– Non-cash trust income securities with a Doosan insulation structure… The first STO structuring case and standard

Real estate token securities service providing “ownership experience” successfully sold out 25.1 billion won in 3 years

-10 consecutive public offerings sold out, 11th public offering of 'Symbiotic Finance' scheduled for next month

-'Ownership' platform that lowers investment threshold, popular with MZ generation and female investors

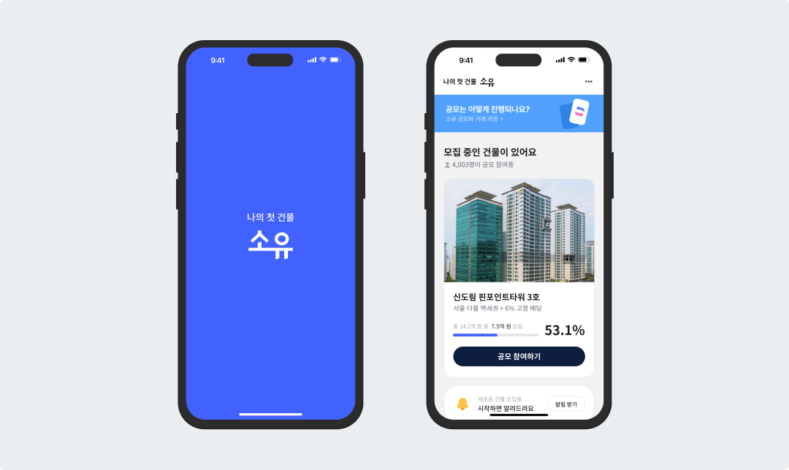

LucentBlock's real estate token securities (STO) platform 'Soyou' has achieved the success of raising a total of 25.1 billion won through 10 real estate public offerings in just 3 years since its launch. The 11th public offering is scheduled to begin next month.

Lucent Block operates a platform called ‘Ownership’ that allows for small investments in high-value commercial real estate. Real estate is an asset that is difficult for the general public to access due to its large size and limited characteristics, but anyone can invest in real estate through ‘Ownership’.

Lucent Block was the first non-metropolitan venture company to be designated as an innovative financial service by the Financial Services Commission in 2021, and was redesignated in 2023. Being designated as an innovative financial service by the Financial Services Commission allows the company to operate transparent and safe services under the supervision of financial authorities. After launching the 'Ownership' service in April 2022, Lucent Block began the public offering of 'Anguk Downtowner', the first real-time token securities (ST) transaction in Korea in June of the same year, and has publicly offered a total of 10 real estates by 2024. In 2024, it was selected as the Financial Services Commission's K-Fintech 30 and the Ministry of SMEs and Startups' 'Technology Protection Leading Company', and was also selected for the 'AI Startup Accelerator 2' operated by SK Telecom and Hana Bank. In November 2023, it secured 15 billion won through Series B investment attraction, and the cumulative investment amount is 34 billion won.

CEO Heo Se-young majored in computer engineering for both his bachelor’s and master’s degrees at Carnegie Mellon University in the United States. With the support of the Electronics and Telecommunications Research Institute (ETRI)’s startup incubation program, he founded LucentBlock in 2018. In recognition of his contributions to revitalizing youth entrepreneurship and developing SME policies, he received the Minister of SMEs and Startups Award in 2023, and since 2022, he has been contributing to the development of the startup ecosystem as an advisory member of the Youth Division of the SMEs and Startups Policy Advisory Group. We met with CEO Heo Se-young of LucentBlock to hear about the operation of its proprietary platform, its achievements, and future plans.

■ Invest and trade real estate safely with small amounts

The real estate tokenization service called 'STO (Security Token Offering)' is what allows ordinary people to invest in real estate in small amounts by splitting large real estate into smaller units. This is an expression of the value of real estate by dividing it into small units of digital tokens. For example, if a building worth 10 billion won is divided into units of 5,000 won, 2 million tokens are created. Through this, investors can participate in real estate investments in small amounts that match their capital size.

This system solves the problem of lack of liquidity, which has been a long-standing problem in real estate investment. Investors can buy and sell their tokens at any time through the app, which provides flexibility not found in traditional real estate transactions. The global STO market is expected to expand in the future. The domestic real estate market is estimated to be worth about 300 trillion won at the small end and over 600 trillion won at the large end.

The issuance of tokens, transfer of ownership, and transaction history are recorded transparently and safely. When a real estate owner entrusts registration to a trust company, the trust company takes ownership of the real estate. The trust company then issues a profit-making certificate based on this real estate as an underlying asset. The issued profit-making certificate is electronically registered through the Korea Deposit Insurance Corporation, and an account management institution such as Hana Securities is responsible for the role of opening the investor's account and profit-making certificate. This 'bankruptcy isolation' structure is designed so that problems in one institution do not affect the entire system by having multiple institutions share roles.

