The Ministry of SMEs and Startups (Minister Oh Young-joo, hereinafter referred to as MSS) announced that as the first step toward establishing the 'K-Global Mother Fund (tentative name K-VCC)', Korea Venture Investment, a subsidiary of MSS, has established a local corporation in Singapore and has begun preparations to complete the fund establishment by 2026.

In the meantime, Korea Venture Investment has been operating a local office in Singapore rather than a corporation, and has been handling tasks such as managing and operating global funds, supporting local expansion and investment attraction for Korean ventures and startups.

This incorporation is intended to promote the inflow of global investment funds into the domestic venture investment market in accordance with the ‘Advanced Venture Investment Market Leap Forward Plan’ announced in October of last year, and can be seen as the first step toward creating a ‘K-Global Fund’ worth 200 million dollars in Singapore by 2026.

In order to attract global investment funds, the Singapore government introduced the VCC system in 2020, providing tax benefits on investment profits and dividends for VCC funds. Currently, 565 fund management companies in Singapore are managing 1,029 VCC funds.

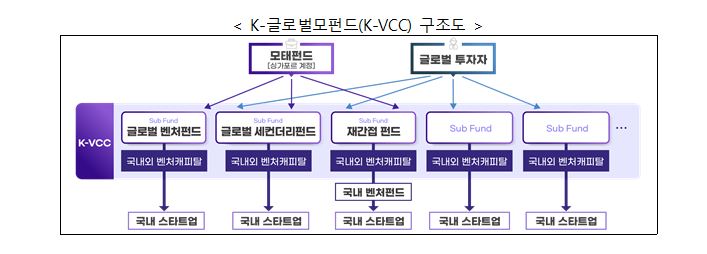

The 'K-Global Fund' to be established in Singapore will see Korea Venture Investment Corporation Singapore create the VCC Fund as the fund management company (GP) and allow not only domestic venture capital but also global investment funds to participate as sub-funds of the K-Global Fund.

The Ministry of SMEs and Startups and Korea Venture Investment Corporation are preparing to launch the 'K-Global Fund' in the second quarter of 2026 by taking follow-up measures such as recruiting local personnel and applying for VCC-related licenses after the establishment of this local corporation.

Kim Bong-deok, director general for venture policy, said, “K-Global Mother Fund is expected to facilitate global investment by domestic venture capitals, such as establishing offshore funds in Singapore, a regional financial and venture investment hub in Asia, and greatly contribute to attracting global investment funds for Korean venture and startups and their global expansion by utilizing local investment networks.” He added, “The Ministry of SMEs and Startups will prepare follow-up measures without a hitch to actively support domestic startups’ advancement into Asia by expanding the Korea Venture Investment Singapore corporation into an investment base for venture and startups in the Asian region.”

- See more related articles

You must be logged in to post a comment.