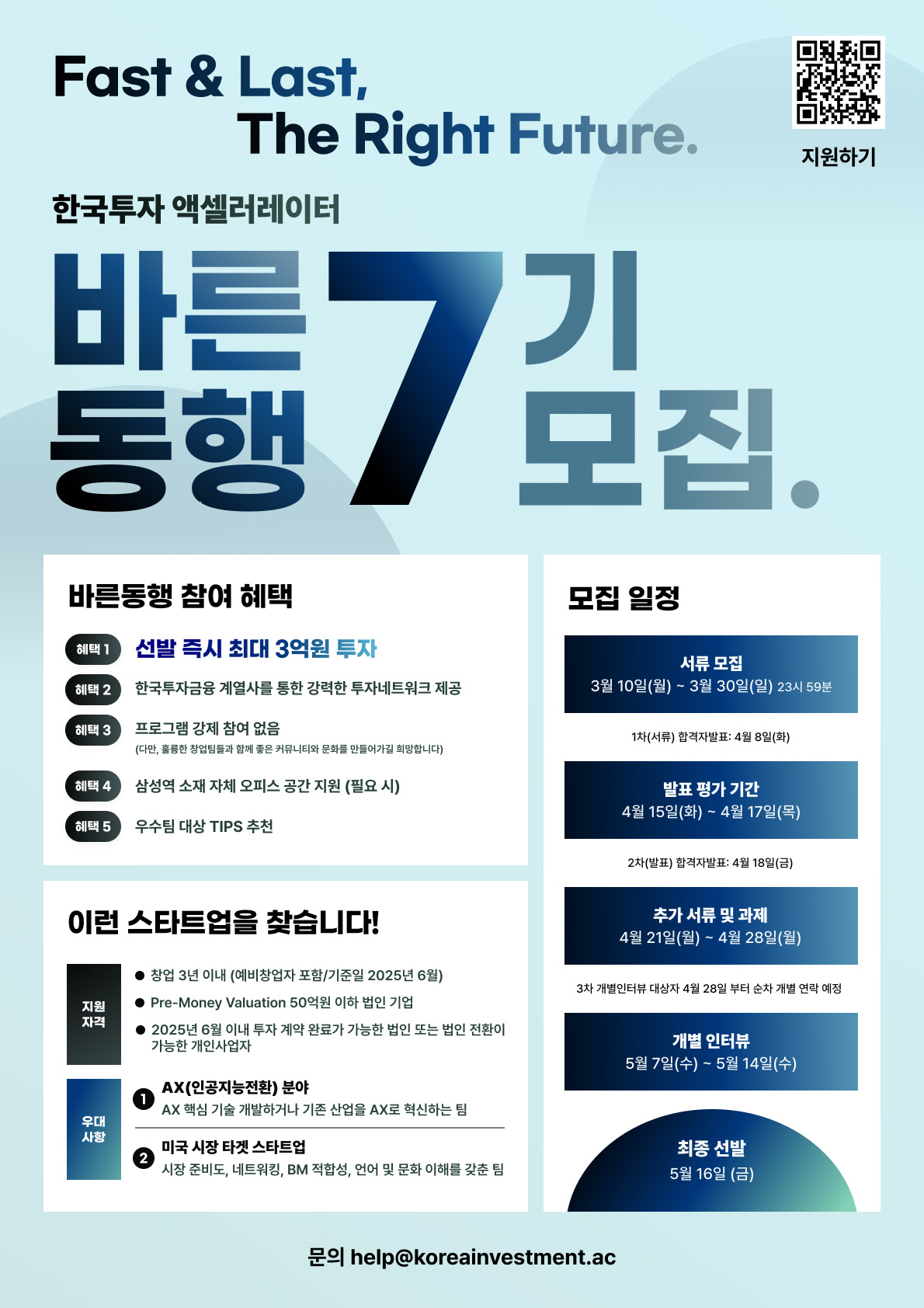

Korea Investment Accelerator announced on the 10th that it is recruiting innovative startups to participate in the 'Barundonghaeng 7th' program, which supports the growth of early-stage startups. This recruitment will be conducted through the first round of document submissions, and the period will be from 2:00 PM on March 10th to March 30th.

The 'Barundonghaeng' program is a startup accelerating program in which Korea Investment Accelerator and affiliates of Korea Investment Holdings, Korea Investment Partners, and Korea Investment Securities, collaborate to discover excellent early-stage companies and support their growth potential. Starting with this 7th term, the existing 3-month program will be changed to a 1-year program, and the largest investment amount ever will be executed. Selected companies will be provided with various benefits, such as up to 300 million won in advance investment, TIPS recommendations, and their own office space in Samseong Station.

The 7th Barundonghaeng will especially give preference to AX startups that pursue innovation using artificial intelligence (AI) and promising startups with the potential to enter the global market. Applicants must be early-stage startups that have been in business for less than 3 years and have a pre-money valuation of less than 5 billion won. Individual business owners and prospective startups who can establish or convert to a corporation by June 2025 can also apply.

This selection process will consist of a first round of document evaluation, a second round of presentation evaluation, a third round of individual interviews and on-site inspection, and the final selection team will be announced on May 16. The Barundonghaeng program boasts an average competition rate of 36.6:1, and 74 teams have been selected out of a total of over 2,700 applicants up to the last 6th term.

Baek Yeo-hyeon, CEO of Korea Investment Accelerator, said, “We are doing our best to help startups grow and create a healthy ecosystem even in a difficult investment market environment,” and “A crisis is the moment when great companies and opportunities are born. We will actively support finding greater opportunities through global market expansion and activating new AI-based businesses.”

- See more related articles

You must be logged in to post a comment.