Korea Investment Accelerator is a wholly owned subsidiary of Korea Investment Holdings. It was established in December 2021 with the vision of ‘creating social value through finance’ and aims to help startups attract funds and support their growth. As of now, it has invested a total of KRW 31.7 billion in 104 companies, and the total corporate value of its portfolio companies amounts to KRW 837.8 billion. To learn about the background of these achievements, investment and growth strategies, and competitiveness compared to other ACs, we interviewed Team Leader Lee Seong-moon of SEED.

Systematic investment system

Korea Investment Accelerator raises a fund of about 15 billion won every year with the investment of affiliates of Korea Investment Holdings and invests the entire amount. The name of the fund, 'Hantu Barundonghaeng Sherpa Fund', contains the meaning of being a strong guide for startups in a difficult market environment. The investment method is 'Barundonghaeng', a placement program, and 'Market Investment', a direct investment method.

'Barundonghaeng' is managed by SEED. It targets early-stage companies that have been in business for less than 3 years and have a pre-valuation of less than 5 billion won, and provides close acceleration after investing up to 300 million won in these companies. It was operated twice a year starting from the first term in 2022 to the sixth term in 2024, but it has been reorganized to once a year starting from the seventh term in 2025. Regarding this, Team Leader Lee Seong-moon explained, "The goal is to extend the acceleration period from the existing three months to six months to further increase the growth potential of startups."

'Market investment' is handled by the investment division. The reviewers directly source deals and invest in startups with corporate values between 5 billion won and 20 billion won. While 'Barundonghaeng' focuses on companies in the early stages of verifying the product-market fit of their products and services, market investment focuses on companies that can scale up in earnest.

Korea Investment Accelerator provides diverse support for the growth of startups through affiliated companies. Korea Investment Holdings has Korea Investment Accelerator (AC), Korea Investment Partners (VC), Korea Investment Private Equity (PE), and Korea Investment Securities (IB), so it can provide support for all stages of corporate growth from SEED investment to IPO and M&A. In fact, Barundonghaeng 2nd round company VUS attracted follow-up investment from Korea Investment Accelerator, Korea Investment Partners, Daekyo Investment, and Korea Credit Guarantee Fund in the pre-A round. Korea Investment Holdings’ long-term vision is to be with startups at all stages of their life cycle.

Active communication with the representative

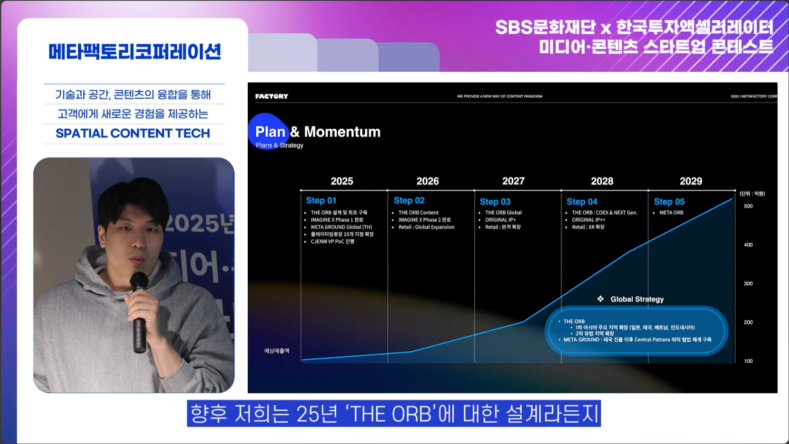

Regarding the type of company he prefers, Team Leader Lee Seong-moon said, “A company that shows clear growth based on active communication.” He quoted Y Combinator founder Paul Graham’s article, “ Startup = Growth ,” and explained, “Just as Y Combinator looks for companies that grow 7% every week, we also want companies that show noticeable growth every week.” He also introduced the case of Metafactory Corporation , saying that he wants to work with a CEO who actively communicates with the Sherpa (in-charge reviewer) to achieve this kind of steady growth.

Metafactory Corporation is a company selected for the 6th 'Barundonghaeng', and is developing digital creative content and space platform businesses. Based on AI-based XR content production capabilities, it is operating ' Metaground Seongsu ', an exhibition and pop-up specialized space, and is supplying XR attractions to the kids' theme park ' Playtime '. In addition, it is also conducting various event productions such as large-scale music shows, broadcasts, and corporate events.

Earlier this year, Metafactory Corporation embarked on a global business based on insights gained from Office Hour with SEED . This was prompted by SEED Director Lee Tak-rim sharing the case of the US sports entertainment company 'Cosm'. Cosm broadcasts popular sports games such as NFL, NBA, and UFC on large screens, allowing audiences to experience the immersive experience of being in the stadium in spaces such as pubs or indoor sports bars. Inspired by this idea, Metafactory Corporation's CEO Han Won-hee completed a business proposal in a week, secured a collaboration meeting with Megabox, and is currently pushing forward with the 'The Orb' project in earnest.

