This article is a contribution from the accounting firm Milestone. If you would like to share quality content for startups in the form of a contribution, please contact the Venture Square editor team at editor@venturesquare.net.

Recently, many companies are introducing various compensation systems using their own stocks. Now, in addition to the familiar stock options, various stock compensation systems are spreading, such as Hanwha Group's introduction of RSU in 2020, Naver's stock grant, and SK Telecom's PSU. In this column, we will look at the types of stock compensation systems and what characteristics each has.

Types of stock compensation systems

① Stock options

The most famous stock compensation system for employees is definitely the stock option. This is a system that allows employees to buy company stocks at a set price after a certain period of service, and is actively used by startups that need rapid growth while also maintaining key talents for growth.

② RSA vs RSU vs PSU

RSA and PSU are systems in which the number of shares to be paid as compensation is fixed after a certain performance target period ends. However, RSA is a system in which shares with transfer restrictions are paid in advance at the time of signing the contract, and the transfer restrictions are lifted or shares are redeemed depending on whether performance conditions are met in the future, while PSU is a system in which a fixed number of shares are paid later depending on performance. On the other hand, RSU is a system in which the number of shares to be paid after achieving conditions is fixed in advance, but shares are actually paid when the period and conditions are met in the future. In the end, they can all be called 'performance-conditional shares' in which rights are fixed in relation to length of service or performance. Some RSUs and PSUs are paid in cash, but this column will cover cases in which they are paid in stock.

③ Stock grant

Stock grants are a system that typically provides stocks for free without any conditions, and are known to be a system used by many early startups in the United States, but in Korea, they are used as a means of immediate compensation for employees, mainly by large corporations.

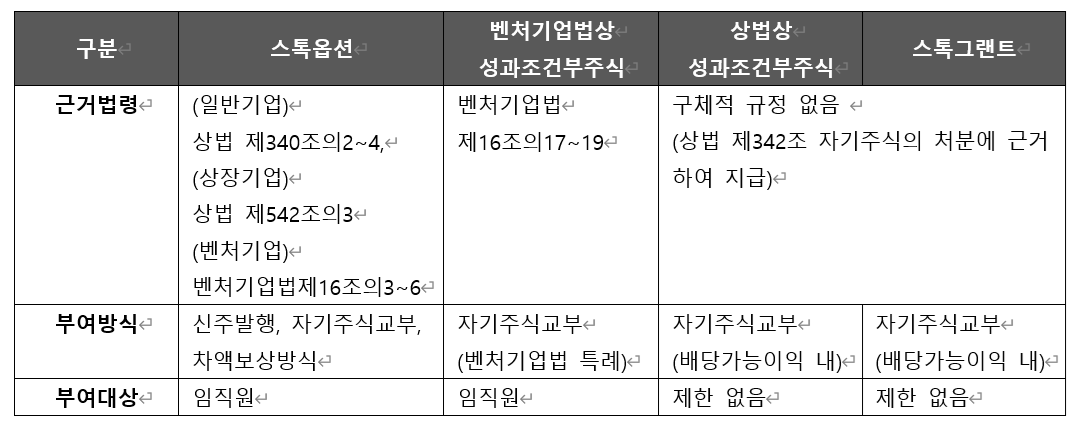

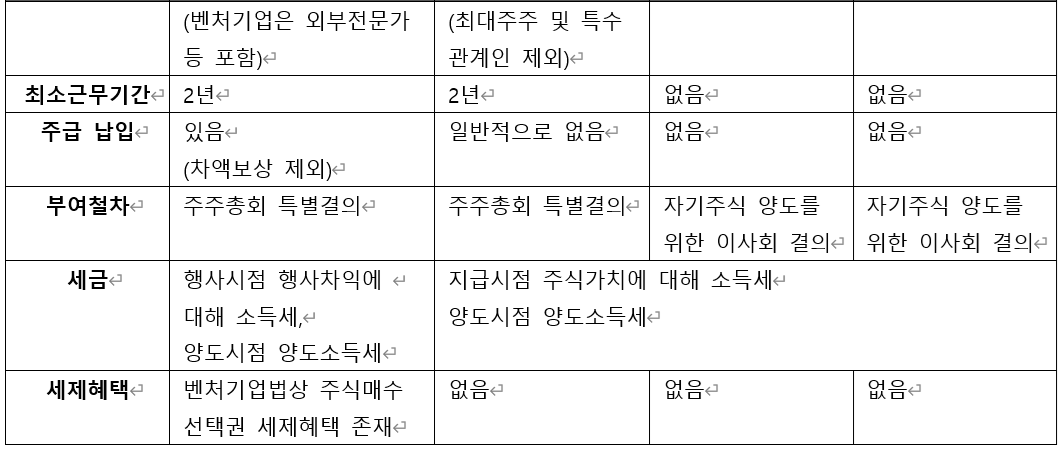

Comparison of each system

In January 2024, the Venture Business Act was revised to allow venture companies to acquire treasury stocks up to the amount of the company's net asset value minus its capital when necessary to pay out performance-conditional stocks. This revision came into effect on July 10. Until then, performance-conditional stocks and stock grants had been paid out by utilizing the provisions on treasury stock acquisition under the Commercial Act. However, since treasury stocks under the Commercial Act can be acquired up to the limit of distributable profits, this was not widely used by venture companies that were not yet making a profit. In other words, venture companies can now pay out performance-conditional stocks as long as they are not in a state of capital impairment.

The specific differences between each system are as follows.

So what kind of system would be suitable for our company?

In the case of venture companies, stock options are inevitably advantageous because they are granted and exercised in accordance with the Venture Business Act and, if certain conditions are met, tax exemption special provisions, exercise profit payment special provisions, and exercise profit taxation special provisions can be applied. It is a welcome development that the revision of the Venture Business Act allows performance-contingent stocks to be paid even when distributable profits are small, but there are still many tax benefits and tax issues to be resolved, so it seems likely that they will be used as a supplementary means to stock options until these issues are resolved.

*Related column: Tax issues surrounding performance-contingent shares (RS)

However, if you compare the stock options granted under the Commercial Act with other systems, in the case of stock options, if the value of the stock at the time of exercise falls below the exercise price, the compensation loses its meaning, whereas performance-conditional stocks and stock grants pay the stocks themselves, so there is a clear possibility of compensation and the granting procedure is simple, so it can be an option worth considering for companies that have grown to a certain extent. However, even for these companies, stock grants are a system that can be transferred at the same time as they are paid, so they have limitations as a compensation method for long-term service, and can be appropriately utilized when immediate compensation is needed.

- See more related columns

You must be logged in to post a comment.