The Ministry of SMEs and Startups (Minister Oh Young-joo) announced the '2024 SME Export Trends (Preliminary Figures)' on the 23rd.

◆ 2024 SME Export Trends

▲ Small and medium-sized enterprise export amount and distribution of export companies

The export volume of SMEs in 2024 is expected to increase by 4.9% year-on-year to $115.1 billion, recording the second-highest export volume among SMEs ever (based on provisional figures).

'From the fourth quarter of 2023 to the fourth quarter of 2024, the growth trend continued for five consecutive quarters, and for the first time in three years since 2021, annual exports of small and medium-sized enterprises turned to growth.

The number of exporting SMEs increased by 1.5% year-on-year to 95,905 companies, the number of new exporting companies increased by 0.7% year-on-year to 25,000 companies, and the number of continuing exporting companies increased by 1.8% year-on-year to 70,905 companies (69,638 companies), showing overall improvement in indicators related to exporting SMEs.

▲ Characteristics of small and medium-sized enterprise exports by item and country

- Main export items

The top export items of SMEs were cosmetics (USD 6.8 billion, +27.7%), automobiles (USD 5.11 billion, +4.2%), plastic products (USD 5.03 billion, +4.2%), and automobile parts (USD 4.38 billion, +1.9%), in that order. The concentration of the top 10 items in the total export amount of SMEs was 34.1%, which was low compared to the concentration of the top 10 export items in total (59.1%).

Exports of eight out of the top ten items in terms of export value increased year-on-year, with cosmetics (USD 6.8 billion, +27.7%) and semiconductor manufacturing equipment (USD 3.96 billion, +15.5%) in particular recording double-digit growth rates.

When analyzing the factors driving the increase in major export items, in the case of cosmetics, despite a decrease in exports to China (USD 1.07 billion, △4.7%), exports increased in various countries including the United States (USD 1.34 billion, +46.5%), Japan (USD 750 million, +29.4%), and Vietnam (USD 450 million, +17.0%), not only recording the highest annual performance ever, but also exceeding USD 6 billion for the first time as a single item of export for small and medium-sized enterprises.

In the case of semiconductor manufacturing equipment, most of the top trading partners, including China (USD 1.69 billion, +18.9%), Taiwan (USD 520 million, +55.0%), the United States (USD 510 million, +42.2%), and the Netherlands (USD 500 million, +30.5%), showed double-digit growth rates due to increased demand resulting from the global semiconductor economic recovery and China’s policy to foster its own semiconductor industry, the largest exporter of the item, recording the highest annual export amount.

In the case of automobiles, exports continued to be brisk for the sixth consecutive month as quality awareness increased in neighboring countries of Russia, such as Kyrgyzstan (USD 1.54 billion, +55.8%) and Kazakhstan (USD 390 million, +8.5%), recording the fourth consecutive year of increase and the highest performance ever.

- Major exporting countries

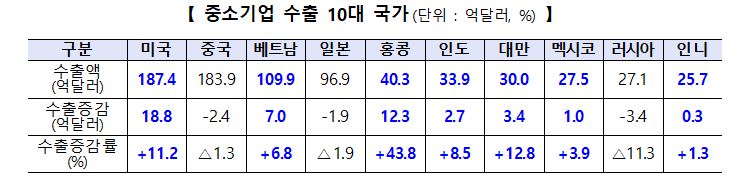

The top countries in terms of export volume for SMEs were the United States (USD 18.74 billion, +11.2%), China (USD 18.39 billion, -1.3%), Vietnam (USD 10.99 billion, +6.8%), Japan (USD 9.69 billion, -1.9%), and Hong Kong (USD 4.03 billion, +43.8%), with export volume increasing in 7 of the top 10 countries.

In the case of the United States, exports of all top 10 items exported to the US increased, showing the largest export increase (+1.88 billion dollars) among all exporting countries as of 2024. In the case of Hong Kong, it showed the highest export growth rate among the top 10 countries exporting to SMEs, and in particular, fashion accessories (USD 930 million, +426.2%) and gold, silver, and platinum (USD 400 million, +356.4%) recorded triple-digit export growth rates. In the case of Taiwan, exports increased as multinational companies increased their investment in the global semiconductor production base, and demand for semiconductor manufacturing equipment (USD 520 million, +55.0%) also expanded, leading to an increase in exports. On the other hand, Russia (USD 2.71 billion, -11.3%) showed a decrease in exports for most items due to the expansion of export controls against Russia, recording the largest decrease rate among the top 10 countries.

