In the [Fintech and Personal Information] corner, we will briefly introduce fintech services and technologies, and learn why personal information is important in fintech and what my data means in fintech.

Introduction to Fintech

Nowadays, it is common to refer to the FinTech industry as an industry that introduces innovation to financial services using modern technology without necessarily defining FinTech. Some FinTech companies compete directly with banks, while others partner with banks or provide good services. What is clear is that FinTech companies are improving the world of financial services by introducing innovative ideas and are intensifying competition in financial services.

Applying new technologies to financial services may initially be confusing, but it can also provide new user experiences for people and create more jobs. However, since the traditional financial sector has been a regulatory sector, it is not easy to increase the speed of application. On the other hand, the amount of news and new technologies generated every day is so large that it is nearly impossible to keep up to date. This is also why ICT-related knowledge is increasingly spread through various blogs on the Internet rather than through books.

Financial technology integrates various types of financial services into the daily lives of customers. Today’s generations, including millennials, are familiar with these technologies and want to manage their money easily and quickly online or through mobile devices instead of going to branches to do financial transactions. Fintech is redefining financial services in the 21st century. Originally, the term fintech referred to the technology used in the backend of traditional trade and consumer finance institutions, but in recent years, the concept has expanded to include various technological innovations, including cryptocurrencies, machine learning, robo-advisors, and the Internet of Things.

The first fintech service was PayPal, which began its service in 2008. PayPal processed payments worth nearly 200 trillion won in over 200 countries around the world. China’s Alipay also grew rapidly. Apple introduced Apple Pay, which has credit card functions, and Daum Kakao launched Kakao Pay and Bank Wallet Kakao, which make full use of the platform called KakaoTalk to make payments, transfer funds, or withdraw cash easily, and Google also introduced Google Pay.

In general, fintech is changing from a form of providing IT services for financial services provided by financial companies to a form of providing financial services directly by non-financial companies. The current form of fintech services can be said to be the so-called ICT companies entering the financial services market.

Financial products and services that were previously only available through financial institutions will be changed to be handled by various ICT companies, which will enhance customer convenience and innovation. Ultimately, this will lead to fierce competition in the financial market, which will lead to the emergence of various financial products and services. Financial companies will strengthen their partnerships with ICT companies that establish Internet banks, and ICT companies and non-financial companies will encroach on some of the financial companies’ markets, and the boundaries between them are expected to disappear.

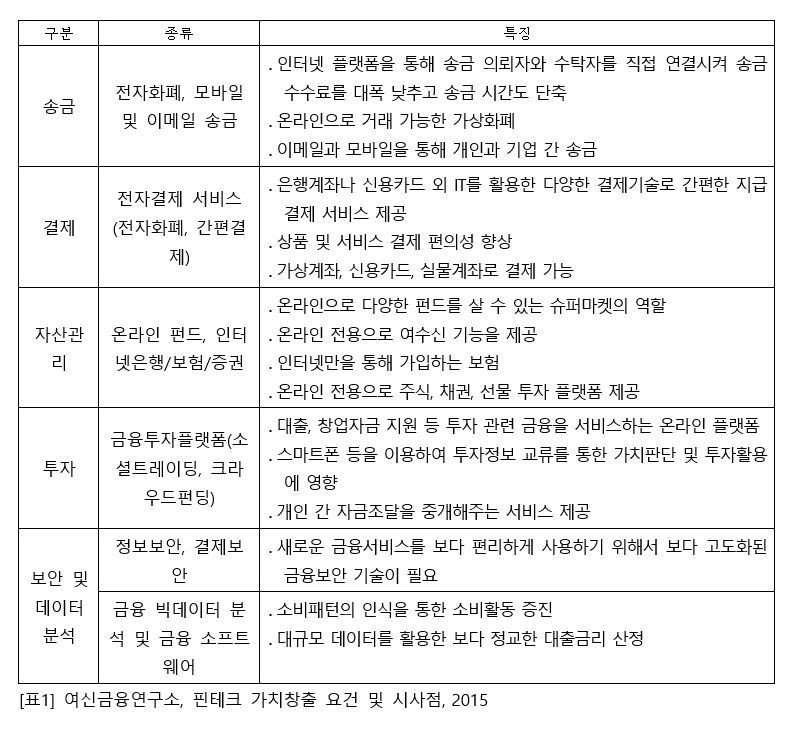

The definition and classification of fintech services are inevitably arbitrary, but they can generally be broadly categorized according to online financial services and the ICT technologies that enable them, as shown in [Table 1].

History of Fintech

It is difficult to define exactly when fintech began, but if we include fintech in the classic sense, it would be good to consider the 1950s as the starting point. This is because credit cards were first introduced in the 1950s. People used these cards to pay for purchases instead of carrying cash. ATMs were introduced in the 1960s, which made it possible for people to no longer visit bank branches for certain types of transactions.

In the 1970s, companies began trading stocks electronically. In the 1980s, banks began using mainframe computers and other cutting-edge record-keeping and data systems. In the 1990s, e-commerce business models and the Internet became widespread.

Over the past 50 years of fintech development, innovators have created sophisticated treasury management, risk management, data analytics and transaction processing tools for financial services firms, institutions and banks.

Today, fintech is digitizing retail financial services through crowdfunding platforms, robo-advisors for retirement and asset planning, payment apps, and mobile wallets. Fintech also provides access to alternative and private investment opportunities, as well as online lending platforms.

However, despite the flourishing of fintech, banks have not been greatly affected. This is because fintech and banks complement each other. In particular, in Korea, internet banking was initially established and became a major turning point in personal financial experiences, so fintech was introduced later than in other countries. However, the banking industry eventually realized that fintech technology is a strategic asset and should be taken seriously, and has recently expanded its investment in fintech.

