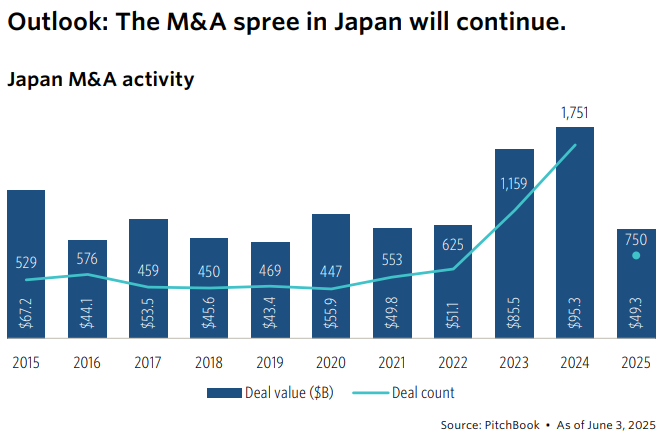

Japan’s mergers and acquisitions (M&A) market is booming like never before. According to recent data from PitchBook, about 1,500 M&A deals have been completed through November 2024, which is three times the average annual volume from 2015 to 2022. The surge coincides with the Bank of Japan’s exit from its long-standing negative interest rate policy. Low interest rates and a weak yen have created a favorable environment for buyers both in Japan and abroad, while the Japanese government and the Tokyo Stock Exchange have also actively encouraged M&A as a growth strategy for struggling companies.

In particular, regulatory changes have opened up new opportunities in the market. As of November 2024, 291 transactions were made in the form of corporate divisions or sales of business units, which is a 35% increase compared to the record in 2023. The average annual number of such transactions over the past 10 years has been less than 100. This is analyzed as the impact of corporate governance reform that has been in full swing since 2022.

The advance of global investment institutions into the Japanese market is also notable. Leading global institutional investors such as Carlyle, KKR, and Blackstone have declared expansion of investment in the Japanese market and created large-scale funds. This appears to be the result of a combination of changes in global interest rate trends and the potential growth of the private market.

2025 Boom, 1% GDP Low Growth Period, M&A Interest Relative Increase

The M&A market in 2025 is not as hot as in 2024, but it is still active. As of the end of June, more than 750 transactions have already been completed, exceeding the annual transaction volume of all years since 2015 except for 2023 and 2024. In this situation, the Tokyo Stock Exchange is drawing attention by applying a new rule that requires a "special independent committee" to calculate an appropriate sale price for acquisition proposals of listed companies. This rule applies only to acquisitions of companies by delisting (delisting) when a specific shareholder holds more than 20% of the shares, and is being implemented for the purpose of protecting minority shareholders and preventing conflicts of interest. However, there is also speculation that this measure may slow down the response of the transaction market in the short term due to the adjustment period for future buyers.

Despite the boom in the M&A market, the Japanese economy has yet to find a clear growth engine. Japan’s GDP growth rate is expected to remain at around 1% in 2025. In addition, the tariff policy imposed by the United States is also a variable. The Trump administration’s constantly changing tariff targets and standards are increasing uncertainty, especially in the automobile industry, and this is having a negative impact on industries where large-scale M&A discussions are underway.

Meanwhile, the yen has strengthened against the US dollar over the past year, stabilizing somewhat at around 160 yen per dollar, which was the highest level in 2024. This is a factor that increases the cost of acquisition for foreign investors, and is pointed out as another reason for the slowdown in the M&A market in 2025.

You must be logged in to post a comment.