Lucent Block also provides detailed information and analysis data on target real estate properties to solve the information asymmetry problem in real estate investment. It transparently presents expected profits to investors through a dividend calculation algorithm that considers rental income, management fees, taxes, etc., and also provides insight into the future value of real estate through data analysis.

■ Killing Two Birds: Profitability and Experience

“Opportunity for ownership to all”

Lucent Block's corporate mission is to value experience, and to reflect this, the service name was set as 'ownership'. Lucent Block aims to provide investors with 'the experience of ownership' beyond simple returns. Over the past three years, it has conducted 10 real estate public offerings and all of them have been sold out. CEO Heo Se-young explained the secret to this success as "we tried many things to meet the diverse needs of customers."

“We currently have about 500,000 customers, and I thought it would be impossible to satisfy them with just one solution. I thought a lot about how I could provide value to customers. Rather than satisfying many people, I am approaching it in the direction of satisfying a small number of customers precisely,” he said, emphasizing the importance of targeting.

Lucent Block is making various efforts to provide the experience of 'ownership'. It hosts 'Owner's Day' to invite owners and also conducts commercial district tours. It provides owner rental benefits and increases contact points and forms communication with customers through real estate finance-related insights, information, quizzes, etc. CEO Heo said, "Lucent Block aims for 'space finance where the experience itself becomes an asset'" and explained, "We are expanding the concept of ownership by allowing investors to have various experiences as owners, such as naming buildings, receiving space usage benefits, and participating in offline events."

In short, 'ownership' goes beyond the simple act of owning assets, and has a multi-layered meaning that includes the expansion of economic opportunities, the valorization of experiences, and inclusiveness within the market economy system. Thanks to this, the proportion of MZ generation and women who value experiences is high. 70% of Lucent Block's investors are MZ generation and 40% are women. It can be said that activities that increase intimacy with customers have been effective.

However, Mr. Heo says that the rate of return is as important as the experience. Even if you invest in small amounts of 5,000 won, you can receive monthly dividends like monthly rent and expect capital gains when selling the building. While the 1st to 6th public offerings mainly catered to the diverse needs of customers such as F&B brands, startup spaces, and local hotels, the 7th to 10th public offerings emphasized the investment perspective centered on offices. Some public offerings even offered high dividend yields of 6% or more.

■ No. 11 Contest… Contributing to regional coexistence and startup ecosystem activation

The 11th public offering building is the 'Startup Park' building being built between KAIST and Chungnam National University in Daejeon. Lucent Block signed a five-party business agreement with Hana Bank, Hana Securities, Daejeon City, and Daejeon Creative Economy Innovation Center in October. Hana Bank will purchase and remodel the building, while Daejeon City and Daejeon Creative Economy Innovation Center will support the overall operation and management of the facility. Lucent Block will host the real estate asset public offering and promote the public offering targeting general investors using 'ownership'. Hana Securities will be in charge of the account management institution.

CEO Heo explained the significance of this contest, saying, “This contest has implemented a win-win model that achieves the goals of all three entities by combining Daejeon City’s regional balanced development policy, Hana Financial Group’s regional customized financial strategy, and Lucent Block’s real estate liquidity technology. In particular, as the first case of collaboration with a local government, it presents a new form of real estate investment model in which the public sector and private finance participate together.”

The 11th public offering is currently in the final stages of preparation, with the aim of launching in March. The scale of this public offering is expected to be approximately 1 billion won, and the target rate of return is 9% based on rentals. This is the highest rate of return among the public offerings Lucent Block has conducted so far.

The feature of this contest is that it implements the concept of 'mutual finance'. It goes beyond simply investing in real estate, and it also has the character of a social investment that contributes to the activation of Daejeon's startup ecosystem, job creation, and regional economic development. Citizens can participate in regional development with small amounts while also expecting stable profits.

■ “I will focus on the essence and think about the value”

What is LucentBlock’s vision as a leader in the domestic token securities market?

“The most important thing is to popularize the service and increase customer satisfaction and trust in line with the service philosophy of ‘Opportunity for everyone.’ The market is not yet mature and has a long way to go, so we are thinking about how to grow it within the larger framework of financial consumer protection.”

“Rather than focusing on lofty goals for the next three to five years, I am focusing on what I can do today, tomorrow, and next week,” said CEO Huh. “I will take it slow, one step at a time.”

CEO Heo finally expressed his ambition to “become a company that focuses on the essence of providing opportunities for ownership and thinks about the value derived from that.”

You must be logged in to post a comment.