Digital marketing solutions company Netthru (CEO Wonhong Choi) announced that it has built a personalized recommendation system, ‘SmartOffer’, for Woori Bank.

Woori Bank introduced Netthru's real-time customer behavior collection solution 'WiseCollector' and customer behavior detection solution 'SmartCEP' through the 2023 Customer Data Platform (CDP) construction project. In addition, 'Smart Offer' was additionally introduced this time to strengthen the hyper-personalized customized service in the 'New WooriWON Banking (hereinafter WooriWON Banking)' app. With this, a personalized recommendation system where the collection and detection of customer behavior and recommendations through this are organically linked has been completed.

Through this, Woori Bank can provide customized information and benefits to customers accessing WooriWON Banking and recommend optimal financial products based on each customer's financial usage patterns and interests.

Netthru's personalized recommendation system applied to WooriWON Banking is characterized by providing customized recommendations by comprehensively analyzing financial data (account, payment information, etc.) and behavioral data (clicks, inputs, etc.). This allows for timely recommendations of customized content based on not only customer accounts but also accounts held and specific behaviors. For example, information suitable for customers, such as certificate expiration, currency exchange receipt, and events, is provided on the banner at the top of the home screen, and new savings products are recommended to customers whose savings maturity is near.

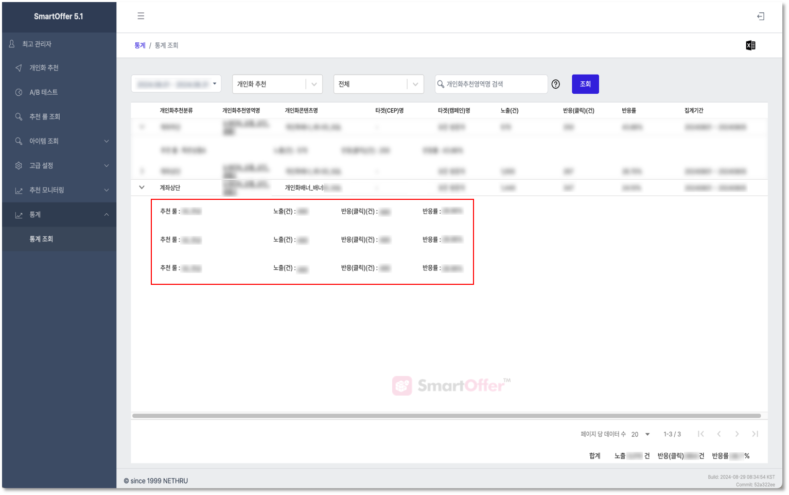

You can also use the A/B testing function to analyze customer responses and automatically select the best content. If you register multiple banners or messages for testing over a certain period of time, Smart Offer analyzes the responses (click rates, etc.) of each content and finally fixes the content with the highest performance. This allows you to more precisely understand customer interests and perform more effective marketing.

A Woori Bank official said, “This project has enabled us to provide more sophisticated hyper-personalized services. We expect this to further increase customer satisfaction using the app.”

Meanwhile, Netthru is leading the industry by providing digital marketing solutions to major financial institutions such as Woori Bank, KB Kookmin Bank, Hana Bank, NH Nonghyup Bank, KB Insurance, and DB Insurance.

Choi Won-hong, CEO of Netthru, said, “In a situation where many banks are competing to become super apps, the one that maximizes customer experience through hyper-personalized services will gain an advantage in the market.” He added, “Based on the technology and know-how we have accumulated from building marketing solutions for major financial companies, Netthru will actively support companies to maximize marketing performance and strengthen customer relationships by utilizing customer data, which is their valuable asset.”

- See more related articles

You must be logged in to post a comment.