This article is a contribution from the accounting firm Milestone. If you would like to share quality content for startups in the form of a contribution, please contact the Venture Square editor team at editor@venturesquare.net.

Since convertible bonds have the characteristics of both bonds and potentially stocks, transferring convertible bonds at a price lower than the market price of stocks can have an effect similar to gifting stocks. Therefore, in order to prevent irregular gifts, the Inheritance Tax and Gift Tax Act stipulates that gift tax be levied on those who gain profits through convertible bonds.

When this regulation was first introduced, the difference between the acquisition price and the exercise price at the time of acquisition of the convertible bonds was taxed as a gift. However, if the issuing company adjusts the exercise price to be close to the stock price at the time of acquisition of the convertible bonds, etc. and issues it, not only will the taxation be ineffective, but considering that the recipient actually gains a profit when exercising the conversion right, it is currently stipulated that taxation is levied when certain requirements are met by dividing it into the time of acquisition, the time of transfer, and the time of exercise of the right (Article 40 of the Gift Tax Act). Below, let's look at the taxation issues that may arise by dividing it into each time point.

1. Time of acquisition

Let's examine the gift tax issues that may arise when acquiring convertible bonds by dividing them into two stages depending on whether the acquisition is at the issuance stage or the distribution stage.

<Issue Stage>

First, at the issuance stage, tax requirements differ depending on whether the convertible bond issuer is an existing shareholder.

(i) In the case of existing shareholders, if the largest shareholder or his/her special related person acquires shares at a low price and in an uneven manner exceeding the number that can be allocated in proportion to the number of shares owned, the tax is imposed.

(ii) In the case of a person who is not an existing shareholder and is a special related person of the largest shareholder of the corporation, tax is levied if the person acquires convertible bonds at a low price.

At this time, the Inheritance Tax Act stipulates that the profits acquired by the acquirer of convertible bonds, etc. are taxed as if they were received as a gift from the largest shareholder, etc. on the date of acquisition or acquisition of the convertible bonds, etc.

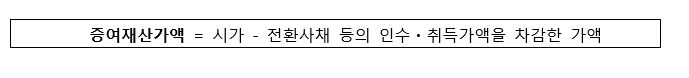

The value of the gifted property is calculated as follows. However, if the profit is less than the standard amount (the smaller of 30% of the market price of the convertible bond or 100 million won), it is not taxed. In this case, the market price of the convertible bond refers to the market price evaluated in accordance with the Gift Tax Act, considering the nature of both the bond and the stock, so separate review is required.

<Distribution stage>

Even at the distribution stage after issuance, it should be noted that ① convertible bonds are acquired from a special related party at the time of acquisition, and ② in the case of acquiring convertible bonds at a low price, the profit of the convertible bonds (the difference between the market price of the convertible bonds and the acquisition price) is taxed as a gift (Article 40, Paragraph 1, Subparagraph 1, Item 1 of the Gift Tax Act).

2. Transfer point

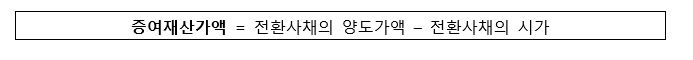

In the case where the acquired convertible bonds are transferred ① to a special related party ② at a high price, gift tax is imposed (Article 40, Paragraph 1, Subparagraph 3 of the Gift Tax Act), and the taxable amount is as shown in the table below. However, this does not apply if the profit is less than the following standard amount (the smaller amount between 30% of the market price of the convertible bonds or KRW 100 million).

3. Time of exercising rights

Since donations using convertible bonds are made through the difference between the stock price at the time of conversion and the conversion price, the difference is taxed when exercising the rights of the convertible bonds (Article 40, Paragraph 1, Subparagraph 2 of the Gift Tax Act).

As with the acquisition of convertible bonds, let's examine the gift tax issues that may arise when acquiring them in two stages, depending on whether the convertible bonds at the time of acquisition are in the issuance stage or the distribution stage.

<Issuance stage>

The tax requirements vary depending on whether the convertible bond issuer is an existing shareholder.

(i) In the case of existing shareholders, if the largest shareholder or his/her special related person acquires shares in an unequal manner exceeding the number that can be allocated in proportion to the number of shares owned, and the value of the shares received or to be received exceeds the conversion price, etc., taxation is imposed.

(ii) In the case of a person other than an existing shareholder, if he or she is a special related person of the largest shareholder of the corporation and acquires convertible bonds, and the value of the shares issued or to be issued exceeds the conversion price, etc., he or she is subject to taxation.

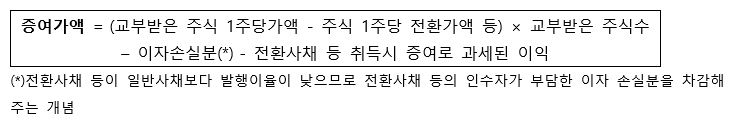

The gift amount is calculated as follows, and if the profit is less than 100 million won, it is excluded from taxation.

<Distribution stage>

Even at the distribution stage after issuance, if ① convertible bonds are acquired from a special related party at the time of acquisition, and ② the value of the stocks granted or to be granted exceeds the conversion price, etc., it should be noted that the profit on the convertible bonds (the difference between the stock price and the conversion price) is taxed as a gift.

4. Conclusion

As described above, convertible bonds may be taxed as a gift of profits to the largest shareholder or his/her special related party, and the tax requirements are different at each point in time and at each stage of the convertible bond issue. Therefore, in order to prevent unexpected tax burdens, it is necessary to review the possibility of taxation with an expert from the time of issuance review.

- See more related columns

You must be logged in to post a comment.