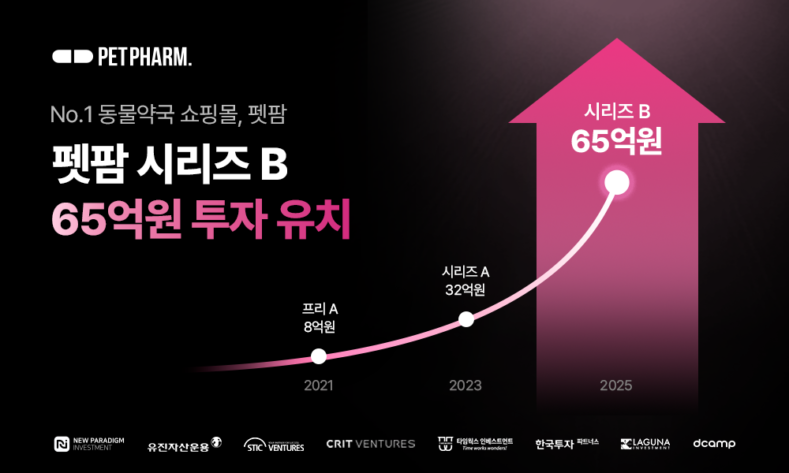

Pet Farm, a pet medicine manufacturing and distribution startup, announced that it has attracted approximately 6.5 billion won in Series B investment.

The cumulative investment that Pet Farm has attracted so far amounts to 10.5 billion won. Five investment companies participated in Pet Farm’s Series B investment. Existing investment company Eugene Asset Management made additional investments, and ▲Stick Ventures ▲Crit Ventures ▲Timeworks Investment ▲D.Camp participated as new investors. Pet Farm attracted 3.2 billion won in Series A investment in 23 years ago.

Song Jae-jun, CEO of Crit Ventures, who participated in this investment, said, “The pet medicine market is growing rapidly due to the increase in the pet population and the government’s improvement of the system,” and “Pet Farm is securing a high market share based on its wide network.” He added, “In the future, Pet Farm is expected to grow through strengthening its own brand and expanding its business.”

Pet Farm CEO Yoon Seong-han said, “The domestic pet medicine market is dominated by multinational pharmaceutical companies, so domestic companies are having a hard time,” and added, “Based on our own distribution network, Pet Farm will localize various pet medicines and provide pet owners with a wider range of choices and a reasonable purchasing environment.”

Pet Farm currently has approximately 6,000 animal pharmacy members nationwide. In February of this year, it obtained a license to manufacture animal medicines and is preparing to launch K-pet medicines in cooperation with domestic manufacturers.

- See more related articles

You must be logged in to post a comment.