Seoul Fintech Lab , a fintech startup incubation hub operated by the Seoul Metropolitan Government, announced on the 9th that it selected Earlypay as a new resident company in the first half of 2025.

Seoul Fintech Lab is a specialized fintech support space that discovers innovative startups with technological prowess and marketability and supports them to establish a foundation for growth. Through this new occupancy, we plan to strengthen our support in the supply chain finance sector within the fintech industry.

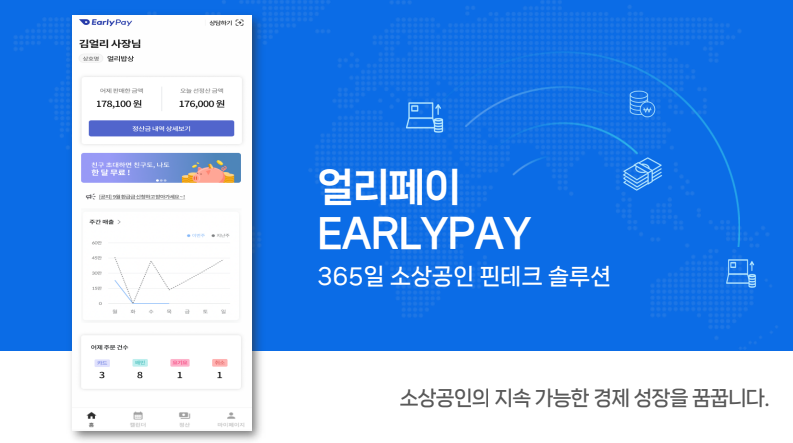

The selected Early Pay is a fintech company that provides real-time sales analysis and pre-payment services to small business owners. It collects credit card sales and fee data through scraping and provides them in a visualized form, thereby simplifying the complex settlement process and improving the management efficiency of small business owners through the function of identifying missing sales and reporting.

In particular, Earlypay's pre-payment service is structured to pay out funds the next day based on daily sales data, and is operated in a non-loan manner, so it does not affect the user's credit rating. The service adopts a daily subscription fee of 2,000 won as its revenue model, and is acting as a practical means of securing cash flow for small business owners who need quick cash turnover.

Earlypay has jointly developed a recovery account and a firmware banking system with BNK Gyeongnam Bank, and is currently operating a pre-deposit fund supply contract worth 2 billion won with Welcome Savings Bank as of November 2024. In addition, an additional fund supply contract with Kiwoom Capital up to 15 billion won is under review, and the company is continuously expanding its service area through cooperation with the financial sector.

CEO Jang Hwan-seong founded Earlypay based on his business experience in small business consulting and P2P finance, and is preparing for global expansion with the goal of entering the Vietnamese market in 2026 based on the domestic market.

A Seoul Fintech Lab official said, “It is very meaningful that a company that solves the cash flow issues of small business owners in the supply chain finance sector has moved in,” adding, “We will continue to strengthen our global competitiveness together with fintech companies with innovation and growth potential.”

- See more related articles

You must be logged in to post a comment.