This article is a contribution from the accounting firm Milestone. If you would like to share quality content for startups in the form of a contribution, please contact the Venture Square editor team at editor@venturesquare.net.

When gifting or transferring membership to a child, you must comprehensively consider various tax factors such as the judgment of market value and tax burden according to the transaction type. In particular, membership is an asset corresponding to the right to use a specific facility, so the valuation method and tax imposition criteria are somewhat different from general assets. In this column, we will summarize tax matters to keep in mind when gifting or transferring membership, assuming that the initial acquisition price of a membership was 40 million won and the market value increased to 100 million won.

1. Criteria for judging the market price

When there is a sale case, the market price of the membership is given priority, and when there is no sale case, the supplementary valuation method of the 'Inheritance Tax and Gift Tax Act' applies sequentially as follows: 1) the market standard amount notified in accordance with the local tax law 2) the amount obtained by adding a premium to the payment amount up to the valuation standard date.

2. Donation upon acquisition

Parents can either acquire the membership directly and then give it to their children, or give funds to their children so that they can acquire the membership directly in their names. In both cases, if the market price is 100 million won, a gift tax rate of 10% is applied, resulting in a gift tax burden of approximately 4 million won. However, since children can deduct up to 50 million won for 10 years as adults (20 million won for minors), if there were no prior gifts other than this case and the children were adults, there would be no actual tax burden.

Meanwhile, the increase in value after the time of acquisition is subject to transfer tax at the time of transfer.

3. Donation after value increase

Gift tax is determined based on the market price at the time of donation, so in this case, if a membership worth 100 million won is donated, a gift tax burden of approximately 10 million won will arise. If there were no prior donations other than this case and the child was an adult, a tax burden of approximately 5 million won will arise.

Ultimately, gifts after an increase in value will result in higher taxes.

4. Transfer after value increase

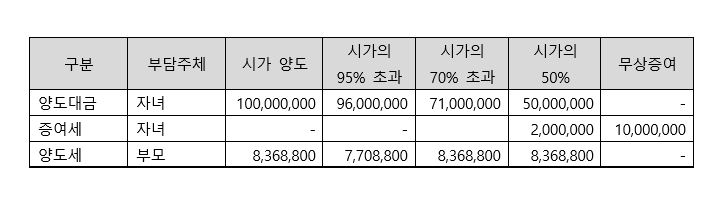

When transferring a membership to a child, transfer tax and gift tax may be imposed as follows depending on the actual transfer amount:

– 95% of the market value: lowest tax burden

– 70% to 95% of the market price: Same transfer tax burden as the market price transfer

– Less than 70% of the market price: In addition to the same transfer tax as for the market price transfer, gift tax is additionally imposed.

The total financial burden of children and parents, including the transfer fee, is summarized by case as follows.

However, the actual tax burden may vary depending on whether the child has acquired the funds, whether there are any gifts in advance, and whether there are any transfers of assets subject to combined taxation.

5. Use of joint names of spouses

If the child actually has the acquisition funds, the parents can reduce some of the transfer tax burden by acquiring the membership in joint names of the couple and then transferring it to the child. However, in the case of a simple gift, there is no difference in the gift tax burden regardless of whether it is jointly owned, and if the child does not have the acquisition funds, additional gift tax may be imposed on the funds.

6. Conclusion and Recommendations

If the value of the membership is expected to increase, it is most advantageous in terms of tax savings to give it to your children when the market price is low. You can also consider giving it to your children at a low price to minimize the overall tax burden, but in this case, the child must actually pay the transfer price to the parents, so it may not be in line with the general purpose of giving.

Inheritance and gifts have many variables depending on each individual's situation, and the results can vary greatly depending on the facts. Therefore, if you actually plan to transfer property, it is advisable to receive specific advice from a tax professional before proceeding.

- See more related columns

You must be logged in to post a comment.