This article is a contribution from the accounting firm Milestone. If you would like to share quality content for startups in the form of a contribution, please contact the Venture Square editor team at editor@venturesquare.net.

Due to the revision of the National Tax Basic Act at the end of 2024, it has become possible to file a correction claim for the carryover tax deduction that was previously impossible to file a correction claim. In particular, companies that were unable to apply the deduction for the 2016-2019 fiscal years should actively review this opportunity as correction claims are temporarily permitted until December 31, 2025.

1. What is a tax carryover deduction correction claim?

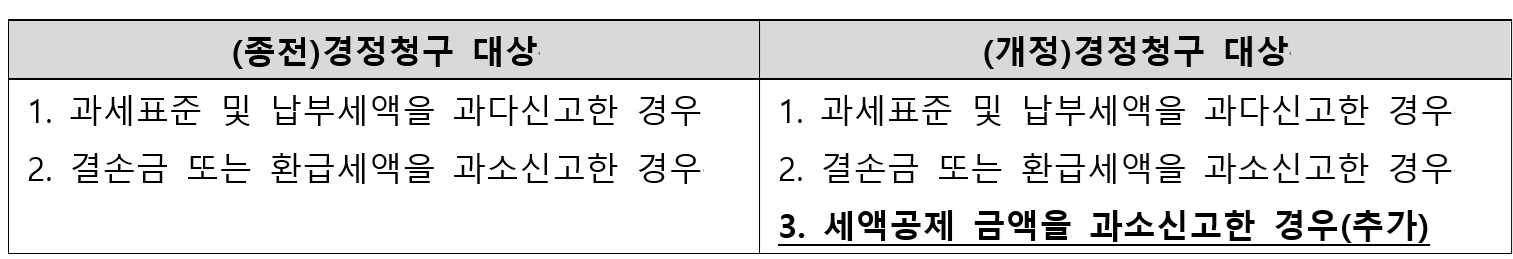

'Claim for correction of tax credit carried forward' was not originally a subject of correction claim. According to tax law, the tax base or tax amount must change to meet the requirements for correction claim, but this is because the carried forward tax credit does not change the actual tax base.

The Supreme Court also maintained its position through a case law (2019du62352, 2020.04.09) that an increase in the carryover tax deduction is not possible to file a correction claim because it does not directly affect the tax amount.

However, it has been consistently pointed out that this interpretation leads to unreasonable results for taxpayers, and accordingly, the system has been improved through this revision to allow for correction claims for carryover tax credits.

2. Why should I file a claim for correction by 2025?

In principle, a claim for correction is only possible within 5 years from the date of report. On the other hand, since the carryover tax credit can be carried forward for up to 10 years, a contradictory situation has arisen in which a deduction is possible but a claim for correction cannot be made.

However, according to the revised National Tax Basic Act transitional provisions, even if the deadline for requesting correction has already passed, correction requests are temporarily possible until December 31, 2025, only if a carryover tax credit is available for the tax period starting after January 1, 2025.

In other words, if a company has tax credits that can be carried forward from fiscal years after 2016, now may be the last opportunity to apply for tax credits that were missed in the past.

3. Practical response strategy

In order to check whether it is possible to proceed with a correction claim for previously missed carryover tax deductions, the following items need to be reviewed.

– Check whether there is a deficit in the fiscal year after 2016

– Check the year in which the minimum tax was applied

– Whether there are any tax deduction items that can be carried forward

– Check whether the existing correction claim is in progress

After comprehensively reviewing the above items, if it is determined that the taxpayer is eligible for a correction claim, it is advisable to consult with a tax agent to organize the relevant documents and proceed with the correction claim procedure quickly.

4. Conclusion

This revision of the National Tax Basic Act is very significant in that it provides a practical opportunity for taxpayers to restore their rights regarding the carryover tax credit, which was previously excluded from the systemic correction claim. In particular, for the fiscal years prior to 2020, it is most important to complete the correction and withdrawal procedures by 2025, so it is recommended that applicable companies review the possibility of a correction claim with their tax agent as soon as possible.

- See more related columns

You must be logged in to post a comment.