Why Fintech Matters

The changes brought about by fintech will make the financial industry smarter and more agile. For example, automated investment opens the way for all social classes to easily invest and see returns on their investments. It also allows people in developing countries without bank accounts to trade. However, despite its growth, the fintech industry still has a lot of room for improvement, and the financial infrastructure needs to be revised for the benefit of consumers.

Fintech innovators can also help develop better methodologies for risk assessment. For example, OnDeck and Kabbage use information to assess the performance of small businesses using more than 1,500 data points. Avant uses machine learning to do underwriting. Kickstarter uses the collective intelligence of people to fund startups. This means more customers have access to lending and investment services. Since the 2008 financial crisis, regulators have tightened banking regulations to make finance safer. Fintechs are introducing regulatory technology and sophisticated fraud detection algorithms to help regulators protect financial transactions and provide better services to customers.

Popularization of Fintech

The fintech sector has been receiving steady investment since 2014, when it saw a huge influx of funds. There are several factors that have contributed to the flourishing of fintech. First, fintech promises investment and growth opportunities and healthy returns, even if its business model is not yet perfect. For example, no one knows whether P2P financing is a sustainable model in the long term. Second, new technologies are emerging in many industries that can be applied to financial services. These include blockchain technology, advanced machine learning software, microcard readers and chips, and powerful servers that can perform intelligent analytics. Third, customer expectations are also increasing interest in the fintech industry. While previous generations had little experience with personalized services, millennials demand it, even in a non-face-to-face manner. In the future, high levels of personalization and internet technology will provide access to the kind of financial relationship they expected. The appropriate use of data will give financial services companies the potential to know and treat their customers better. Fourth, regulatory changes and innovations can help fintech. Regulations can generally impede capital inflows and growth. While adoption may be slow due to the need to protect and control the public, regulators in many countries are recognizing the value of the technology and providing innovation sandboxes. In some areas, such as P2P lending, regulatory clearances are needed to allow new companies to grow rapidly.

Global Fintech Investment

The fintech industry has experienced significant growth due to massive investments and new trends in the financial industry, and customers have been exposed to a variety of financial services that can change the way they deal with banks.

According to a report by London Fintech Week on 18 July 2016, fintech investment grew to US$8 billion in China between July 2015 and June 2016, an increase of around 250% since 2010. China continued to be a major investor with three large deals in 2017: Xinhua Dianrong for around US$220 million, Feidee for around US$220 million, and Dashu Finance for around US$118 million, while Alibaba, JD Finance, and Tencent expanded their domestic operations through regional investments.

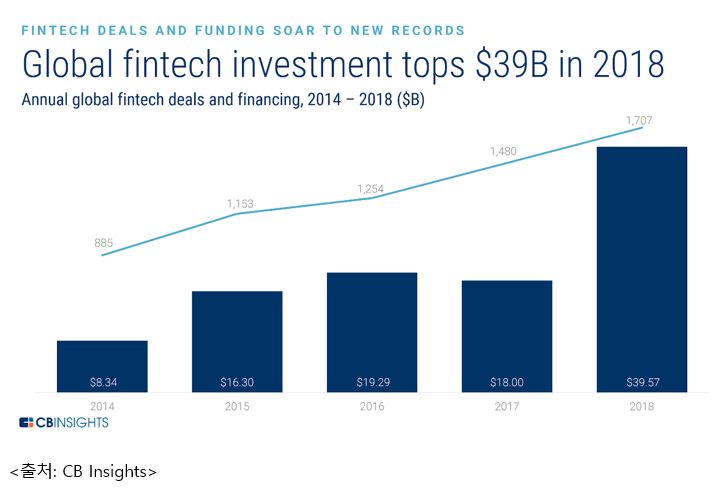

Recently, as global investments in startups have been active, the proportion of investments in fintech companies is increasing. According to CB Insights, the amount increased by 374.5% from $8.34 billion (2014) to $39.57 billion (2018), and the number of cases increased by 92.9% from 885 (2014) to 1,707 (2018).

Major Fintech Hubs

Some regions are more open to fintech innovation than others. Factors that contribute to fintech growth include government support, a developed innovation culture, proximity to customers, skilled talent, and flexible legal regulations. When considering these factors, the cities with the best fintech environments are London, Singapore, New York, Silicon Valley, and Hong Kong. Unfortunately, our country is not a good fintech environment. These centers have been developing financial services or technology (especially London and Silicon Valley in the UK) for many years and know that it is important to work with the ecosystem of companies to achieve greater results.

In Europe, London combines cutting-edge technology with the world's largest financial services sector. London-headquartered Atom Bank, Funding Circle, Monzo, Worldpay and Zopa. The success stories of Worldpay and Transferwise show that London can scale independently. London is strong in retail banking, neobanking, foreign exchange and asset management.

New York has great financial talent and a strong investment community. OnDeck and Betterment are two big fintech companies based here. Silicon Valley is usually associated with technology, and many of them are oriented towards finance, with PayPal, Square, LendingClub, and Sofi all based in New York.

Hong Kong is the largest financial center in Asia and is known for its strengths in B2B solutions. Its proximity to China is also a strategic asset (although political considerations may need to be taken into account). Welend, a lending platform, is the biggest success story to come out of Hong Kong. Singapore has also created a top financial center. Governments around the world are investing heavily in supporting the sector, and regulatory sandboxes have been created to ensure safe innovation.

Finally, China is the largest fintech market by investment and total usage. Shanghai is strong in asset management, liquidity management, and blockchain. Unicorns like Ant Financial (Alipay), Lufax, and Zhong An are here. There is no doubt that it is one of the fastest growing markets in terms of size.

You must be logged in to post a comment.