Startup Alliance (Director Lee Ki-dae) announced on the 19th that it published a report titled ‘2024 Korea’s CVCs: Current Status and Investment Activation Measures.’

This report was planned to deeply analyze the investment status and changes in domestic corporate venture capital (CVC) and to suggest future policy and institutional supplementary directions. The research director was Professor Kang Shin-hyung of the Department of Business Administration at Chungnam National University, and the analysis utilized The VC’s Korean startup database.

CVC refers to venture capital that companies invest in startups and the overall organization that operates it. However, in Korea, there is a tendency to narrowly define CVC as a 'separate investment company established with investment from a company'. Accordingly, Startup Alliance categorized the types in this report into ▲independent corporate CVC (independent investment company established separately with investment from a non-financial general company and the funds managed by this investment company), ▲internal department CVC (internal funds invested by a non-financial general company in startups and the department that executes these funds), and ▲fund investment CVC (LP investment in a fund formed by an existing private VC by a non-financial general company), and comprehensively analyzed the domestic CVC ecosystem focusing on independent corporate CVC and internal department CVC.

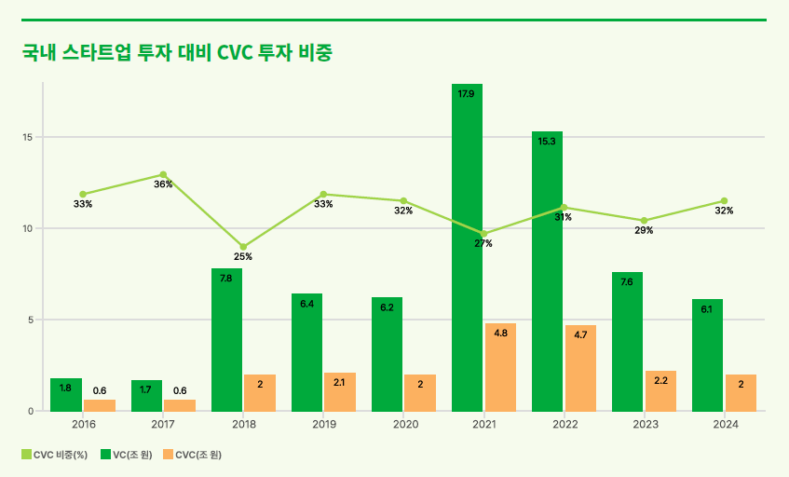

The proportion of domestic CVC investment is by no means low. According to the report, the amount of domestic CVC investment in 2024 will account for 32% of total startup investment, which is higher than the global average (26%) and the US (29%). However, unlike the gradual recovery of CVC investment in the global and US markets, investment in Korea is still shrinking. In fact, by the third quarter of 2024, the global CVC investment volume increased by 10% year-on-year and the US increased by 24%, while the domestic investment decreased by 9%.

