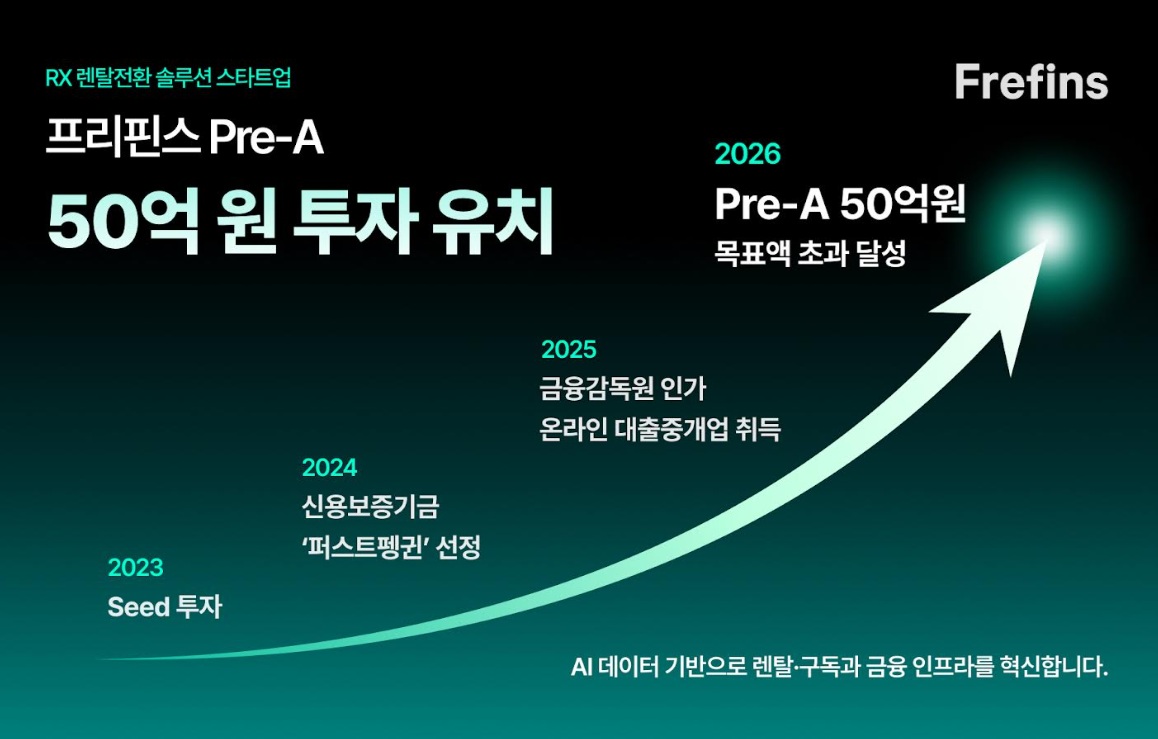

Rental Transformation (RX) startup Prepins announced on the 10th that it has secured 5 billion won in investment in its Series A pre-round, significantly exceeding its initial target.

Freepins is a startup founded by CEO Sangyong Shin, founder of AI parking control company iParking, after selling iParking to SK Innovation E&S and NHN.

This round saw new investors including Hyundai Motor Zero One, Korea Credit Guarantee Fund, Honest Ventures, and SG Auto Service, an affiliate of Kojin Motors, while existing investor Coolidge Corner Investment provided a follow-on investment. The simultaneous participation of domestic venture capitalists, policy finance firms, and global financial firms demonstrates the validation of Freefins' data-driven rental finance infrastructure model in both domestic and international markets.

Freefins cited its AI-based risk management technology as a key factor in attracting investment. Leveraging real-time operational data and AI-powered risk management (RM) solutions, it reduced the rental business's default rate and enhanced its structure connecting financial institutions and clients.

Since obtaining an online loan collection company license from the Financial Supervisory Service in May of last year, Freefins has been brokering structured finance products, such as ABL and factoring, to corporate clients. When a client applies on the platform, a financial institution uses RM solutions to assess the value of the bonds and assets and then offers the optimal financial product through a competitive bidding process.

Currently, approximately 400 rental receivables are being managed without default through the Prefins solution, and the rental finance ecosystem connecting manufacturers, retailers, and financial institutions is rapidly expanding.

Based on this investment, Prefins has completed the pilot structure design for a "rental bond-based mutual lending fund" and entered the verification phase, aiming to secure actual fund operation cases by 2026. Furthermore, Prefins plans to launch its proprietary solution, "Prefins OS," which integrates the entire process, including trust-based data generation, financial industry standard bond verification, real-time asset management, and bond collection and recycling, starting in January 2026.

Shin Sang-yong, CEO of Prefins, said, “This round, in which domestic financial institutions, policy finance institutions, and global financial institutions participated simultaneously, is the result of verifying the risk management model based on Prefins data,” and added, “We will establish a standard for rental finance beyond a simple management tool.”

- See more related articles

You must be logged in to post a comment.