Regarding this, Team Leader Lee Seong-moon highly praised Metafactory Corporation, saying, “If we throw out an idea that is 100, they are a team that returns 150.” He continued, “Korea Investment Accelerator aims to be a ‘Thinking Partner’ that thinks about business growth together with startups,” and “I hope to work with a team that can lead explosive growth through close communication between Sherpa and the startup team.”

Solving problems through collaboration between portfolio companies

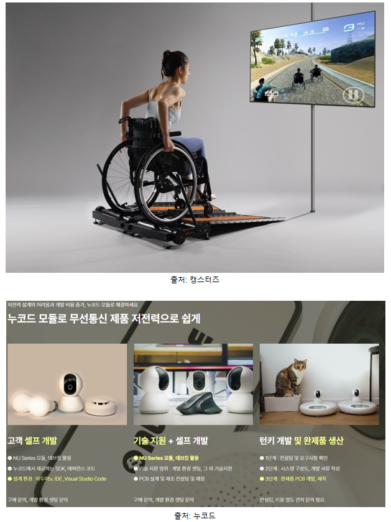

The value of 'communication' that Korea Investment Accelerator considers important is also well demonstrated through cooperation between startups. Team Leader Lee Seong-moon said, "Collaboration cases between portfolio companies are our pride," and introduced the collaboration case between Kangsters and Nucode.

Kangsters (Barundonghaeng 1st) is a startup that develops smart healthcare solutions for the disabled. Their flagship product, 'WHEELY-X', is a fitness device for wheelchair users that enables aerobic exercise by spinning the wheels. It is designed to measure exercise performance by linking sensors and a dedicated app, and to enjoy game content. This product is also receiving attention on the global stage, winning the CES 2024 Innovation Award and being named one of TIME magazine's '2024 Inventions of the Year'.

Nucode (Barundonghaeng 6th) is a startup that develops low-power IoT communication modules. It provides 'NU-Module', which is made with its own technology, and 'NUWROKS', which allows easy programming of the module. Its main feature is that it has an integrated low-power IoT solution that covers everything from hardware to software.

Kangsters needed a low-power wireless communication module to transmit exercise data collected by WheelieX to the app. While looking for a solution, they were introduced to Nucode by SEEDsil, and the two companies began developing a Bluetooth low energy (BLE)-based communication module. At the time, Team Leader Lee actively recommended the two companies, saying, “We need to meet each other,” at every meeting, and the two companies have continued to cooperate to this day.

In addition to Kangsters and Nucode, the circular fashion platform 'Yunhoe' (Barundonghaeng 2nd term), return solution 'Liternol' (Barundonghaeng 4th term), Metafactory Corporation (Barundonghaeng 6th term), and smart window solution 'Viewjun' (Barundonghaeng 3rd term) are also conducting business cooperation. In this way, the Korea Investment Accelerator faithfully fulfills its role as a sherpa that goes beyond an investment partner and leads business growth together.

Focus on investing in global business

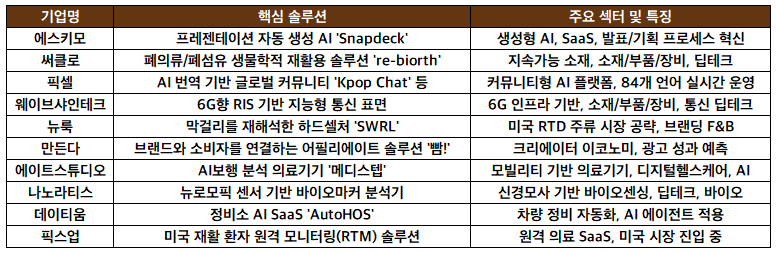

Korea Investment Accelerator has focused on investing in early-stage startup teams targeting the global market, and plans to continue this direction in the future. Ultimately, their goal is to grow together with startups that have global competitiveness enough to challenge for NASDAQ listing. In fact, the companies participating in the 7th Barundonghaeng, which were selected on May 23, were mostly teams that targeted the global market from the beginning of their business or had global technological competitiveness in fields such as AI, deep tech, and bio.

The 11 teams that were finally selected will focus on strengthening their business capabilities over the next six months through regular mentoring through 'Office Hours', interaction with senior entrepreneurs through 'Hantu Morning Club', networking between selected companies through 'Cohort Meetup', and participation in IR and seminars with affiliates of Korea Investment & Securities Group (partners, securities, etc.) through 'Hantu Day'. Among them, promising companies that have achieved their KPI will take to the Demo Day stage to be held on November 27.

You must be logged in to post a comment.