“Isn’t it strange that only monthly rent cannot be paid by credit card?”

A cafe in front of Yeouido Station. Kim Ki-tae (32), CEO of Devdi, who arrived 10 minutes earlier than the appointed time, was concentrating on something with his laptop open. “A new partnership came in this morning.” A dashboard showing the monthly transaction status was displayed on the screen. A graph with numbers rising steeply caught my eye.

“Even six months ago, I wouldn’t have expected this level of growth. To be honest, I thought of it as my last challenge.”

The main service of Devdi, founded by CEO Kim Ki-tae, is the monthly rent card payment solution within the 'Zipup' app, an all-in-one solution for single-person households. It is the service that he came up with while contemplating monetization after the app's launch in 2023. Since its launch in October of last year, Zipup Pay has been growing its monthly transaction amount by 150% for the past six months.

Motivation for starting a business discovered through long-term living alone

When asked why the process of paying rent by card was difficult, he confessed, “It’s more complicated than I thought.”

“Most landlords are individuals and are reluctant to accept card payments due to tax issues.” In the end, tenants have to send cash every month, and there is no benefit to be gained from this process.

CEO Kim Ki-tae also had the same experience while living alone in a foreign country for over 10 years. “When the day I had to pay my rent overlapped with the day my credit card bill was deducted, or when I suddenly had a big expense, it was hard to manage my money. Every time, I thought, ‘It would be easier if there was some time between the payment date and the withdrawal date, like with a credit card.’”

CEO Kim Ki-tae said that his experience in founding the AI tea curation startup 'DiversiTea' in the UK was the key to solving the problem. "Even problems that seem impossible can be solved by breaking them down into steps." In particular, he was able to come up with this idea from his experience of enjoying the services of advanced fintech startups such as Monzo, Revolut, and Wise.

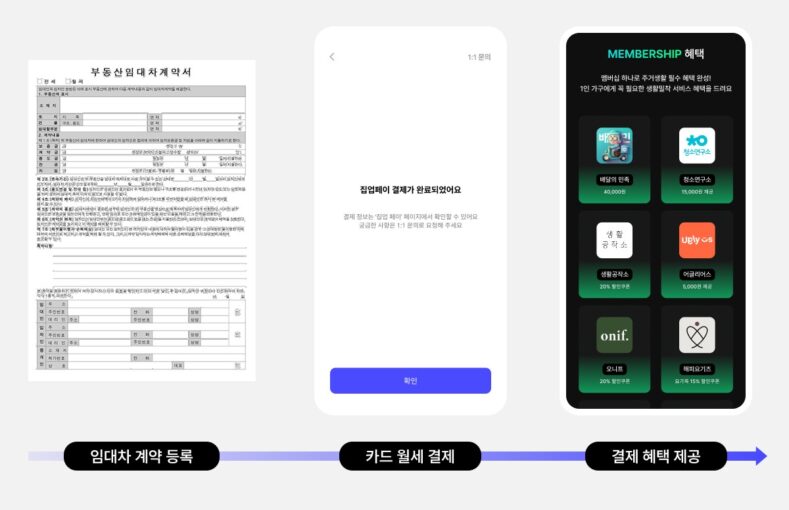

“It wasn’t impossible to pay rent with a card before.” According to CEO Kim Ki-tae, previously, landlords could receive payments directly with a card machine, or only landlords who gave written consent could use innovative financial services from financial institutions. However, he explained the effectiveness of a structure that does not involve landlords, saying, “The current monthly rent landlord is in his 90s. It’s hard for them to understand this.” Zipup Pay is a structure that processes the tenant’s remittance on their behalf by intervening with a PG company.

