Cloocus (CEO Hong Seong-wan) , a cloud-based company specializing in data and artificial intelligence (AI), announced on the 11th that it has selected NH Investment & Securities and Hana Securities as joint lead managers for its IPO and has begun full-scale preparations for listing.

The selection of this joint lead manager was finalized after an evaluation process lasting approximately two months following the RFP sent out at the end of September, and Cluckus plans to accelerate the expansion of its global AI MSP business and the pursuit of an IPO.

Cluckus was recently named a Microsoft Partner Awards Global Finalist, earning recognition as Korea's leading AI MSP. Working with key enterprise clients such as Samsung Electronics, Samsung C&T, Hyundai Motor Group, Krafton, Pearl Abyss, and Sangsangin Savings Bank, the company has established a foundation for growth across diverse industries. Currently, Cluckus operates in Korea, the US, Japan, and Malaysia, securing approximately 2,500 clients.

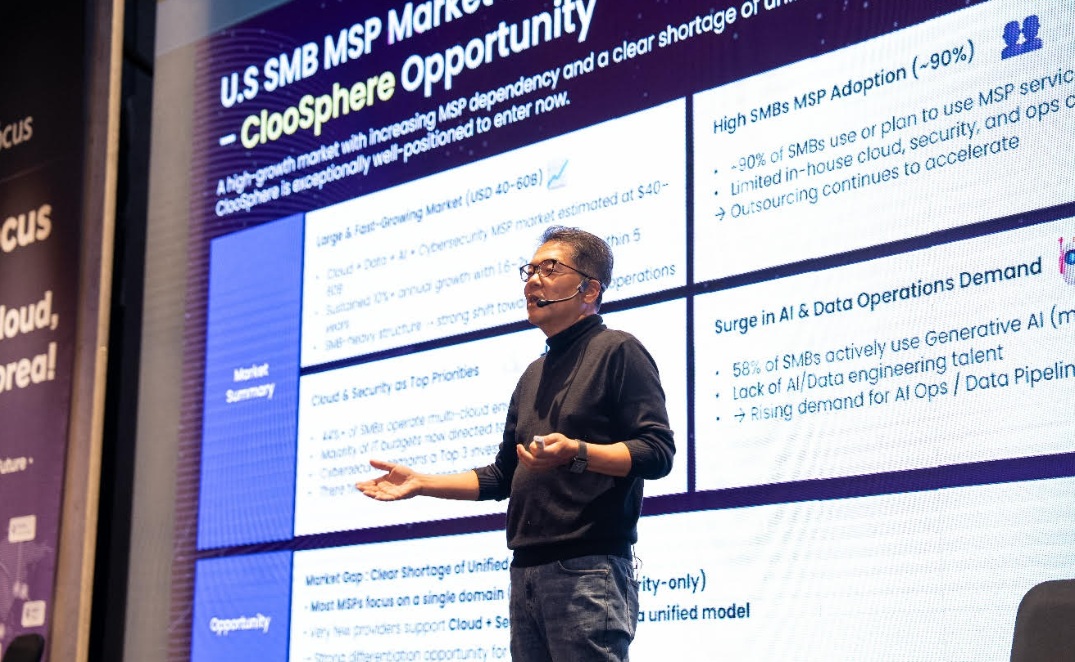

The company is evolving its managed service model, centered around its AI agent-based multi-cloud managed platform, ClooSphere. Beyond simple infrastructure operations, the company is building a next-generation MSP model focused on AI, data, and security. The resources secured through the IPO will be invested in expanding its global Tech Center, enhancing the ClooSphere platform, and strengthening industry-specific solutions.

We're also expanding our global business. We completed the establishment of a Japanese subsidiary and strengthened our sales and partnership system to meet local AI and cloud demand. In Malaysia, we're proactively responding to the growing demand for MSP and AI services by collaborating with the Microsoft data center, which opened in May 2025. In the US market, we're exploring opportunities for SMBs and enterprises to transition to an AI-based operating model.

CEO Hong Seong-wan said, “Cloocus has reached a turning point where it will begin full-scale global expansion based on continuous technology-centered growth,” and added, “Through the IPO, we will secure growth capital to leap forward as a global AI MSP, and we will more aggressively expand the experience and technological prowess we have accumulated in the cloud, data, and security fields in the global market.”

Going forward, Cluckus will proceed with procedures such as requesting preliminary listing review and submitting a securities report through consultation with the underwriter, and the target listing date is expected to be 2027.

- See more related articles

You must be logged in to post a comment.