In addition to the top 10 countries in terms of SME exports, there was a notable increase in SME exports in the Middle East (USD 5.81 billion, +3.2%) and Central and South America (USD 5.20 billion, +4.6%).

▲ Online exports by small and medium-sized enterprises

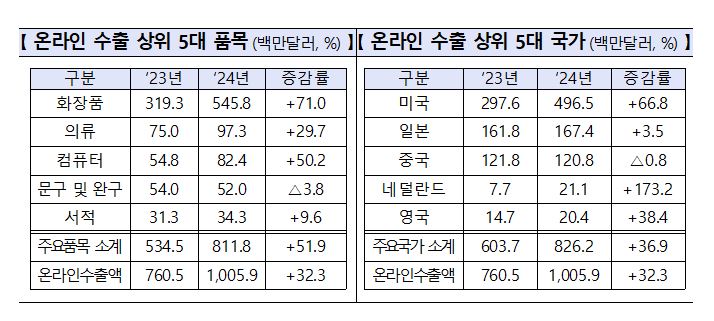

'In 2024, online exports by small and medium-sized enterprises reached $1.01 billion, a 32.3% increase from the previous year ($760 million), surpassing the $1 billion mark for the first time. The share of exports by small and medium-sized enterprises in the total domestic online exports was 73.2%, showing that small and medium-sized enterprises are leading the online export sector.

Among the major online export items, cosmetics (USD 545.8 million, +71.0%) and computers (USD 82.4 million, +50.2%) showed a large increase as exports to the US expanded. However, the number of small and medium-sized enterprises exporting online decreased slightly (△6.8%) to 3,835 companies compared to the previous year (4,116 companies).

◆ Export trends for small and medium-sized enterprises in the fourth quarter of 2024

▲ Small and medium-sized enterprise export amount and export companies

The export amount of small and medium-sized enterprises in the fourth quarter of 2024 was $29.76 billion, up 5.9% year-on-year, and the number of exporting small and medium-sized enterprises was 66,438, up 2.0% year-on-year.

▲ Characteristics of small and medium-sized enterprise exports by item and country

- Main export items

'Out of the top 10 export items for SMEs in the fourth quarter of 2024, exports increased for 9 items. The top export item, cosmetics (USD 1.84 billion, +27.8%), recorded high export growth rates in the US (USD 340 million, +36.3%), Japan (USD 210 million, +39.2%), Hong Kong (USD 120 million, +53.5%), and the UAE (USD 0.50 million, +93.6%). The second-largest item, automobiles (USD 1.39 billion, +14.4%), continued to increase exports to Central Asian regions such as Kyrgyzstan (USD 410 million, +46.9%) and Kazakhstan (USD 100 million, +62.9%), recording double-digit export growth rates year-on-year.

- Major exporting countries

'Out of the top 10 export destinations for SMEs in the fourth quarter of 2024, exports to 9 countries increased. The largest export destination in the fourth quarter was China (USD 5.0 billion, +4.7%), with large increases in copper products (USD 240 million, +97.2%) and aluminum (USD 150 million, +51.1%) compared to the same period last year, marking the first increase in exports in 12 quarters since the first quarter of 2022. The United States (USD 4.8 billion, △0.8%), in second place, saw a slight decrease in total exports despite large increases in cosmetics (USD 340 million, +36.3%) and power equipment (USD 290 million, +59.2%), but decreases in several items such as other machinery (USD 230 million, △44.2%). India, ranked 7th (USD 890 million, +20.0%), recorded double-digit growth year-on-year, driven by increased exports of machinery, including miscellaneous machinery (USD 150 million, +76.9%) and metalworking machine tools (USD 120 million, +62.8%).

Choi Won-young, director general of the Ministry of SMEs and Startups’ Global Growth Policy Bureau, said, “Despite the recent difficult external environment such as high interest rates and high prices, exports by SMEs have been doing well. However, domestic and external uncertainties surrounding SMEs continue to grow due to the inauguration of the second term of the Trump administration and the continued high exchange rate situation.” He added, “The Ministry of SMEs and Startups will closely monitor these changes in the external environment and strive to quickly resolve the difficulties faced by SMEs.”

- See more related articles

You must be logged in to post a comment.