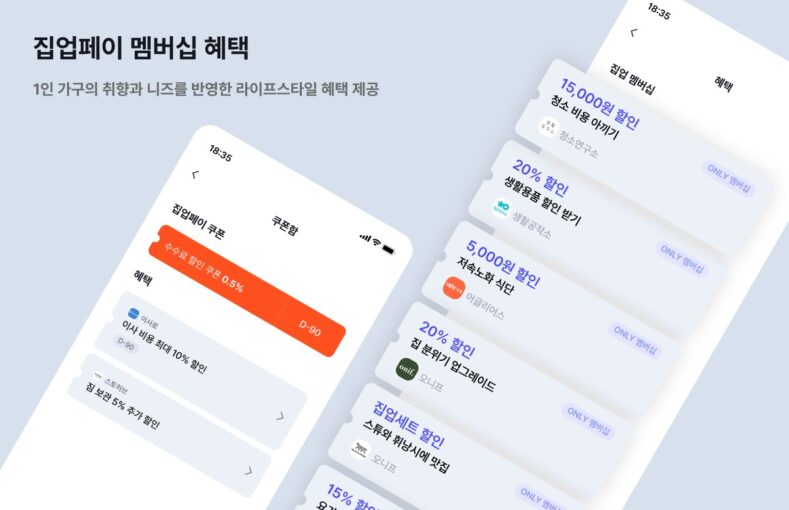

“Users authenticate their lease agreements at the home and pay their monthly rent with a card. In addition to accumulating card performance with the monthly rent amount, they can also enjoy card benefits such as points and payment date adjustments, tax deductions, and housing/lifestyle membership benefits. The landlord receives the monthly rent as before.”

Average age 26.8 years old, 2030 generation responds quickly

The average age of the Zipup Pay users is 26.8 years old. They are a generation accustomed to using various cards and sensitive to various benefits. CEO Kim Ki-tae said, “It just happened naturally.” “The older generation thinks it is natural to pay the monthly rent in cash, but the younger generation wonders, ‘Why should only the monthly rent be paid in cash?’”

Marketing was not easy. There are still many people who are unfamiliar with the concept of 'paying rent with a card' and find it awkward. Some people have a negative perception of it, confusing it with 'card fraud'. So we focused on ensuring security and stability. Devdi was the first in the industry to simultaneously obtain ISO 9001 and ISO 27001, and established a stable and reliable service operation system.

From preventing fraud to monthly rent financing

Zipup Pay was not the main business from the beginning. Zipup’s integrated service strategy started from the philosophy of solving the fragmented problems that single-person households experience in their residential life on a single platform. It started with the ‘Moving Planner’ that can manage the entire process from moving preparation to completion and the personalized property search function, and later expanded the scope to include the ‘Rental Safety Report’ to prevent rental fraud and the ‘Magazine’ containing information specialized for single-person households.

“We found that users wanted help with all aspects of moving. From finding a home, reviewing contracts, preparing for the move, to paying the monthly rent. Of these, monthly rent was particularly repetitive and inconvenient. That’s why we focused on this.”

There are three revenue models, and data collaboration is key.

The revenue sources of this one-person household total all-in-one service are threefold: card payment fees, revenue from housing-related affiliate services such as moving, cleaning, and repairs, and revenue from affiliate cards and customized financial products through collaboration with financial institutions.

“We are expanding financial products tailored to single-person households through collaboration with various financial institutions,” he explained.

“Last year, we collaborated with Hana Bank and Hana Card. Hana Card also designed and created a partnership card.”

This year, we are conducting open innovation projects with Woori Financial Group, Kakao Bank, and BNK Gyeongnam Bank, and are carrying out various forms of collaboration.

CEO Kim Ki-tae said that the vision of the company is “to change monthly rent from a simple expense to the first step in starting a personal financial life.” Rather than recognizing the monthly rent payment as a fixed cost, the company aims to connect it with various financial benefits such as credit management, point accumulation, and investment linkage to enable tenant financial planning and financial portfolio expansion. The goal is to help single-person households obtain real economic benefits from their housing expenses.

Although not a financial company, Devdi aims to make finance easier for users. The technology focuses on making the flow of money in people’s daily lives more flexible.

A world where paying rent by credit card is common sense

Regarding other companies that provide similar services, he emphasized that “Zipup Pay has a differentiating strength.” It provides better choices and value to users through benefits such as the industry’s lowest commissions, financial sector affiliated cards, and membership services covering all aspects of residential life.

He said, “The concept of paying rent with a card is unfamiliar, but more and more people are becoming interested in it as a means of managing their finances,” and “I want to help renters generate various financial benefits from their housing expenses through Zipup Pay.”

It seems that the era of paying monthly rent 'only in cash' is slowly coming to an end.

Kim Ki-tae, CEO of Devdi, graduated from The University of Sheffield in the UK and founded DiversiTea, an AI-based commerce startup in the UK. He then worked as a coach at social venture accelerator Underdogs and mentored various startup teams. Since founding Devdi in 2022 and launching 'Zipupx', it has secured over 40,000 users to date.

You must be logged in to post a comment.