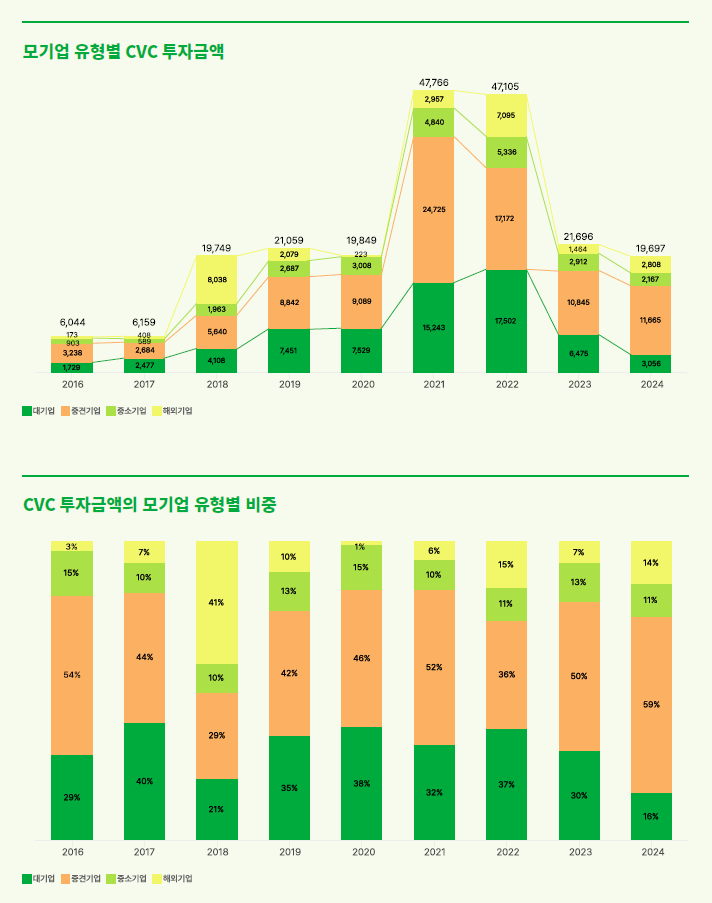

In particular, the decline in CVC investment centered on large corporations is notable. Compared to 2022, the amount of CVC investment in large corporations in 2024 has decreased to 1/5, and in-house department-type CVCs have plummeted to 1/10. This is interpreted as a result of large corporations adjusting their investments as they feel the limits of their strategic investment performance, although this is also due to the impact of the economic downturn.

On the other hand, CVC investment in mid-sized companies has increased. The proportion of CVC investment in mid-sized companies has expanded to 59% in 2024, and it is analyzed that the main factor is the active investment by major mid-sized companies such as Krafton and NCSoft. However, many mid-sized companies still complain about the lack of startup information and the difficulty of finding collaboration partners, and it was pointed out that policy support is needed for this.

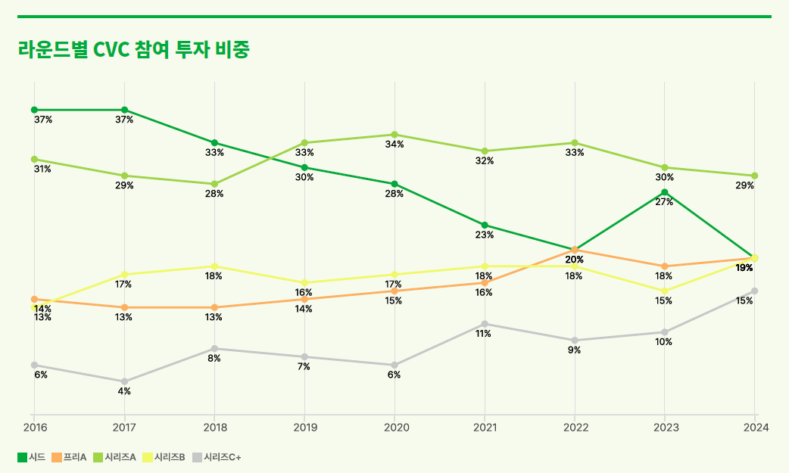

Changes in CVC’s investment behavior were also evident. The proportion of early (seed) investments, which were previously focused on securing technology and options, decreased, while the proportion of later (series B, C, and above) investments increased. This shows that investment strategies are changing beyond simple technology acquisition to startups in the growth stage that can create real business synergies.

In terms of industry status, the bio/medical/healthcare sector was shown to have the most investment from 2018 to 2024, followed by games, mobility, finance, and content. In particular, the finance sector has recently shown a notable decrease in investment, and was excluded from the top 10 investment sectors in 2024. On the other hand, the enterprise/security and food/restaurant sectors have consistently been included in the top 10, showing continued stable investment.

The report emphasized that policy improvement is necessary for the sustainable growth of the domestic CVC ecosystem. Specifically, ▲increased policy interest and support for CVCs in internal departments, ▲inducing open innovation linkages of independent corporate CVCs, ▲activating open innovation in mid-sized companies, ▲strengthening management supervision and disclosure functions rather than restricting investment activities, etc. In particular, it pointed out that most of the current restrictions on the activities of general holding company CVCs under the Monopoly Regulation and Fair Trade Act are mid-sized companies, and that in order to activate CVC investment, the government needs to strengthen management supervision and disclosure functions rather than restricting investment activities in detail.

Lee Ki-dae, head of the Startup Alliance Center, said, “As global high interest rates hit, many large companies’ in-house investment organizations stopped functioning. This suggests that policies related to CVCs, which are strategic investors, should ultimately focus on mid-sized companies that are actual users.”

The Startup Alliance Report is a report that deeply analyzes the domestic startup ecosystem and policy issues and presents alternatives. The full report can be viewed and downloaded for free on the Startup Alliance website.

- See more related articles

You must be logged in to post a comment.