Freefins announced on the 15th that it had attracted Pre-Series A investment from venture capital firm Coolidge Corner Investment. This investment is the second external funding following seed investment from Leading Capital and K-Clavis Investment last year.

Freepins is a startup re-founded by CEO Sangyong Shin, who previously founded the AI parking control company iParking and sold it to NHN and SK Innovation E&S. It develops and provides software solutions specialized in rental conversion.

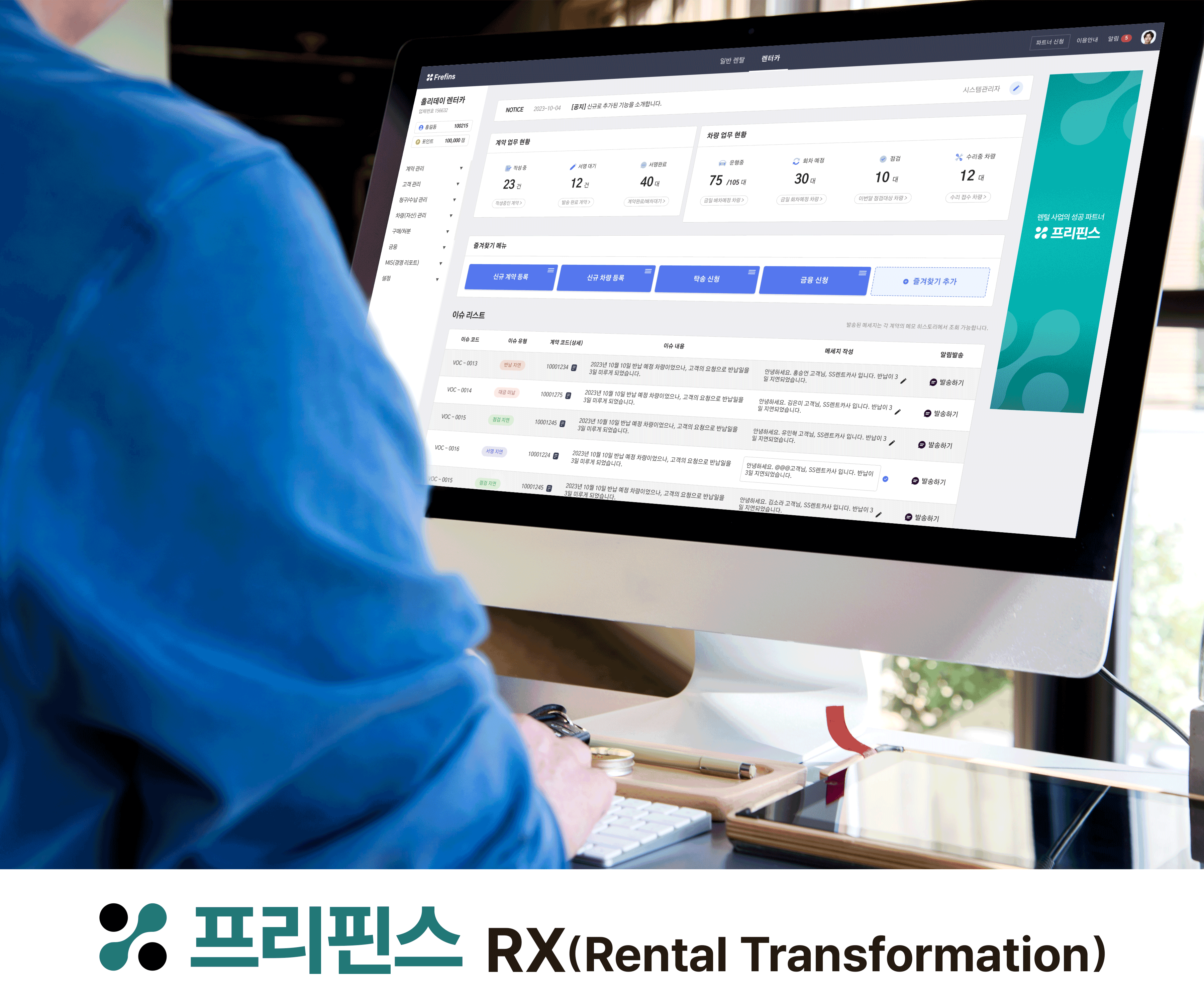

The company aims to support the transformation and growth of businesses that are adopting rental or subscription business models through cloud-based software (SaaS) that integrates rental ERP (enterprise resource planning) systems and financial linkage functions. Its main clients include kiosks, serving robots, digital signage, food waste disposers, and franchise companies, and it currently provides services to about 200 of them.

Freefins plans to focus this investment on enhancing the AI function of its rental conversion platform (FRP). Through this, it aims to strengthen the customized financial service recommendation function based on the rental business operator’s operational data and expand the effectiveness and scope of the solution provided to customers.

“This investment attraction is significant in that it has grown the previously non-existent rental conversion (RX) market to a meaningful size in just one year and verified its profitability,” said Sangyong Shin, CEO of Freepins. “We will create a rental conversion value chain that increases the value of participants, such as contributing to the growth of the rental and subscription businesses of strong manufacturing and sales companies and providing a stable new investment market for financial institutions.”

- See more related articles

You must be logged in to post a comment.