The Ministry of SMEs and Startups (Minister Oh Young-joo, hereinafter referred to as the Ministry of SMEs and Startups) announced on the 23rd that it has completed the selection of venture funds for the '2025 Mother Fund 1st Regular Subscription' project.

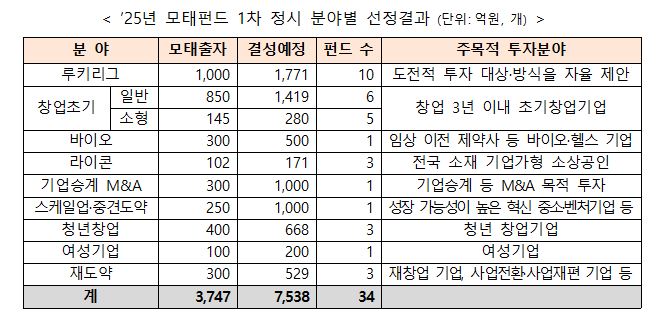

This investment project selected 34 funds with a total investment of 374.7 billion won and 753.8 billion won worth of venture funds. The selected funds are expected to be formed within 3 months, and most of the funds are expected to be formed within July. These funds are expected to contribute to accelerating the recovery of venture investment as they begin to invest in earnest in the second half of the year.

The selection results by field are as follows.

The 'Rookie League' dedicated to new and small venture capitals has been selected with 10 funds and a scale of 177.1 billion won. 10% of the 1 trillion won budget for the 2025 SMEs and Startups Fund, or 100 billion won, will be allocated to the Rookie League to support new and small venture capitals to have the opportunity to form funds and make challenging investments.

Considering the recent initial investment decline, the startup early stage sector, which expanded its investment, was selected with a scale of 169.9 billion won, the largest after the Rookie League. In particular, this year, a new 'startup early stage small' sector was established to invest in startups through small funds of around 5 billion won, and startup planners, creative economy innovation centers, and university technology holding companies with strengths in discovering and nurturing startups were selected.

The 'Bio Fund', valued at 50 billion won, is expected to contribute to raising funds for early-stage bio companies, such as those in the pre-clinical stage, which have recently been experiencing difficulties in attracting investment.

The Lycon Fund, which was established in 2024 and reorganized its investment target to include the metropolitan area nationwide starting this year, was also selected with a scale of 17.1 billion won to continuously support small business owners and entrepreneurs to grow in the living culture sectors such as food, clothing, and housing based on innovative business models.

In addition, the 'M&A Fund' to support the corporate succession of small and medium-sized enterprises was selected at a scale of 100 billion won, and the 'Scale-up and SME Leap Fund' to support scale-up investment attraction of venture and startups was selected at a scale of 100 billion won.

We will also select a ‘Youth Entrepreneurship Fund’ worth 66.8 billion won, a ‘Women’s Enterprise Fund’ worth 20 billion won, and a ‘Leap Forward Fund’ worth 52.9 billion won to continuously provide support to areas in need of policy support.

This investment project also includes new system improvements to ensure that venture capital can remain faithful to its original role as an adventure investor even in difficult times.

Investment management companies that actively engage in non-metropolitan investment and early-stage investment have been given preferential treatment to strengthen incentives for local investment and early-stage investment. As a result, more than half of the incentive target funds have investment obligations, and the remaining funds, which are not dedicated to local and early-stage startups, plan to invest KRW 86.2 billion in local companies and KRW 52.3 billion in early-stage startups.

In order to promote a virtuous cycle of 'investment → recovery → reinvestment', up to 20% of the purchase of existing stocks will be temporarily recognized as the primary investment for two years ('25~'26) starting this year, and 120% of the investment in non-metropolitan areas will be recognized as the primary investment. The impairment loss guidelines, which serve as the basis for payment of management fees, have also been reorganized to be more market-friendly so that they can support challenging investments such as initial investments. For companies with less than 5 years of business history that are unlikely to generate sales, management fees will not be reduced as an exception even if their financial statements deteriorate after investment, and other companies will also be allowed to postpone reductions in management fees under an accounting auditor's review if management improvement is expected.

Minister of SMEs and Startups Oh Young-joo said, “Last year, the scale of venture investment in our country successfully rebounded for the first time, breaking away from the downward trend since 2021, and has been growing steadily even in difficult global market conditions.” He added, “If the 700 billion won venture fund selected for this investment project is quickly formed and full-scale investment begins in the second half of the year, we expect it to support this recovery.”

- See more related articles

You must be logged in to post a comment.